Techniques of Inventory Control

Last Updated :

13 May, 2024

What is Inventory Control?

Inventory control is the process of managing and overseeing a company’s inventory. It involves monitoring and managing the flow of goods from manufacturers to warehouses and then to retail outlets or directly to customers. The primary goal of inventory control is to ensure that the right amount of inventory is available at the right time, in the right place, and at the right cost. Effective inventory control helps businesses reduce carrying costs, prevent stockouts and overstock situations, improve cash flow, and enhance customer satisfaction by ensuring products are available when needed.

Key Takeaways:

- Inventory control involves forecasting demand, determining optimal inventory levels, and setting reorder points to ensure that stock levels are neither too high nor too low.

- Tracking inventory levels in real-time to know exactly how much stock is on hand, in transit, or in production.

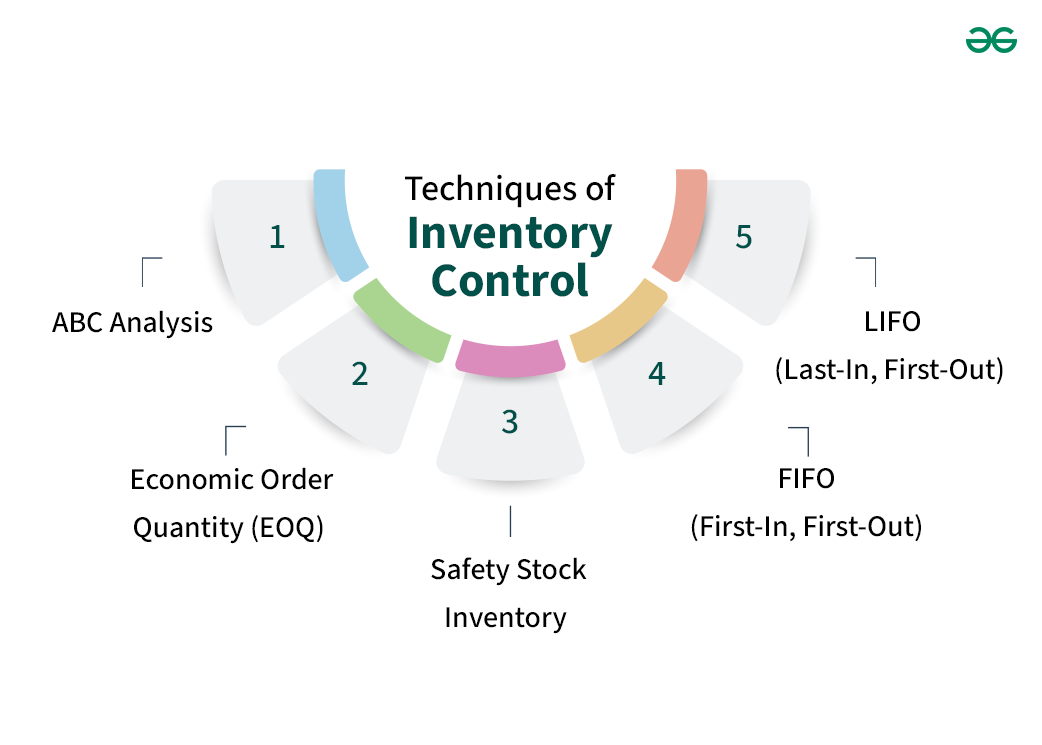

Techniques of Inventory Control

Inventory control techniques are strategies and methods used by businesses to manage their inventory levels effectively, ensuring that they have the right amount of stock on hand at the right time. Here are the inventory control techniques that businesses commonly employ to optimize their inventory management,

1. ABC Analysis

ABC Analysis is a technique used to manage inventory by dividing items into three categories (A, B, and C) based on their importance and value. ‘A’ items are the most valuable and require close attention, ‘B’ items are less critical but still important, and ‘C’ items are the least valuable. This method helps businesses prioritize their efforts and resources effectively.

Features

- Categorization: Items are classified into categories (A, B, and C) based on their significance to the business.

- Usage of Pareto Principle: ABC analysis is often guided by the Pareto Principle, also known as the 80/20 rule, which suggests that roughly 80% of the effects come from 20% of the causes.

- Criteria for Classification: Items are classified based on criteria such as annual sales revenue, inventory value, contribution margin, or frequency of usage. The specific criteria used may vary depending on the objectives and context of the analysis.

