10 Best Online Payment Apps in India For Domestic and International Transactions [2024]

Last Updated :

08 Feb, 2024

Online payment is an instant method of transferring money to individuals or organizations directly over the Internet, making our regular bill payments, balance inquiries, account details inquiries, money transfers, etc. more manageable and effortless.

In this article, we will explore 5 Domestic Payment Apps used within India and 5 International Payment Apps that best suit Indians aiming to make or receive International payments, with their key features. The apps for the online payments are:

- Paytm

- Google Pay

- PhonePe

- CRED

- MobiKwik

- PayPal

- Payoneer

- Wise

- Revolut

- Remitly

5 Best Online Payment Apps in India For Domestic Transactions

Transactions carried within the country are called Domestic Transactions. In this section, we will focus on apps that are domestically (within India) used and supported to carry out day-to-day transactions.

A good domestic payment app is versatile and should support:

- Wide range of credit, debit cards and other payment options

- Fast and secure transfer of funds without any technical glitches

- Compatible with a wide range of devices

- Supports a neat User Interface and 24/7 Helpdesk

Let’s explore the popular online payment apps in India with their key features in 2024.

1. Google Pay

Google Pay, often called “G-Pay” allows users to make UPI transactions and Direct Bank Transfers with ease. One can effortlessly pay individuals by scanning the QR code or by entering a registered mobile number linked with their bank account. It has a simple and interactive user interface.

Key Features:

- AutoPay Feature: Provides a facility to auto-recharge or pay for monthly subscriptions for OTT apps.

- UPI Lite: UPI lite can be used to initiate transactions of small amounts without the security pin.

- CIBIL Score: Users can check their CIBIL score easily for free.

2. Paytm

Paytm is an all-in-one platform that supports UPI, Direct Bank Transfer and E-Wallet facility. It allows users to perform all kinds of bookings and reservations like – electricity bill recharge, education fee payment, flight tickets and many more, directly and instantly from their app.

Paytm is widely known among local vendors and businesses for their voice-alert products and Financial Services.

Key Features:

- E-Wallet Facility: This allows us to withdraw and store the amount in a digital wallet which is similar to withdrawing cash from an atm and storing it in a wallet.

- Insurance, Investment & Loan Facility: This allows user to purchase insurance for their vehicle or medical along with buying different SIPs, investments and apply for different instant loan schemes.

- Paytm Postpaid Feature: Provides emergency funds that can be paid back within 30 days with 0% interest.

- Watchlist Feature for Investing & Trading Platforms: Allows us to keep track of the market data of your favourite companies.

- Paytm Soundbox, Paytm QR, All-in-One POS: A very useful voice-alert device for vendors and sellers that confirms the payments received. Soundbox supports 11 languages.

3. Phone Pe

PhonePe has the largest user base in India and serves as an all-in-all platform to support, UPI transactions, Direct Bank Transfers, E-Wallet Facility and International Payments being new to the list. The app supports instant bookings and reservations directly through the app using the PhonePe Switch option.

Key Features:

- UPI International: It allows users to make international transactions. Currently accepting countries – Bhutan, Singapore, Nepal, UAE, and Mauritius.

- UPI payments with Credit Cards: Usually, UPI payments with credit cards are not supported. But using this feature, we can make payments using Rupay Credit Cards.

- Cashbacks on One Tap Subscription Payment

- Insurance & Investment Facility

- PhonePe Smart Speaker: A voice-alert device that alerts confirmation of the payment and currently supports 11 languages including English.

4. CRED

CRED is a reward-based credit card payments and tracking app extensively developed for Credit Card users with good Credit Score and Credit History. It also provides short-term credit lines which is a type of loan often borrowed and repaid.

Key Features:

- CRED Protect: Allows users to gain complete control over their credit cards. Provides complete analysis of their spending and helps to detect hidden charges and track credit limits.

- CRED Store: An online store where we can buy products at special prices and discounts.

- CRED RentPay: Allows users to pay their rent with a credit card and awards upto 45 days of credit-free days and reward points to users.

- Allows users to buy Vouchers, Coins and participate in Bids where Bid is a number guessing game.

- Step-Up Cashback with Credit Card Bill Payments: Allows users to get cashback upto 3 consecutive days after a bill is paid.

- Detects Hidden Charges applied to your Credit Cards

- Check Credit Score for Free

5. MobiKwik

MobiKwik is an emerging payment app that provides UPI transactions, Direct Bank Transfers and E-Wallet Facility. Similar to other payment apps, this can be used to pay our regular bills and bookings instantly and directly. It also provides the facility of wallet-to-wallet transfer using a registered phone number.

