Adjustment of Use of Goods in Business in Final Accounts (Financial Statements)

Last Updated :

22 Jun, 2023

The goods which have been purchased by the trader in order to run the business efficiently and brought into the firm for use by the business are known to be the goods for use in business.

Adjustment:

A. If Use of Goods in Business is given outside the trial balance:

In such a case, two effects will take place:

- Deducted from Purchases A/c in the Trading A/c.

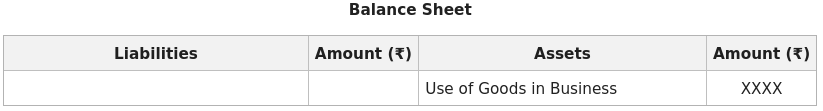

- Shown as an Asset on the Assets side of the Balance Sheet.

B. If Use of Goods in Business is given inside the trial balance:

It will only be shown as an Asset on the Assets side of the Balance Sheet.

Illustration:

Following is the trial balance of Mr. Rajan.

The following adjustments were noted:

- Goods to be used in business amounting to ₹10,000.

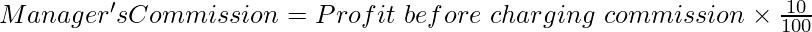

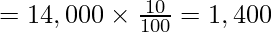

- The manager is entitled to commission @10% on net profit before charging such commission.

- Out of the total Advertisement expenditure incurred, only ₹4,000 belongs to the current year.

- Goods are sent to customers on a sale or return basis at cost plus 25% profit, the cost is ₹10,000.

- Goods in transit costs ₹2,000.

- Closing stock ₹4,500 to be taken into account.

Prepare Trading A/c, P & L A/c, and Balance sheet.

Solution:

Note: Contingent Liability will not be taken into account in the Balance sheet. It will be shown in Notes to Account.

Working Notes:

1. Calculation of Manager’s Commission

Share your thoughts in the comments

Please Login to comment...