Advantages

- Resource Optimization: It allows companies to focus more resources on the most critical items, ensuring that the most valuable products are always available and managed efficiently.

- Cost Efficiency: By identifying less critical items, businesses can reduce costs related to overstocking and storage, optimizing overall inventory expenses.

Disadvantages

- Complex Setup: Setting up an ABC Analysis can be complicated, requiring detailed analysis to accurately categorize items, which might be challenging and time-consuming.

- Potential Neglect: Lower-value items might be overlooked, which can be problematic if these items are essential for certain operations or customer demands, potentially disrupting business processes.

2. Economic Order Quantity (EOQ)

Economic Order Quantity (EOQ) is a formula used by businesses to determine the ideal order quantity that minimizes the total costs of inventory. This includes costs like ordering, holding, and shortage costs. EOQ helps ensure that a company orders the optimal amount of stock, balancing various cost factors.

Features

- Optimal Order Quantity: EOQ calculates the ideal order quantity that minimizes total inventory costs, considering both ordering costs and holding (or carrying) costs.

- Trade-off Analysis: It balances the costs associated with holding inventory (storage, insurance, obsolescence) and the costs of ordering (processing, transportation, setup).

- Deterministic Demand: EOQ assumes constant and known demand over time, making it suitable for items with stable and predictable demand patterns.

Advantages

- Cost Efficiency: EOQ helps minimize total inventory costs by optimizing order quantities, reducing excess inventory holding costs and ordering costs.

- Simplicity: The EOQ formula is easy to understand and apply, making it accessible to businesses of all sizes without requiring advanced mathematical knowledge.

- Inventory Optimization: By determining the optimal order quantity, EOQ ensures that inventory levels are neither too high (which ties up capital and incurs holding costs) nor too low (which risks stockouts and potentially higher ordering costs).

Disadvantages

- Assumptions: EOQ relies on several assumptions that may not always hold true in real-world situations, such as constant demand, stable costs, and no quantity discounts.

- Complexity in Application: While the EOQ formula is simple, its application may be more complex in practice, especially when dealing with multiple products, variable demand, or fluctuating costs.

- Limited Scope: EOQ is most effective for items with stable demand and known costs. It may not be suitable for products with uncertain demand, seasonal variations, or rapidly changing market conditions.

3. Safety Stock Inventory

Safety Stock Inventory involves keeping a reserve of items on hand to prevent stockouts typically caused by fluctuations in demand or supply delays. This buffer stock acts as an insurance against unforeseen changes in customer demand or supply chain disruptions.

Features

- Buffer Inventory: Safety stock, also known as buffer stock, serves as a cushion against unexpected fluctuations in demand, supply disruptions, or lead time variability.

- Risk Mitigation: It helps mitigate the risk of stockouts, ensuring that businesses can fulfill customer orders even when demand exceeds expectations or unforeseen delays occur in the supply chain.

- Dynamic Adjustment: Safety stock levels can be adjusted based on factors such as demand variability, lead time uncertainty, and service level objectives to strike a balance between inventory costs and customer service levels.

Advantages

- Improved Customer Service: Safety stock ensures product availability and reduces the likelihood of stockouts, enhancing customer satisfaction and loyalty.

- Supply Chain Resilience: It provides resilience against supply chain disruptions, such as delays in shipments, production issues, or unexpected increases in demand, helping businesses maintain continuity in operations.

- Flexibility in Demand Fluctuations: Safety stock accommodates fluctuations in demand, seasonal variations, or unforeseen spikes in sales, allowing businesses to respond effectively without incurring excessive costs or delays.

Disadvantages

- Increased Holding Costs: Maintaining safety stock incurs additional holding costs, including storage space, insurance, and obsolescence, which can impact overall inventory carrying costs.

- Capital Tie-Up: Safety stock ties up working capital that could be invested elsewhere in the business, potentially limiting financial resources for other investments or operational needs.

- Risk of Overstocking: Excessive safety stock levels can lead to overstocking, increasing the risk of inventory obsolescence, carrying costs, and capital tied up in slow-moving or obsolete inventory.

4. FIFO (First-In, First-Out)

FIFO is an inventory management method where the oldest stock (first-in) is sold first (first-out). This technique is particularly useful in managing perishable goods or products with expiration dates to ensure that items do not become obsolete.

Features

- Chronological Order: FIFO operates on the principle that the oldest inventory items (those acquired first) are the first to be used or sold, ensuring that goods are consumed in the order they are received or produced.

