What is Seed Funding?

Seed Funding refers to the initial capital provided to start a new business or launch a new product. It is often the first stage of funding in a startup’s life cycle and is used to cover initial expenses such as market research, product development, and early marketing efforts. Seed funding is typically provided by angel investors, venture capitalists, or even friends and family who believe in the potential success of the startup. In return for their investment, seed investors usually receive equity in the company.

- When any startup is at the seedling stage, the funding raised by the startup is called Seed funding.

- This funding is for the raised at the inception, ideation, or beginning stage.

- The entrepreneur needs to understand what constitutes seed funding and why seed funding is so crucial for building businesses in the early stage.

Who are Angel Investors?

An Angel investor is the one who provides initial seed money for startup businesses, usually angel investor provides funding in exchange for ownership equity in the company. The Angel Investor may take a significant interest in the working of the startup and might also be involved in a series of projects on a professional basis using his area of expertise or may be found among an entrepreneur’s relation. The angel investor’s involvement might be a one-time infusion of seed funding or an ongoing injection of cash to help the product reach the market. Angel investors are not to be confused as any loan businessmen or business house, rather angel investor keeps looking for new ideas in which they can invest their money with the expectation of an earning reward of wealth maximization if their invested business takes off. Angel Investors search for those startups which have intriguing ideas, and they invest their own money to help them develop further.

Types of Angel Investors

1. Individual Angel Investors: These are private investors who put their own money into new businesses. Such people generally have previous experience as business owners or in a certain field. They have the option to make investments in startups that are related to their knowledge or interests.

2. Serial Entrepreneurs: A selected group of angel investors consists of experienced business owners who have previously established and sold their own enterprises. They may allocate financial resources to support early-stage ventures while also giving mentorship and insightful advice grounded in their personal experiences.

3. Venture Capitalists into Angel Investors: Angel investors are individuals who have departed from conventional venture capital firms after serving as venture capitalists. Individuals may exhibit a preference for the personalised attention and adaptability afforded by angel investing as opposed to the more regulated atmosphere traditional of venture capital firms.

4. Strategic Angels: They are a subset of angel investors who make investments with strategic objectives in addition to financial gain. A potential motivation for their investment could be an interest in the startup’s industry or technology, which would grant them access to innovative goods, technologies, or market intelligence.

5. Groups of Angel Investors: Collectives of individual angel investors, known as Angel Investor Organisations, syndicates, or angel networks, engage in joint ventures to identify and pursue investment opportunities. These collectives combine their resources, assume collaborative duties of due diligence, and might make joint investments in new companies. This methodology facilitates a diversified portfolio and shared knowledge.

Places to Look for Angel Funding

1. Individual Savings: Numerous angel investors finance ventures with their own funds or accumulated wealth. This is frequently described as “bootstrapping” the capital outlay.

2. Previous Venture Capital Remains: Angel investors, who have prior entrepreneurial success, may use the proceeds from the sale of their own previous companies to finance their investments. This may encompass earnings generated from an IPO (Initial Public Offering) or the divestiture of a company to another organisation.

3. Friends and Family: Certain angel investors are granted strong financial backing by close acquaintances or family members who have faith in their investment expertise. This may refer to an informal agreement wherein financial resources are extended with the intention of investing in new enterprises.

4. Savings of Corporate Executives: Top-ranking executives of well-established corporations may employ their personal savings in angel funding. This is a common occurrence when executives pursue personal pursuits in particular industries or wish to broaden their investment portfolios.

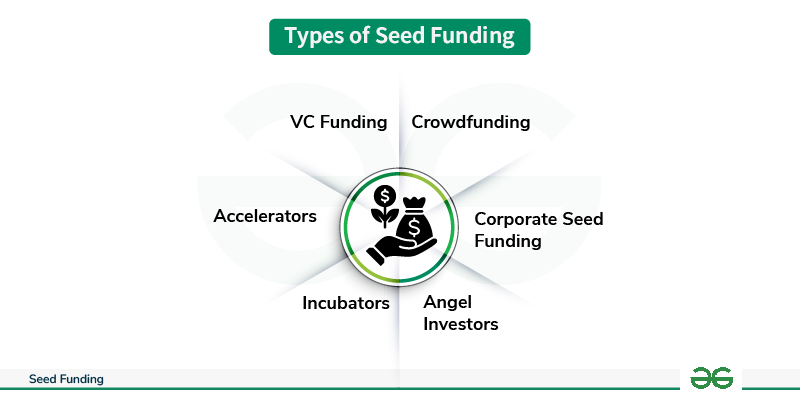

Types of Seed Funding

1. Crowdfunding: Crowdfunding platforms have become a very popular destination for seed funding. These platforms are generally open, and anyone can share the idea, concept, or product, and others can support the idea by contributing.

