A market is a place where the exchange of goods takes place. Monopoly is one such type of market where only one seller sells products in the market.

In this article, we will cover the meaning, features, and demand curve of a monopoly market.

What is Monopoly Market?

Monopoly is derived from two Greek words, Monos (meaning single) and Polus (Meaning seller). It is a market situation where there is only one seller in the market selling a product with no close substitutes. For example, Indian Railways. In a monopoly market, there are various restrictions on the entry of new firms and exit of existing firms. Also, there are chances of Price Discrimination in a Monopoly market.

Key Takeaways:

- In a monopoly market, there is only one seller or producer of a particular product or service.

- Monopolies often arise due to significant barriers to entry, such as exclusive access to resources, patents, or high start-up costs.

- Monopolies may engage in price discrimination, charging different prices to different consumers based on their willingness to pay.

- Monopoly Markets are often associated with allocative inefficiency, as prices are typically higher and output lower compared to perfectly competitive markets.

Features of Monopoly Market

1. Single Seller: Under Monopoly, there is only one seller selling the product in the market. It means that the monopoly firm and the industry are the same in this form of market. As there is one seller, the monopolist has full control over the price and supply of the product. Whereas, the number of buyers in a Monopoly market is large, which means that no single buyer can influence the price of a product in the market.

2. No Close Substitutes: As there is a single seller selling the product under a monopoly market, there are no close substitutes for the same. Therefore, a monopoly firm has no fear of competition from other firms, either new or existing ones. For example, Indian Railways has no close substitute for transportation services. However, there are other distant services like metro, etc.

3. Price Discrimination: As a monopolist is a single seller in the market, he/she can charge different prices at the same time from a different set of consumers, which is also known as Price Discrimination.

Charging different prices from different consumers for the same product at the same time is known as Price Discrimination. The three types of Price Discrimination are Personal Price Discrimination, Place Price Discrimination, and Use Price Discrimination.

Personal Price Discrimination: When the seller charges different prices for the same product from different kinds of buyers, it is known as Personal Price Discrimination. For example, a doctor charges less from poor people and more from rich, railways charges less from senior citizens and more from young citizens.

Place Price Discrimination: When the seller charges a different price for the same product at different places, it is known as Place Price Discrimination. For example, the money charged for electricity in rural areas is less than the money charged per unit in urban areas.

Use Price Discrimination: When the seller charges a different price for the same product based on its uses, it is known as Use Price Discriminations. For example, electricity charges per unit for a commercial purpose is different from the charges per unit for residential purpose.

4. Restrictions on Entry and Exit: Under a Monopoly market, there are strong restrictions/barriers on the entry of new firms and exit of the existing firms. It means that a monopoly firm can earn abnormal losses and profits in the long run. One of the reasons behind the barriers may be legal restrictions, like licensing, patent rights, etc., or it might be due to the restrictions in the form of cartels created by the firms.

5. Price Maker: As there is only one seller under the monopoly market, and the firm and the industry are the same things, the seller has a complete control over the price of the product. Being a sole seller, the monopolist can influence the supply of goods in the market and can fix the price on their own.

Reasons for Emergence of Monopoly

The basic cause of the existence of monopoly is the barrier of entry into the market. Various other reasons for the emergence of Monopoly are as follows:

1. Government Licensing: Before entering into an industry, a firm has to take permission from the government and obtain a license for the same. Licensing helps a firm in ensuring minimum standards of competency. Therefore, sometimes government does not grant the license to the new firms so they can make sure that only one firm runs in the market.

2. Patent Rights: Many big private companies perform Research and Development activities at their own risk and sometimes if the R&D gets successful, they come up with a new product or technology. For the risk, they have taken in R&D, the government as a reward grants them patent rights. A patent right is the right granted by the government to a firm or manufacturer to use or sell their invention for a certain period of time. The period for which patent rights are granted to the firms or manufacturers is known as patent life.

3. Control on Raw Materials: Another reason for the emergence of Monopoly is sole ownership or control of the essential raw materials required in a specific industry. For example, De Beers control a large percentage of the world’s production of diamonds and can therefore influence the market.

4. Cartel: Some firms use cartels to retain their individuality and coordinate their output and pricing policies so they can act as a monopoly. They also agree among themselves to restrict their total output up to the level at which they can maximize their joint profits. One of the most famous examples of a cartel in monopoly is OPEC (Organisation of Petroleum Exporting Countries).

A Cartel is an organisation or a group of producers of goods and suppliers of services formed with a formal agreement among them for the regulation of supply to manipulate or regulate the price of goods or services.

Demand Curve under Monopoly

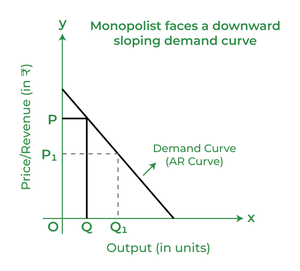

As there is a single seller or firm in the monopoly market selling products with no close substitute, a monopoly firm is like an industry. It gives the monopolist, full freedom and power to fix the price of their product. However, a monopoly firm cannot control the demand for a product. Therefore, if the firm wants to increase the number of goods to be sold in the market, it has to reduce the price of the product. Hence, the demand curve of a monopoly firm is downward sloping. This concept can be understood with the help of a demand curve.

In the above demand curve of a monopoly firm, the output of the product is measured along the X-axis and the price and revenue of the firm is measured along the Y-axis. At OP price, the firm can sell OQ quantity of the product, and the demand will rise to OQ1 if the firm reduces the price to OP1. Therefore, the demand curve under a monopoly market has a negative slope as a firm can sell more quantity at a lower price.

A monopoly firm can increase the demand for its product in the market only if it reduces its price, which results in a downward sloping demand curve. Because of this reason, the revenue generated by the monopoly firm from every extra unit, also known as MR, is less than the price of the product, also known as AR.

Therefore, under Monopoly firm, MR < AR.

Monopoly Market – FAQs

How does a monopoly form?

Monopolies can form for various reasons, such as owning exclusive rights to a resource, having patents on a product, or through aggressive business practices that eliminate competition.

How do governments regulate monopolies?

Governments may regulate monopolies through antitrust laws, which aim to prevent monopolistic behavior such as price fixing, collusion, and abusing market power. They may also break up monopolies or impose price controls.

Can monopolies be beneficial for innovation?

While monopolies may have incentives to innovate to maintain their market dominance, they may also have less pressure to innovate compared to competitive markets where firms must constantly strive to improve to stay ahead.

Are natural monopolies different from other types of monopolies?

Yes, natural monopolies arise in industries where economies of scale are so significant that it is more efficient to have a single supplier. Examples include utilities like water, electricity, and natural gas distribution.

Can monopolies be beneficial for the economy?

Some argue that monopolies can lead to efficiencies and innovation, but others contend that the negative effects on consumers and competition outweigh these potential benefits.

How do monopolies affect income distribution?

Monopolies can increase income inequality by allowing the owners of the monopoly to amass significant wealth and power, while consumers may face higher prices and reduced purchasing power.

Share your thoughts in the comments

Please Login to comment...