Key Features:

- Special Investment Options:

- XTra Flexi – offers 12% Annual Returns and allows withdrawal anytime.

- XTra Plus – offers 13% Annual Returns but has a 3 months lock-in period.

- ZIP EMI: Provides a credit line of Rs 2 Lakhs with a repayment tenure of 2 Years.

- ZIP Pay Later: Provides a credit line of Rs 60,000 with 0% interest upto 15 days.

- Vibe: A newly launched voice-alert product that notifies the confirmation of payment and supports multiple Indian languages.

- Mutual Funds Investment: Allows users to create an account and invest in mutual funds.

Comparison Table: Online Payment Apps in India

Let’s compare the 5 Domestic Payment Apps widely used in India with their key features and ratings on Play Store and App Store.

- Auto Pay

- UPI lite

- Gold Bar

|

4.4

|

4.7

|

- Paytm E-Wallet

- Soundbox

- Paytm Postpaid

- Stock Options

- Insurance Options

|

4.5

|

4.7

|

- UPI International

- One tap subscription

- Link Credit cards on UPI

|

4.4

|

4.7

|

- CRED Protect

- CRED Store

- Step up cashback

|

4.8

|

4.8

|

- Xtra – Flexi & Plus

- ZIP EMI

- ZIP Pay Later

|

4.2

|

4.6

|

5 Best Online Payment Apps in India For International Transactions

Freelancers and businesses dealing with International clients are booming in India. In this section, we explore the International payment apps that best suit Indians who are aiming to make or receive International payments.

A good International Payment App has the features:

- Should have less transaction & currency conversion fee

- Supports wide payment methods and banks

- Fast and secure transfer of funds with 24X7 support.

Let us dive in to understand the best International payment apps with their key features.

1. PayPal

Paypal is a very renowned International Payment App networking in 200+ countries. It offers a faster way to send money. The transaction fee charged is high compared to other Apps but it’s a very helpful platform for Businesses and Freelancers to make and receive payments globally.

Key Features:

- Easy Cross-Border Transactions: PayPal automatically converts local currency into the intended currency when paying or withdrawing.

- Support Currencies from 26 Countries

- Check for PayPal’s Transaction Fees as shown below:

- PayPal has the Highest Transaction Limit of $10,000 compared to all other International Payment Apps & the settlement TAT is 2 days.

2. Payoneer

Supporting over 200+ countries with their service and 150 currencies globally. Payoneer is a chosen one among the Indian Freelancers to receive International payments. It provides an option to bear the transaction fee either by receiver or payer, which in most cases is borne by the client (payer).

Key Features:

- Current Account to Send Money: Payoneer supports payers only having Current Account (Business Account) to send money internationally. Whereas users with either account (Savings or Current Account) can receive and withdraw money.

- Store Manager: This feature helps in tracking multiple store payments across various marketplaces from one convenient location.

- Supports 150 Currencies and is widely used in 200 Countries

- Request A Payment: A useful feature for the receiving party to raise their invoice.

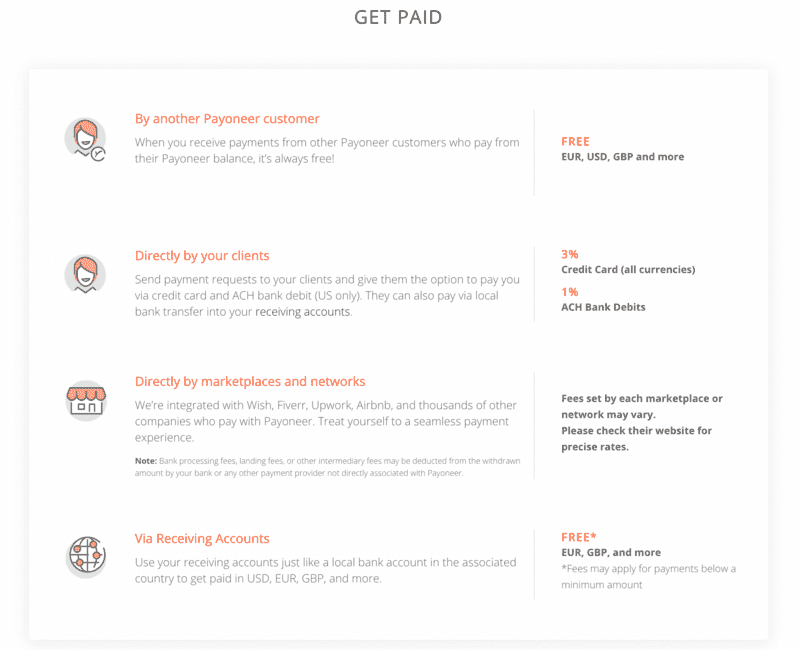

- Check for Payoneer’s Transaction Fees as shown below:

Fee for Receiving Amount:

Fee for Withdrawing the Amount:

- Payoneer Virtual Card: Offers a Payoneer Mastercard which allows business owners to pay for global business expenses in a simple way. It also allows withdrawing money.

