Difference between AIS and Form 26AS

Last Updated :

18 Apr, 2024

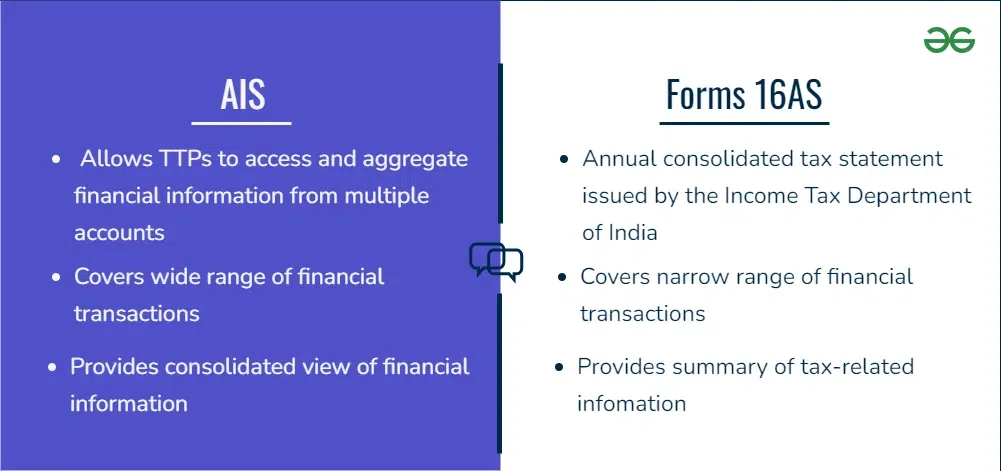

Annual Information Statement (AIS) and Form 26AS are two important documents that taxpayers in India need to be aware of. They both provide information about your financial transactions, but they do so in different ways.

What is Form 26AS?

Form 26AS is a consolidated statement of all tax deducted at source (TDS) and tax collected at source (TCS) transactions that have been reported to the Income Tax Department (ITD) in a given financial year. It includes information such as the amount of TDS/TCS deducted, the name of the payer, and the date of deduction. Form 26AS can be accessed through the ITD’s e-filing website.

What is AIS (Account Information Service)?

AIS is a more comprehensive document that provides information about a wider range of financial transactions. In addition to TDS/TCS, it includes information about savings account interest, dividend income, rent received, purchase and sale of securities, foreign remittances, and GST turnover. AIS can also be accessed through the e-filing website, and it allows taxpayers to provide feedback on the information that is reported.

Difference between AIS and Form 26AS

|

Basis

|

AIS (Account Information Service)

|

Form 26AS

|

| Definition |

AIS allows authorized third-party providers (TPPs) to access and aggregate financial information from multiple accounts held by an individual or business. |

Form 26AS is an annual consolidated tax statement issued by the Income Tax Department of India to individual taxpayers. |

| Scope |

AIS covers a wider range of financial transactions. |

Form 26AS covers a narrow range of financial transactions. |

| Purpose |

Provides users with a consolidated view of their financial information from different banks or financial institutions. |

Provides taxpayers with a summary of tax-related information. |

| Information Included |

Account details, transaction history, balances, and other relevant financial data from multiple accounts. |

Tax deducted at source (TDS) details, advance tax, self-assessment tax, tax refunds, and high-value transactions are reported to the tax department. |

| Usage |

Used for personal finance management, budgeting, financial planning, or other services requiring consolidated account information. |

Used by taxpayers for tax compliance, filing income tax returns, and verifying tax credits. |

| Accuracy |

AIS is more accurate as it includes feedback from taxpayers. |

Form 26AS is less accurate as it doesn’t includes feedback from taxpayers. |

| Geographic Scope |

Can vary depending on the country and the financial institutions involved. |

Specific to the Indian tax system. |

| Regulatory Framework |

Governed by applicable regulations and data privacy laws in each country. |

Governed by the Income Tax Act, 1961, and related regulations in India. |

Share your thoughts in the comments

Please Login to comment...