National Income is the aggregate value of all goods and services produced by firms in a given financial year. It can be stated that when the aggregate revenue generated by the firms is paid out to factors of production, it equals aggregate income or National Income. There are different variants or aggregates of National Income and each of the aggregates has a specific meaning, use, and method of measurement. These aggregates are as follows:

- Gross Domestic Product at Market Price (GDPMP)

- Gross Domestic Product at Factor Cost (GDPFC)

- Net Domestic Product at Market Price (NDPMP)

- Net Domestic Product at Factor Cost (NDPFC)

- Gross National Product at Market Price (GNPMP)

- Gross National Product at Factor Cost (GNPFC)

- Net National Product at Market Price (NNPMP)

- Net National Product at Factor Cost (NNPFC)

Basic Aggregates of National Income

A number of goods and services are produced in a year by different production units within an economy. It is not possible to add those goods and services in terms of their quantity; therefore, these are added in terms of money. There are eight aggregates in National Income for measuring the value of goods and services in terms of money. These are as follows:

1. Gross Domestic Product at Market Price (GDPMP)

GDPMP refers to the gross market value of all the final goods and services produced during a year within the domestic territory of a country.

Gross in GDPMP means that the total value of final goods and services includes depreciation, i.e., no provision has been made for it.

Domestic in GDPMP means that the final goods and services produced are located within the domestic boundaries of the country.

Product in GDPMP indicates that only final goods and services are included.

Market Price in GDPMP means that the amount of indirect taxes paid is included in GDP; however, the subsidies are excluded from it.

The rest of the aggregates are determined by making some adjustments in GDPMP.

2. Gross Domestic Product at Factor Cost (GDPFC)

GDPFC refers to the gross money value of all the final goods and services produced during a year within the domestic territory of a country. It can be determined as:

GDPFC = GDPMP – Net Indirect Taxes

3. Net Domestic Product at Market Price (NDPMP)

NDPMP refers to the net market value of all the final goods and services produced during a year within the domestic territory of a country. It can be determined as:

NDPMP = GDPMP – Depreciation

4. Net Domestic Product at Factor Cost (NDPFC)

NDPFC refers to the net money value of all the final goods and services produced during a year within the domestic territory of a country. It can be determined as:

NDPFC = GDPMP – Net Indirect Taxes – Depreciation

NDPFC is also known as Domestic Factor Income or Domestic Income.

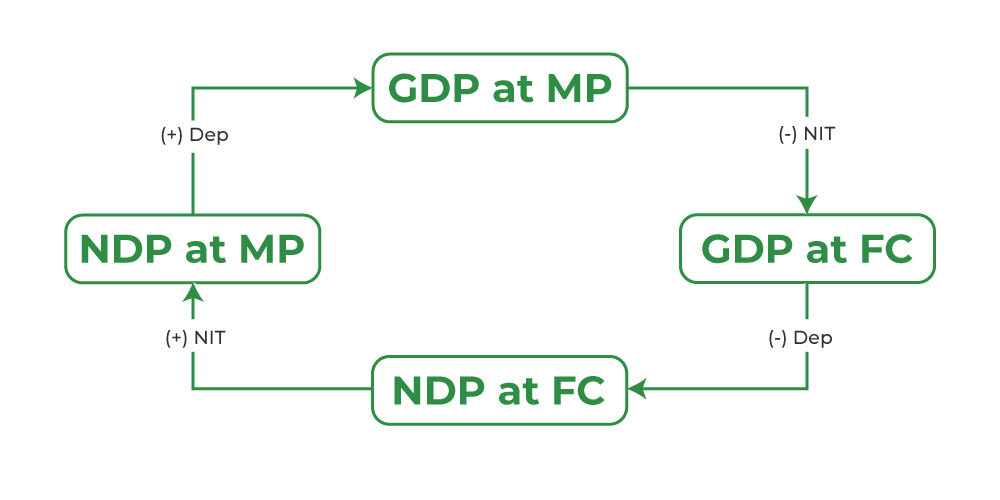

Relationship between the four Domestic Aggregates (GDPMP GDPFC NDPMP and NDPFC)

Domestic in each of these aggregates states that the contribution of only those producers whether they are resident or non-resident will be included who are producing within the domestic territory of the country.

5. Gross National Product at Market Price (GNPMP)

GNPMP refers to the gross market value of all the final goods and services produced during a year by the normal residents of a country. It can be determined as:

GNPMP = GDPMP + Net Factor Income from Abroad

GNPMP of a country can be less than its GDPMP if NFIA is negative. However, it can be more than GDPMP if NFIA is positive.

6. Gross National Product at Factor Cost (GNPFC)

GNPFC refers to the gross money value of all the final goods and services produced during a year by the normal residents of a country. It can be determined as:

GNPFC = GNPMP – Net Indirect Taxes

7. Net National Product at Market Price (NNPMP)

NNPMP refers to the net market value of all the final goods and services produced during a year by the normal residents of a country. It can be determined as:

NNPMP = GNPMP – Depreciation

8. Net National Product at Factor Cost (NNPFC)

NNPFC refers to the net money value of all the final goods and services produced during a year by the normal residents of a country. It can be determined as:

NNPFC = GNPMP – Net Indirect Taxes – Depreciation

NNPFC is also known as National Income.

