Advantages and Disadvantages of a Partnership

Last Updated :

13 Feb, 2024

A partnership is a form of business where two or more people formally agree to be co-owners, divide up the duties of running the organization, and split the profits and losses the organization earns. Persons who have formed a partnership with one another are referred to as partners. The firm name is the name under which the business operates.

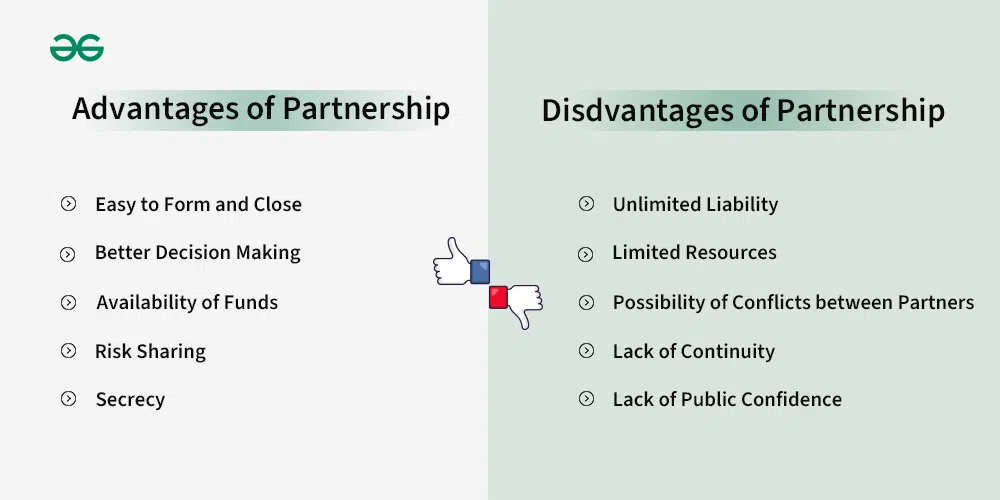

Advantages of Partnership

The advantages of Partnership are as follows:

1. Easy to Form and Close: The partnership business, like the sole proprietorship, can be formed immediately and without any legal stipulations. It is not essential to register the company. A simple agreement, either oral or written is all that is required to form a partnership company. A partnership is a contractual arrangement between two or more people to manage a business. As a result, it is quite simple to form. The legal requirements for formation are limited. on the other hand, the registration of a partnership is desirable, but not required. It’s the same in the case of closure, as it is also an easy task.

2. Better Decision Making: The firm is owned by the partners. Each of them has an equal right to participate in corporate management. In the event of a disagreement, they can sit down together to work out the issues. Because all partners are involved in decision-making, there is less room for reckless and hasty decisions. Because there are several owners in a partnership, all partners are involved in decision-making. Typically, partners from various specialist fields are brought together to complement one another. For example, if there are three partners, one may be a specialist in production, another in finance, and the third one in marketing.

3. Availability of Funds: In comparison to a sole proprietorship, it could be possible to pool more resources when two or more partners work together to establish a partnership firm. The partners may invest more money, more time, and more effort into the company.

As we know, a sole proprietorship experiences financial constraints due to its restricted resources. Due to this fact, the partnership firm now has more than one source of funding to solve this issue effectively. Additionally, it also boosts the company’s capacity to borrow money because the risk of loss is shared among numerous partners rather than just one. Banking institutions also see less danger in granting credit to partnerships than to sole proprietorships.

4. Risk Sharing: Each partner contributes to the firm’s losses in accordance with their agreed-upon profit-sharing percentages. As a result, the loss share for each partner will be lower than it would be for a proprietorship. The chance of losing money or defaulting can be greatly reduced because all profits and losses are shared among the partners. All of the partners in a partnership firm share the business risks. For example, if there are three partners and the company incurs a loss of Rs.12,000 over a specific time period, all partners may split it, with each partner bearing just a Rs. 4,000 burden.

5. Secrecy: Since businesses are not compelled to publish their financial statements or submit any reports to the government, secrecy regarding their activities can be easily maintained. This allows it to keep its operations and policies secret.

Disadvantages of Partnership

The disadvantages of Partnership are as follows:

1. Unlimited Liability: The partners are completely responsible for the firm’s debt, both jointly and individually. They can thus divide the liability among themselves or demand that each individual pay for all of the obligations, even any covered by personal property. The parties’ liability in a partnership business is unlimited. Similar to a sole proprietorship, if a partnership is unable to pay its debts, the personal assets of the partners may be in danger. Partners are jointly and separately accountable, and their liability is unlimited. For those partners who have more personal money, it might prove to be a significant disadvantage. If the other partners are unable to pay the loan, they will be responsible for paying it all back.

2. Limited Resources: The number of partners is restricted, and as a result, the capital they provide is also limited. There are restrictions on adding partners, so there won’t ever be enough funds to support a big firm. Partnership businesses thus have difficulties with business expansion.

3. Possibility of Conflicts between Partners: Every partner in a partnership business has an equal right to take part in management. Additionally, each partner has the right to present any matter to management at any moment with their thoughts and opinions. Due to this, there is sometimes a possibility of conflicts and disagreements among individuals, which may frequently result in the closure of the business.

4. Lack of Continuity: The partnership ends when one partner passes away or leaves. So, there is uncertainty in the continuity of the business. A partnership is an unstable type of organisation since it can collapse due to the death, retirement, or insolvency of any partner. The surviving partners, though, may reach new agreements and carry on the business.

5. Lack of Public Confidence: A partnership firm is an entirely private type of organisation. Government neither controls nor regulates it. Public trust in such types of businesses is generally low, as they are not required to publish their financial reports or make other related information public. As a result, it is challenging for the public to determine the genuine financial situation of a partnership business, which lowers public trust in partnerships.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...