2. Corporate Seed Funding: Corporate Seed Funding is a good source of seed funding as start-ups gain more visibility with the help of big corporate investors. Large companies like Google, Intel, Apple, and Microsoft support start-ups regularly with seed funding. Such investments will prove to be very useful for new firms to build their brand and compete with established business houses.

3. Angel Investors: These are the investors who invest seed funds in a start-up in exchange for equity ownership or convertible debt.

4. Incubators: Incubators not only help with providing small seed funds but also focus on helping the new ventures through training, and they also provide office space. Many leading educational institutes, like IITs and IIMs, also provide such assistance for startups. Also, most of the time Incubators do not ask for equity holdings from start-ups.

5. Accelerators: These investors mainly help the new firms in scaling up rather than supporting them in early-stage innovation. They also provide help through various training, mentoring, and giving network reach. Unlike most incubators, accelerators usually take equity in exchange for their assistance and support.

6. VC Funding: Venture Capitalists are those high-end investors that invest in a new venture after looking into various parameters such as market conditions, founder vision, growth potential, etc. An example of VC funding is SoftBank, etc.

Advantages of Seed Funding

1. Risk Mitigation and Investor Commitment: Investors in seed-funding comprehend the inherent risk associated with unproven startup ideas. They are willing to take on risk, showcasing their commitment to the startup’s potential success.

2. Expertise and Guidance: Seed investors bring valuable expertise and insights to the table, which act as the most important advantage. Their experience can guide startups in navigating challenges and making informed business decisions, ultimately enhancing the startup’s growth and development. They act as mentors, providing crucial advice and mentorship.

3. Access to Extensive Networks: Investors typically possess well-established business networks. By securing seed funding, startups gain access to these networks, which can open doors to valuable connections, partnerships, and opportunities, ultimately helping in the growth of business. This expanded reach can significantly accelerate the startup’s progress.

4. Debt-Free and Flexible Financing: Seed-funding is typically structured as equity investments rather than loans. This means that it won’t be burdened with debt repayment, allowing startups to allocate resources more efficiently. Additionally, the flexible nature of equity financing enables startups to focus on their business’s growth without restrictive repayment agreements.

5. Validation on Market Offering: Seed funding can also help validate a startup’s business model and provide a level of credibility to the company. By securing it, startups can showcase to investors and customers that there is a market for their product or service and the idea is viable if catered properly.

Risks Associated with Seed Funding

1. The Risk Of Not Getting Funded: This is the most common risk, and it’s one that every co-founder faces. There’s no guarantee that your startup will receive funding, even though the idea is good and viable.

2. The Risk Of Not Being Able To Raise More Money: Once a startup has received seed funding, the startup will need to continue to raise additional rounds of funding in order to grow the business. If the startup is unable to raise additional funding at an increased valuation, the business will fail to grow.

3. The Risk Of Giving Up Too Much Equity: In order for a startup to receive seed funding, the co-founders have to give up a significant amount of equity in your startup company in order to attract seed funding. This can be risky, as it means you’ll have less control over your business.

4. The Risk Of Not Having A Viable Product: Many startups receive seed funding based on the promise of a great product or service that doesn’t yet exist, they have yet to come up with the actual product or service offering. In case, they are not able to deliver on this promise, investors will lose confidence, and the business will fail.

5. The Risk Of Running Out Of Money: All businesses require capital to operate, and startups are no exceptions. If the startup runs out of money before the startup is able to achieve profitability, the business will likely fail.

Seed Support System – Technology Development Board (TDB)

Technology Development Board (TDB) is a proactive step taken by the government towards the promotion of providing soft financing to Indian companies enabling the commercialisation of their scientific and technological innovations. TDB is set up by the Ministry of Science and Technology and has provided financial assistance of a whopping ₹100 lakh each as a grant to 36 Technology Business Incubators (TBIs) and Science & Technology Entrepreneur Park (STEPs) established under the Seed Support System for Start-ups in Incubators in order to incubate innovative technological ideas and to lead them to successful commercialisation of those ideas. The assistance is positioned to create techno-entrepreneurs space around the nation and also act as a bridge between the development & commercialisation of the technologies. The objective of such a grant is to provide support for the start-ups primarily for product development, testing & trials, marketing feasibility, mentoring, professional consultancy, filing patents, manpower and other wings as may be important to carry out the commercialisation of that idea.

The financial assistance by TDB would also facilitate the STEPs/TBIs to build up an incubation fund out of the inflows over a period of 5 years. The inflow would be ploughed back to support the next round of start-ups. The assistance to the incubators can be either in the form of loans or equity.

Share your thoughts in the comments

Please Login to comment...