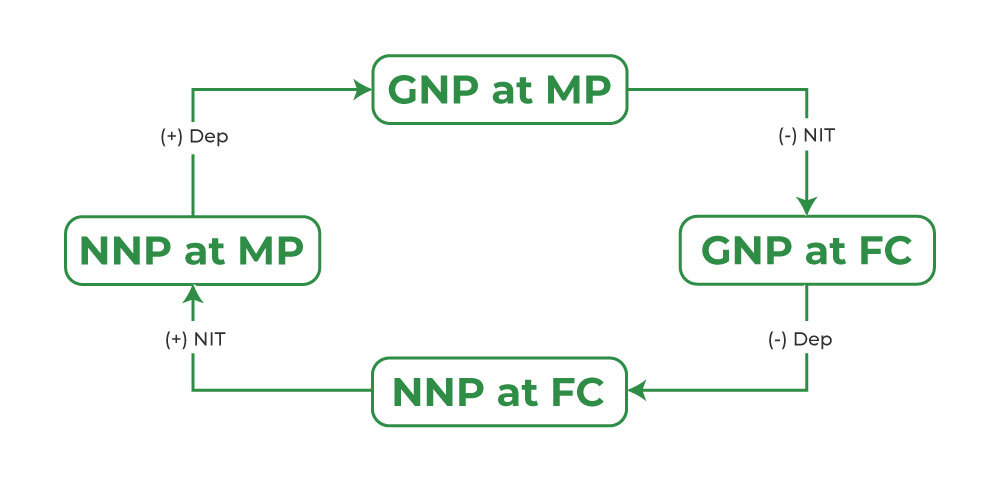

Relationship between the four Domestic Aggregates (GNPMP GNPFC NNPMP and NNPFC)

National in each of these aggregates states that the contribution of only those producers who are normal residents of a country will be included. It does not matter if the production is being held outside the domestic territory of the country.

Domestic Income (NDPFC) v/s National Income (NNPFC)

|

Basis

|

Domestic Income

|

National Income

|

| Meaning |

It refers to the net money value of all the final goods and services produced during a year within the domestic territory of a country. |

It refers to the net money value of all the final goods and services produced during a year by the normal residents of a country. |

| Nature of Concept |

Domestic Income is a territorial concept. It includes the value of all the final goods and services produced within the domestic territory of a country. |

National Income is a national concept. It includes the value of all the final goods and services produced in the whole world. |

| Category of Producers |

All producers within the domestic territory of the country are included in Domestic Income. |

All producers who are normal residents of the country are included in National Income. |

| NFIA |

Domestic Income does not include NFIA. |

National Income includes NFIA. |

Gross Domestic Product at Market Price (GDPMP) v/s National Income

|

Basis

|

Gross Domestic Product at Market Price (GDPMP)

|

National Income (NNPFC)

|

| Meaning |

It refers to the gross market value of all the final goods and services produced during a year within the domestic territory of a country. |

It refers to the net money value of all the final goods and services produced during a year by the normal residents of a country. |

| Nature of Concept |

GDPMP is a territorial concept. It includes the value of all the final goods and services produced within the domestic territory of a country. |

National Income is a national concept. It includes the value of all the final goods and services produced in the whole world. |

| Category of Producers |

All producers within the domestic territory of the country are included in GDPMP. |

All producers who are normal residents of the country are included in National Income. |

| Net Indirect Taxes |

GDPMP is at market price; therefore, net indirect taxes are included. |

National Income is at factor cost; therefore, net indirect taxes are excluded. |

| Depreciation |

Depreciation is included in GDPMP |

Depreciation is not included in National Income. |

Steps to Calculate Practicals of Basic Aggregates of National Income

There are eight basic aggregates of National Income among which four are of Domestic Concept (GDPMP GDPFC NDPMP and NDPFC) and four are of National Concept (GNPMP GNPFC NNPMP and NNPFC). To determine the National Income of a country, it is required to first calculate one of the basic aggregates of national income out of the rest of the seven. To better understand, let us take an example where we have to determine NDPMP from GNPFC.

Step 1:

Prepare an equation by placing the aggregate to be determined on the left side of the equal-to sign and the aggregate given on the right side.

For example, NDPMP = GNPFC ± Adjustments.

Step 2:

Identify the Adjustments required and then calculate the answer.

In the above example, as we have to determine NDPMP from GNPFC, there are three adjustments required.

