Adjustment of Provision for Bad and Doubtful Debts in Final Accounts (Financial Statements)

Last Updated :

19 Jun, 2023

Provision is created out of profits of the current accounting period to reduce the amount of loss that may take place in the future. A Provision for Bad and Doubtful Debts is created so that the debtors who are not able to make the payment of their liability on the due date has no major effect on the profits of the current year and the profits remain intact. This also helps to know the true picture of business following the principle of conservatism.

Adjustment:

The following treatment takes place for Provision for Bad and Doubtful Debts:

A. If Provision for Bad & Doubtful Debts is given outside the trial balance:

In such case, two effects would take place:

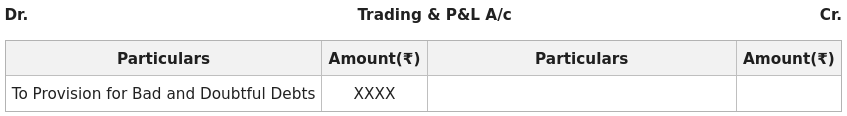

- First, it will be shown in the Dr. side of the Profit & Loss A/c.

- Second, amount of Provision for Bad & Doubtful Debts will be deducted from the Debtors in the Assets side of the Balance Sheet.

B. If Provision for Bad & Doubtful Debts is given inside the trial balance:

In such a case, it will be shown only on the Dr. side of the Profit & Loss A/c.

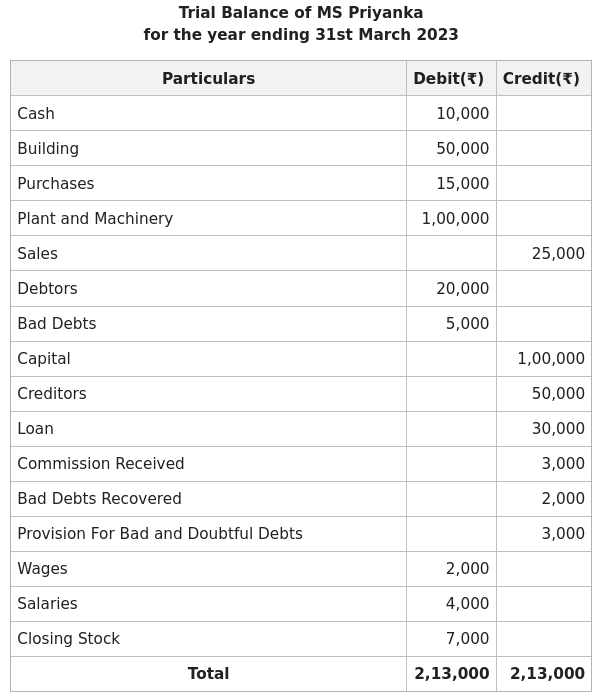

Illustration:

The following adjustments were noted :

1. Further Bad Debts amounting to 2,000 and Provision to be created at 5% of debtors.

2. The value of Plant and Machinery is appreciated by 10%.

3. Depreciation on the building is charged at 12.5%.

Solution:

Share your thoughts in the comments

Please Login to comment...