3. Wise

Wise is an easy-to-use platform offering an advantage to users having no or little knowledge about the process involved in making International.

Mostly chosen by Freelancers in India to raise an invoice and receive International Payments. The App charges very less Transaction Fee and supporting over 227 Countries worldwide.

Key Features:

- Know about Wise’s Transfer Limits and Receiving Limits as shown below:

Transfer Limits:

Receiving Limits:

- Send Money Now: Process to send money effortlessly without having the prior need to link a bank account.

- Wise Travel Money Card: For all the travel enthusiasts, it is like a debit card where an individual can hold and manage 53 currencies in their Wise Account.

- Wise Business Debit Card: A normal debit card to counter all the global business expenses.

- Supports 40+ Currencies Globally.

4. Revolut

Revolut is one emerging International Payment App with lots of new features and plans. It is mostly suitable for Individuals, Children and Businesses who have frequent requirements for International Transactions.

Key Features:

- Provides Cryptocurrency Support: Allows users to buy and sell cryptos at one touch at their own risks.

- Revolut <18: Allows children (6 – 17) to get their free account under Parents or Gaundians’ supervision.

- Supports Investing and Tracking options for Stocks and Commodities

- Savings Vault: Allows retail customers to set aside funds that would earn interests.

5. Remitly

An emerging app that aims to support immigrants all over the world. Supporting over 170 countries, it is very useful for Indian individuals, Businesses and Freelancers sending and receiving payment in dollars.

Remitly supports a majority of the Indian Government and Private Banks, UPI’s, Credit and Debit Cards and takes around 3-5 days for successful payment.

Key Features:

- Remitly Economy and Express Money Transfer Options

- Allows upto $30,000 in a single transfer

- 0 Transfer Fees for sending amounts more than $1000

- Transaction Limit: $2999 per day, $10,000 per month and $18,000 per 6 months.

- Check the Exchange Rates for Remitly as shown below:

.png)

Exchange Rates in Remitly

Comparision Table

- Auto Currency converter

- Fixed transaction fee

- $10,000 transaction limit

|

Suitable for All

|

3.8

|

4.0

|

- Website transaction service

- Store manager

- Virtual Card

|

For B2B Transactions and Freelancers

|

3.3

|

4.0

|

- Send Money Now

- Travel Money Card

- Business Debit Card

|

For Beginners (in International Payment process) and Freelancers

|

4.6

|

4.5

|

- Cryptocurrency support

- Revolut <18

- Stocks and Commodities

|

Suitable for all and Children aged (6 – 17)

|

4.7

|

4.8

|

- 0 Transaction Fees after $1000

- Upto $30,000 Single Transfer

|

Suitable for all

|

4.7

|

4.8

|

Limitations of Online Payments

1. Technical Glitches:

- Payment Apps might undergo technical glitches and maintenance periods sometimes.

- To avoid this, having multiple functioning payment apps is advisable.

2. Bank Server Down:

- When our Banks are very busy and the server tends to go down.

- We can come over this by using UPI-Wallets to make transactions.

3. Cyberthefts:

- Online Payment apps can be vulnerable and an open door for cyberthefts if not secured properly.

- We can secure our apps by turning on two-factor authentication and tokenization.

Must Read:

Conclusion

The future of Online Payments seems very promising since the COVID-19 as there can be newest technologies being applied, there can be new payment methods, and we can hope for enhanced security. Therefore, these are all the top online payment apps of 2024. We can never say one particular app is best because every online payment has its own key features which makes them unique from the other.

FAQs

Which payment app is best in India 2024?

These are the best payment apps in India:

- Paytm

- Google Pay

- PhonePe

- CRED

- MobiKwik

Which payment app is most used in the world?

Below is the list of payment apps that are widely used across the world:

- Samsung Pay

- Google Pay

- PayPal

- MobilePay, etc.

Which payment app launched recently?

PayRup has been launched on 9th January, 2023 and is considered among the fastest payment apps for making any online transactions safely.

Share your thoughts in the comments

Please Login to comment...