- Simple Tracking: FIFO is relatively easy to implement and understand, as it follows a straightforward rule of using the oldest available inventory before newer stock.

- Compliance: FIFO is often preferred for financial reporting purposes, as it aligns with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), providing transparency and accuracy in inventory valuation.

Advantages

- Accurate Inventory Valuation: FIFO results in more accurate inventory valuation, especially during periods of inflation, as it assigns the highest costs to goods sold, reflecting current market prices more closely.

- Better Matching of Costs and Revenue: By using older, lower-cost inventory first, FIFO ensures that the cost of goods sold (COGS) closely matches the revenue generated, leading to more accurate profit calculations.

- Reduced Risk of Obsolescence: FIFO helps reduce the risk of inventory obsolescence by ensuring that older inventory items are used or sold before newer ones, minimizing the likelihood of holding obsolete stock for extended periods.

Disadvantages

- Complexity in Tracking: While FIFO is conceptually simple, its implementation can be more complex in practice, especially in businesses with large inventories or frequent inventory turnover, requiring meticulous tracking and record-keeping.

- Potential for Distorted Margins: During periods of rising costs, FIFO may result in higher reported profit margins, which could overstate the company’s profitability and mislead stakeholders if not adjusted for inflationary effects.

- Higher Tax Liability in Inflationary Environments: Inflationary environments can lead to higher taxable income and tax liabilities under FIFO, as the method assigns older, lower-cost inventory to COGS, resulting in higher reported profits and tax obligations.

5. LIFO (Last-In, First-Out)

LIFO is an inventory management method where the most recently received items (last-in) are sold first (first-out). This is commonly used in non-perishable industries where inventory obsolescence is less of a concern.

Features

- Reverse Chronological Order: LIFO operates on the principle that the most recently acquired or produced inventory items are the first to be used or sold, with older inventory items remaining in stock.

- Cost Flow Assumption: LIFO assumes that the most recent costs incurred are directly attributable to goods sold, reflecting current market prices more accurately than older costs.

- Tax Benefits: LIFO can provide tax advantages, especially during periods of rising prices or inflation, as it assigns higher costs to goods sold, resulting in lower reported profits and tax liabilities.

Advantages

- Tax Savings: LIFO can lead to lower taxable income and tax liabilities compared to other inventory costing methods, particularly in inflationary environments, where it allows businesses to match higher current costs with revenue.

- Improved Cash Flow: By deferring taxes through the use of LIFO, businesses can preserve cash flow, as they have fewer tax obligations in the short term, enabling them to reinvest capital or fund other operational needs.

- Mitigation of Price Volatility: LIFO can help mitigate the impact of price fluctuations on reported profits and taxable income, as it reflects the higher costs of replacing inventory in inflationary periods, thereby stabilizing financial results.

Disadvantages

- Complexity in Inventory Valuation: LIFO can be more complex to implement and manage than other inventory costing methods, as it requires detailed tracking and record-keeping of inventory purchases, prices, and quantities.

- Potential for Distorted Financial Statements: LIFO may result in distorted financial statements, especially during periods of rising prices, as it can understate inventory values, overstate cost of goods sold (COGS), and inflate profit margins.

- Inventory Erosion: Continuous use of LIFO can lead to inventory erosion over time, as older, lower-cost inventory is never fully expensed, potentially causing distortions in reported inventory levels and valuation.

Techniques of Inventory Control – FAQs

What is the Economic Order Quantity (EOQ) model, and how does it work?

The EOQ model calculates the optimal order quantity that minimizes total inventory costs, balancing ordering costs and holding costs. It helps businesses determine the most cost-effective order quantity to maintain.

How does Just-In-Time (JIT) inventory control differ from traditional inventory management?

JIT inventory control focuses on minimizing inventory levels by receiving goods from suppliers exactly when needed in production or for sale, reducing the need for excess inventory storage and improving efficiency.

What is ABC analysis, and how does it help in inventory management?

ABC analysis categorizes inventory items into three groups (A, B, and C) based on their value and importance, allowing businesses to prioritize management efforts and resources accordingly.

How does Safety Stock inventory help in mitigating supply chain risks?

Safety stock inventory serves as a buffer against demand variability, supply disruptions, or lead time uncertainties, ensuring product availability and reducing the risk of stockouts.

Share your thoughts in the comments

Please Login to comment...