What is a Nominal Account? | Rule, Types & Examples (Journal Entries)

Last Updated :

23 Apr, 2024

A nominal account, also known as an income statement account or a temporary account, is a type of account used in accounting to record revenues, expenses, gains, and losses. These accounts are temporary because their balances are transferred to the owner’s equity or retained earnings account at the end of an accounting period. Nominal accounts are temporary in nature, meaning their balances are reset to zero at the end of each accounting period.

Key Takeaways:

- Nominal accounts are closed at the end of each accounting period by transferring their balances to the owner’s equity or retained earnings account, which are permanent accounts.

- Nominal accounts primarily record transactions related to revenues, expenses, gains, and losses.

- By monitoring nominal accounts, businesses can assess their profitability and make informed decisions about operations and investments.

Types of Nominal Account

Nominal accounts encompass various types of accounts that record different financial transactions.

1. Revenue Accounts: These accounts track the income earned by a business from its primary operations. Examples include sales revenue, service revenue, interest income, dividend income, and rental income.

2. Expense Accounts: Expense accounts record the costs incurred by a business in order to generate revenue. Examples include salaries and wages, rent, utilities, supplies, advertising expenses, depreciation, and interest expenses.

3. Gain Accounts: Gain accounts record any gains earned by a business from sources other than its primary operations. Examples include gains from the sale of assets, investments, or foreign currency exchange.

4. Loss Accounts: Loss accounts track any losses incurred by a business, such as losses from the sale of assets, write-offs of bad debts, or other non-operating losses.

5. Income Summary Account: This is a temporary account used to summarize the revenues and expenses for a specific accounting period before they are transferred to the owner’s equity or retained earnings account during the closing process.

Rules of Nominal Account

The rules governing nominal accounts primarily revolve around their treatment in the accounting cycle, especially during the closing process at the end of an accounting period.

1. Recording Revenue and Gains: Revenue and gain accounts are credited when recording increases in income. For example, when recording sales revenue, the sales revenue account is credited.

2. Recording Expenses and Losses: Expenses and loss accounts are debited when recording increases in expenses. For instance, when recording salaries expense, the salaries expense account is debited.

3. Closing Process: At the end of an accounting period, nominal accounts are closed out to reset their balances to zero for the next period. Revenue and gain accounts are closed by debiting them, while expense and loss accounts are closed by crediting them. The balances of these nominal accounts are then transferred to the income summary account.

4. Transferring to Permanent Accounts: After the closing entries are made, the balances of revenue and expense accounts are transferred to the owner’s equity or retained earnings account. This transfer reflects the net income or net loss for the period.

5. Accrual Basis Accounting: Nominal accounts follow the accrual basis of accounting, where revenues and expenses are recorded when they are earned or incurred, regardless of when cash is exchanged. This ensures that financial statements accurately reflect the company’s financial performance during a given period.

Reason behind Debiting Expenses and Crediting Income

Debiting expenses and crediting income in accounting helps businesses keep track of their financial activities in a clear and organized way.

1. Debiting Expenses: When you debit an expense, you’re recording the money you spent to run your business, like buying supplies or paying bills. By doing this, you’re showing that your business’s assets are decreasing because you’ve used them to cover costs. It’s like marking down the money you’ve spent in your wallet. This helps you see where your money is going and keeps your spending in check.

2. Crediting Income: On the other hand, when you credit income, you’re noting down the money your business earns from sales or other activities. By crediting income, you’re increasing your business’s assets because you’re adding more money to them. It’s like adding money to your savings account. This helps you see how much money you’re making and where it’s coming from, giving you a clear picture of your business’s financial health.

How to Transfer Funds from Nominal Account to Real Account?

- Identify the purpose of the transaction, such as capitalizing an expense or transferring income to a liability account.

- Prepare a journal entry by debiting the real account and crediting the nominal account.

- Determine the specific accounts to debit and credit based on the nature of the transaction.

- Calculate the amounts to debit and credit considering the balances in the nominal and real accounts and transaction details.

- Record the journal entry in the general ledger with accurate descriptions and references.

- Update the ledger accounts for both the nominal and real accounts with the journal entry information.

- Review the entry for accuracy and reconcile the affected accounts.

- Adjust financial statements, like the balance sheet and income statement, to reflect the transfer accurately.

- Consider consulting a professional accountant or financial advisor for complex transactions or specific accounting requirements.

Examples of Nominal Account with Journal Entries

Example 1: Sales Revenue Account

Assume, ABC Ltd. sells goods worth ₹10,000 on credit. Record the necessary journal entry in nominal accounts.

Solution:

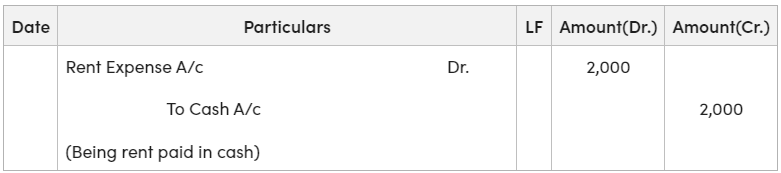

Example 2: Rent Expense Account

Assume, XYZ Ltd. pays rent of ₹2,000 in cash. Record the necessary journal entry in nominal accounts.

Solution:

Nominal Account vs. Real Account

|

Basis

|

Nominal Account

|

Real Account

|

|

Nature of Account

|

Records incomes, expenses, gains, and losses.

|

Records assets and liabilities.

|

|

Balance at the End of Period

|

Temporary accounts; get closed at the end of an accounting period.

|

Permanent accounts; carry forward to the next accounting period.

|

|

Examples

|

Examples include Salary Expense and Sales Revenue.

|

Examples include Cash/Bank and Equipment.

|

|

Effect on Financial Statements

|

Helps in calculating profit or loss for a specific period.

|

Reflects the financial position of the business at a point in time.

|

|

Purpose

|

Used for measuring the performance of the business.

|

Used for evaluating the financial stability and liquidity of the business.

|

Nominal Account – FAQs

What is a Personal Account in accounting?

A personal account is an account that records transactions with individuals, businesses, or organizations. It keeps track of amounts owed to or by the business by specific parties.

How often should I review my accounting records?

It’s a good practice to review your accounting records regularly, preferably monthly or quarterly. This helps you stay updated on your business’s financial health and make timely decisions.

What is the difference between cash accounting and accrual accounting?

Cash accounting records transactions when cash is received or paid, while accrual accounting records them when the transaction occurs, regardless of when the cash is received or paid. Cash accounting is simpler, while accrual accounting gives a more accurate picture of a business’s financial position.

Do I need to hire an accountant for my small business?

While it’s not mandatory, hiring an accountant can be beneficial for managing finances, ensuring compliance with tax laws, and providing financial advice. However, many small business owners manage their own accounting using software or spreadsheets.

How can I improve my cash flow?

Improving cash flow involves managing expenses, invoicing promptly, offering discounts for early payments, and maintaining a buffer for unexpected expenses. Regularly reviewing and updating your cash flow statement can also help you identify areas for improvement.

Share your thoughts in the comments

Please Login to comment...