What is Quantity Theory of Money?

Quantity Theory of Money is the oldest theory for determining the value of money. It was proposed by French economist Jean Bodin in 1566. It was further elaborated upon by the Italian economist Davanzatti in 1588, the English economists John Locke in 1691, and David Hume in 1752. In the twentieth century, economists such as Irving Fisher, Marshall, Pigou, Robertson, and others addressed the theory extensively. Professor Milton Friedman has put forward Modern Quantity Theory.

According to the quantity theory of money, the average price of transactions in an economy is proportional to the nominal quantity of money in circulation. The theory states that as the quantity of money price level rises, the value of money decreases.

According to J.S.Mill, “The value of money, other things being the same, varies inversely as its quantity, every increase of quantity lowers the value and every diminution raising it in a ratio exactly equivalent.”

In the words of Fisher, “Other things remain unchanged, as the quantity of money in circulation increases the price level increases in direct proportion and the value of money decreases and vice versa.”

There are two versions of the quantity theory of money; viz., The Transaction Approach and The Cash Balance Approach.

The Transaction Approach or Fisher’s Equation

In his book “The Purchasing Power of Money”, published in 1911, Prof. Irving Fisher puts forward the Transaction Approach of the Quantity Theory of Money.

According to him, “The quantity theory is correct in the sense that the level of prices varies directly with the quantity of money in circulation provided the velocity of circulation of that money and volume of trade is not changed”.

According to Fisher, money is demanded as a transaction motive. (The value of money, like the value of any other item, is determined by the supply and demand for money. As a result, the value of money or price level is decided when the demand for money is equal to the supply of money.)

According to this theory, the demand for money is only created to pay for the existing supply of transactions. When the supply of money increases, people come to possess more money than is required to pay for current transactions. They make an attempt to spend this increased quantity of money. Hence, demand for goods rises, but due to full employment and a fixed supply of transactions, there is no increase in the production of goods, but rather a rise in prices. When prices rise, the value of transactions rises as well, which ultimately leads to an increase in the demand for money. This process continues until the demand for money equals the supply of money.

Demand for Money (PT) = Supply of Money (MV)

This equation is known as the Cash Transactions Equation and can also be expressed as:

Here, M= Money in circulation

V= Velocity of circulation of money

T= Total volume of transactions or trade transactions

P= Price level

This equation indicates that the price level is determined by the quantity of money. The price level changes with the quantity of money provided V and T remain constant. However, this equation only includes primary money or currency money (currency notes and coins), which is not the case in the modern economy. The modern economy also consists of banks’ demand deposits or credit money. Hence, after realising the growing importance of credit money, Fisher extended the equation of exchange to include credit money. The extended equation is as follows:

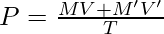

PT = MV + M’V’

or

Here, M= Money in circulation

V= Velocity of circulation of money

M’= Total Quantity of Credit Money (Bank Money)

V’= Velocity of circulation of Credit Money

T= Total volume of transactions or trade transactions

P= Price level

The above equation states that the factors responsible for the determination of price level are:

- Quantity of money in circulation (M)

- Velocity of circulation of money (V)

- Volume of bank or credit money (M’)

- Velocity of circulation of bank or credit money (V’)

- Volume of trade (T)

Also, price level; i.e., P is directly related to M, V, M’, and V’, and is inversely related to T.

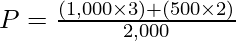

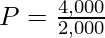

Example:

If M = ₹1,000; M’ = 500, V = 3; V’ = 2; and T = 2,000. Calculate price level.

Solution:

P = ₹2 per unit

In the above example, if the money supply is doubled, the price level is also doubled and the value of money is halved. Similarly, when the money supply is halved, the price level us laso halved and the value of money is doubles.

In the above graph, when the money supply is doubled; i.e., from OM to OM1, the price level is also doubled from OP to OP1 and when the money supply is halved; i.e., from OM to OM2, the price level is also halved from OP to OP2. Besides, the price curve P = f(M) is a 45° line and has a direct proportional relationship between the money supply and the price level.

Thus, the basic proposition established by Fisher in the equation of exchange states that the price level of the money value is a function of the money supply if V, M’, V’, and T remain constant. If these things remain constant, then the change in P will be in direct proportion to M.

Assumptions of Fisher’s Equation of Exchange

Quantity Theory of Money is based on the following assumptions:

1. Constant Velocity, also known as Constant V and V’: The velocity of currency (V) and the velocity of credit money or bank money (V’) are considered to be constant.

2. Full Employment: The quantity theory of money assumes that the economy is currently at full employment situation.

3. Constant Trade Transactions: Due to the full employment condition, Fisher believed that trade transactions (T); i.e., the volume of goods, services, and securities, would remain constant during a specific period.

