Adjustment of Deferred Revenue Expenditure in Final Accounts (Financial Statements)

Last Updated :

23 Jun, 2023

Deferred revenue expenditure means the expenditure, the benefit of which is accrued in more than one accounting period. In other words, it means that the expense that has been incurred at once, its benefit shall be received in the coming years as well. If the whole expense is debited in the current year, it may lead to an underestimation of the profit of the business and the balance sheet may not depict the correct financial position of the business. So, this expense is distributed over the different years in terms of the benefit that are estimated to be received every year.

Adjustment:

A. If Deferred Revenue Expenditure is given outside the trial balance:

- Will be shown on the Dr. side of the Profit & Loss A/c.

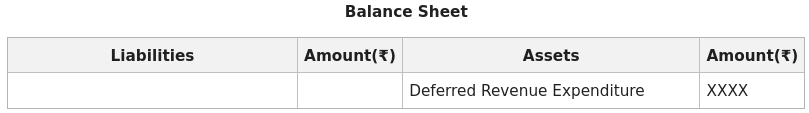

- The balance amount shall appear as an asset on the Assets side of the Balance Sheet.

B. If Deferred Revenue Expenditure is given inside the trial balance:

Only the balance amount shall appear as an asset on the Assets side of the Balance Sheet.

Illustration:

Following is the trial balance of Mr. Rajan.

The following adjustments were noted:

- Out of the total Advertisement expenditure incurred, only ₹4,000 belongs to the current year.

- Goods to be used in business amounting to ₹10,000.

- The manager is entitled to commission @10% on net profit before charging such commission.

- Goods are sent to customers on a sale or return basis at cost plus 25% profit, the cost is ₹10,000.

- Goods in transit costs ₹2,000.

- Closing stock ₹4,500 to be taken into account.

Prepare Trading A/c, P & L A/c, and Balance sheet.

Solution:

Note: Contingent Liability will not be taken into account in the Balance sheet. It will be shown in Notes to Account.

Working Notes:

1. Calculation of Manager’s Commission

Manager’s Commission =

=

Share your thoughts in the comments

Please Login to comment...