- G in GNPFC refers to Gross. It means that it includes Depreciation. Therefore, depreciation will be subtracted from GNPFC to arrive NNPFC

- N in GNPFC refers to National. It means that it includes Net Factor Income from Abroad (NFIA). Therefore, NFIA will be subtracted from NNPFC to arrive NDPFC

- FC in GNPFC refers to Factor Cost. It means that it does not include Net Indirect Taxes (NIT). Therefore, NIT will be added to NDPFC to arrive NDPMP

Hence, the final equation to determine NDPMP will become NDPMP = GNPFC – Depreciation – NFIA + NIT.

Example 1:

Calculate National Income or NNP at FC.

|

Particulars

|

₹ in crores

|

| GNP at MP |

7,000

|

| Subsidies |

400

|

| Net Factor Income from Abroad |

300

|

| Depreciation |

100

|

| Indirect Tax |

500

|

Solution:

NNP at FC = GNP at MP – Depreciation – NIT (Indirect Taxes – Subsidies)

= 7,000 – 100 – (500-400)

= ₹6,800 crores

Note: We will not adjust NFIA as there is national value in both NNP at FC and GNP at MP.

Example 2:

Calculate NNP at FC.

|

Particulars

|

₹ in crores

|

| GDP at MP |

6,500

|

| Goods and Services Tax (GST) |

500

|

| Factor Income from Abroad |

260

|

| Factor Income to Abroad |

400

|

| Subsidies |

110

|

| Consumption of Fixed Capital |

150

|

Solution:

NNP at FC = GDP at MP – Consumption of Fixed Capital + NFIA (Factor Income from Abroad – Factor Income to Abroad) – NIT (Goods and Services Tax – Subsidies)

= 6,500 – 150 + (260 – 400) – (500 – 110)

= ₹5,820 crores

Example 3:

Calculate Factor Income from Abroad.

|

Particulars

|

₹ in crores

|

| GNP at MP |

7,000

|

| Indirect Taxes |

500

|

| Replacement of Fixed Capital |

150

|

| Factor Income to Abroad |

270

|

| Subsidies |

50

|

| NDP at FC |

4,600

|

Solution:

GNP at MP = NDP at FC + Replacement of Fixed Capital + NFIA (Factor Income from Abroad – Factor Income to Abroad) + NIT (Indirect Taxes – Subsidies)

Therefore,

Factor Income from Abroad = GNP at MP – NDP at FC – Replacement of Fixed Capital + Factor Income to Abroad – NIT (Indirect Taxes – Subsidies)

= 7,000 – 4,600 -150 + 270 – (500 – 50)

= ₹2,070 crores

Note: Replacement of Fixed Capital is another name for Depreciation.

Example 4:

Calculate:

i) Indirect Tax

ii) Depreciation

iii) Domestic Income or NDP at FC

|

Particulars

|

₹ in crores

|

| GNP at FC |

80,000

|

| Subsidies |

15,000

|

| GNP at MP |

1,00,000

|

| National Income or NNP at FC |

75,000

|

| GDP at MP |

1,10,000

|

Solution:

i) GNP at FC = GNP at MP – NIT (Indirect Tax – Subsidies)

Indirect Tax = GNP at MP + Subsidies – GNP at FC

= 1,00,000 + 15,000 – 80,000

= ₹35,000 crores

ii) NNP at FC = GNP at FC – Depreciation

Depreciation = GNP at FC – NNP at FC

= 80,000 – 75,000

= ₹5,000 crores

iii) Domestic Income or NDP at FC = GDP at MP – Depreciation – NIT (Indirect Tax – Subsidies)

= 1,10,000 – 5,000 – (35,000 – 15,000)

= ₹85,000 crores

Example 5:

The Net Domestic Product at Factor Cost of an economy is ₹5,000 crores. Its capital stock is worth ₹3,000 crores and it depreciates @20% per annum. The Subsidies, Indirect Taxes, Factor Income to the rest of the world, and Factor Income from the rest of the world are ₹70 crores, ₹150 crores, ₹400 crores, and ₹400 crores respectively. Find out the Gross National Product at Market Price.

Solution:

Gross National Product at Market Price = Net Domestic Product at FC + Depreciation + Net Indirect Taxes (Indirect Taxes – Subsidies) + Net Factor Income from Abroad (Factor Income from the rest of the world – Factor Income to the rest of the world)

= 5,000 + 20% of 3,000 + (150 – 70) + (400 – 400)

= 5,000 + 600 + 80 + 0

= ₹5,680 crores

Quick Revision:

Net Indirect Taxes = Market Price – Factor Cost

Depreciation = Gross Value – Net Value

Net Factor Income from Abroad = National Value – Domestic Value

GDPFC = GDPMP – Net Indirect Taxes

NDPMP = GDPMP – Depreciation

Domestic Income or NDPFC = GDPMP – Depreciation – Net Indirect Taxes

GNPMP = GDPMP + Net Factor Income from Abroad

GNPFC = GNPMP – Net Indirect taxes

NNPMP = GNPMP – Depreciation

National Income or NNPFC = GNPMP – Depreciation – Net Indirect Taxes

Share your thoughts in the comments

Please Login to comment...