4. M and M’ have a Constant Proportion: The theory assumes that any change in the quantity of bank money is proportional to any change in the quantity of currency (M). When the quantity of currency increases, there is a proportionate rise in the amount of bank money. On the contrary, when the quantity of the currency falls, the value of bank money also decreases, because people withdraw their bank deposits. As a result, the quantity of bank money reduces.

5. Quantity of Money is an Active Factor: Fisher has only included the quantity of money; i.e., money which is transactional and thus active. It does not include deposits and money held in reserve.

6. Price level is a Passive Factor: Fisher assumed that the price level is a passive factor. It is governed by the other factors of the equation but does not govern them.

7. Long Period: Fisher’s Theory is based on the assumption of a long period. According to this theory, the quantity of money in circulation and the level of prices are properly coordinated over time.

Critical Appraisal of the Quantity Theory of Money

1. Unrealistic Assumptions:

It is based on the unrealistic assumption that changes in money supply are the only factors that affect the price level. The other factors in the equation, such as V and T remain, are constant and do not affect the price level. These factors are never constant in real life, and a change in one will result in a change in the price level.

2. Variables are not Independent:

According to Fisher, M, M’, V, V’, and T are independent variables, which indicates that one does not affect the other. However, in real life, these variables are not independent of one another. Any change in one variable also affects other variables.

3. One-sided or more Importance to Supply:

Critics claim that this theory places more emphasis on the supply of money than the demand for it, making it one-sided or giving the supply more importance. Fisher has overlooked the effect of demand on price determination with the assumption that money demand is constant. According to him, changes in the money supply also affect the level of prices. This indicates that the theory has given the exchange medium importance and ignored the function of store of value. This makes it a biased theory.

4. Price level is not a Passive Factor:

Fisher assumed that the price level is a passive factor. But, this assumption is not true. Moreover, with the change in the price level, there is a change in the level of profits and volume of trade, which ultimately leads to a change in the quantity of money. An increase in price increases the quantity of money, whereas a decrease in price decreases the quantity of money.

5. Applicable only in case of Full Employment:

The quantity theory of money is only applicable in the case of Full Employment. But according to Keynes, most economies do not have a full employment situation. In such economies, increasing money supply is followed by increased production and not rising prices.

6. Fails to Explain Trade Cycles:

According to Crowther, “The quantity theory is at best an imperfect guide to the cause of the trade cycle”.

The quantity theory of money does not explain why prices rise during a boom without an increase in the money supply and why they do not rise during a depression despite an increase in the money supply. It does not explain why prices rise during a boom without an increase in the money supply and why they do not rise during a depression despite an increase in the money supply. The root cause for this is that during a recession, the velocity of money slows down; whereas, during boom, it accelerates. But, the theory considers that the velocity of money is constant. Indeed, money velocity is changing.

7. The Theory Ignores the Impact of Non-Monetary Factors:

The theory does not take into consideration the impact of non-monetary factors on the price level. The price level is influenced by various non-monetary factors such as institutional, technical, political, international, psychological, etc. These factors are not considered by the theory.

8. Measures only Cash Transactions:

According to Lord Keynes, the quantity theory of money does not measure the purchasing power of money; rather, it measures only cash transactions. Money is related to the general price level in Fisher’s equation, and the general price level is based on all types of goods and services. Both consumer and producer goods are included in the “general price level.” As a result, both producer and consumer goods are included in total transactions.

9. Inconsistent:

According to Halm, the Quantity Theory of Money is inconsistent. This theory aims to determine the quantity of money by multiplying the quantity of money that is related to a point of time or is a stock or static concept by the velocity that is related to the period of time or is a flow or dynamic concept. It is technically inconsistent to multiply two divergent factors.

10. Ignores the Effect of Rate of Interest:

The impact of interest rates on prices is ignored by theory. According to Lord Keynes, Hawtrey, and Prof. Hayek, the conclusion of the theory is that there is a direct relationship between the quantity of money and the price level, which is wrong. In fact, changes in the quantity of money affect the rate of interest, and changes in the rate of interest cause changes in the price level. However, this theory ignores the impact of interest rates. Mrs. Joan Robinson considers that changes in the quantity of money are extremely significant. Its impact on the interest rate indicates its significance. A theory of money that ignores the rate of interest is not really a theory of money.

11. Static Theory:

The Quantity Theory of Money only reveals that there is no time lag between changes in the money supply and price levels. It does not specify how long it takes to adjust the price level or what exactly happens during the process. This theory is unable to explain the dynamic elements.

12. Fails to Integrate the Theory of Value and the Theory of Money:

Lord Keynes claimed that this theory has created a wedge between the Theory of Relative Prices, or the Theory of Value, and the Theory of Absolute Prices, or the Theory of Money. Don Patinkin refers to it as a classical dichotomy. The relationship between prices and the theory of money is not explained by this theory. In reality, relative prices, which are determined by the demand for and supply of commodities, and general price levels, which are determined by the demand for and supply of money, are closely connected to each other.

Share your thoughts in the comments

Please Login to comment...