A Market is a place where the exchange of goods takes place. The market is the nervous system of modern economic life where producers and consumers carry out the sale and purchase transactions. The market has a different and wider meaning in economics, as it does not refer to a specific place. In Economics, a Market is a region where the buyers and sellers don’t have to assemble at a specific place for the sale and purchase of goods. Instead, they have to be in contact with each other through any communication means, such as the internet, letters, mail, telephone, etc.

Market refers to the whole region where buyers and sellers of a commodity are in contact with each other for the purchase and sale of the commodity.

Key Takeaways:

- Markets can exhibit different structures based on the number of buyers and sellers and the degree of competition. Common structures include perfect competition, monopolistic competition, oligopoly, and monopoly.

- Markets are driven by the forces of supply and demand. Sellers provide goods or services, while buyers demand them.

- In a competitive market, equilibrium occurs when the quantity supplied equals the quantity demanded at a specific price, known as the equilibrium price.

- Markets are considered efficient when they allocate resources to their most valued uses.

Essentials or Characteristics of a Market

1. Area: In economics, a market is not related to a specific place, instead, it spreads over an area that becomes the point of contact between the producers/sellers and consumers/buyers. With the advancement of technology and modern means of communication, the market area of a product has become wide.

2. Commodity: In economics, a market is not related to a specific place but to a specific product. It means that a market can exist if there is one commodity that will be purchased and sold among the buyers/consumers and sellers/producers.

3. Buyers and Sellers: Another characteristic of a market is the presence of buyers and sellers. The buyers and sellers must contact each other in the market. However, it does not mean that they should meet physically, the contact can be through modern means of communication, like the internet, mail, telephone, etc.

4. Competition: For a market to exist, it is necessary that there is free competition amongst the buyers and sellers. The absence of competition in the market results in the charging of different prices for the homogeneous commodity by the sellers.

What is Market Structure?

The number and types of firms operating in the industry and the nature and degree of competition in the market for the goods and services is known as Market Structure. To study and analyze the nature of different forms of market and issues faced by them while buying and selling goods and services, economists have classified the market in different ways.

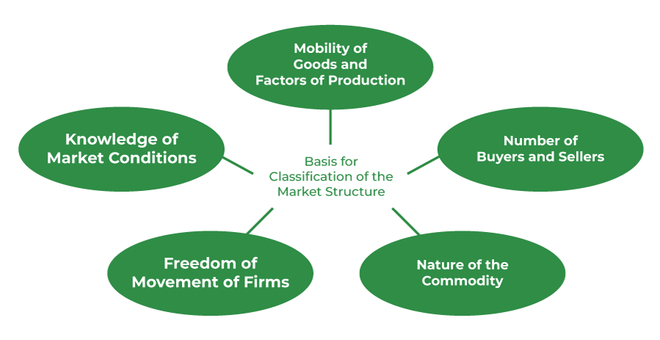

Basis for Classification of the Market Structure

The factors determining the market structure are as follows:

1. Number of Buyers and Sellers

The volume/number of buyers and sellers in the market of a commodity exercises a great influence on the price of a commodity. If there are a large number of buyers and sellers in the market, then a single buyer or seller cannot influence the price of a commodity. However, if there is one seller of a commodity, such as Railways, then the seller has great control over its price.

2. Nature of the Commodity

The nature of the commodity has a great impact on the price of the commodity. If a commodity is homogeneous in nature (identical goods such as pen, paper, etc.), then it is sold at a uniform price in the market. If a commodity is heterogeneous in nature (non-identical, totally different goods, such as different toothpaste brands, etc.), then it may be sold at different prices. However, commodities with no close substitutes, such as Railways can charge a higher price from the buyers.

3. Freedom of Movement of Firms

Freedom in entry and exit of firms results in price stability in the market. However, restrictions on the entry of new firms or exit of the existing ones can lead to the firms influencing the price of goods and services, as they have no fear of competition from other existing or new firms.

4. Knowledge of Market Conditions

If the buyers and sellers are aware of the market conditions and have full knowledge about them, then the uniform price of goods and services prevails in the market. Whereas, if the buyers and sellers are unaware of the market conditions, then sellers are in a position to charge their customers different prices.

5. Mobility of Goods and Factors of Production

Free movement of factors of production from one place to another results in a uniform price in the market. However, if the movement of factors of production is not free, then the prices may differ from each other.

The different forms of market structure are Perfect Competition and Imperfect Competition (Monopoly, Monopolistic Competition, and Oligopoly).

1. Perfect Competition

A market situation where a large number of buyers and sellers deal in a homogeneous product at a fixed price set by the market is known as Perfect Competition. Homogeneous goods are goods of similar shape, size, quality, etc. In other words, in a perfect competitive market, the sellers sell homogeneous products at a fixed price determined by the industry, not by a single firm. In the real world, the situation of perfect competition does not exist; however, the closest example of a perfect competition market is agricultural goods sold by the farmers. Goods like wheat, sugarcane, etc., are homogeneous in nature and their price is influenced by the market.

2. Monopoly

Monopoly is a completely opposite form of market and is derived from two Greek words, Monos (meaning single) and Polus (Meaning seller). A market situation where there is only one seller in the market selling a product with no close substitutes is known as Monopoly. For example, Indian Railways. In a monopoly market, there are various restrictions on the entry of new firms and exit of the existing firms. Also, there are chances of Price Discrimination in a Monopoly market.

3. Monopolistic Competition

A Monopolistic Competition Market consists of the features of both Perfect Competition and a Monopoly Market. A market situation in which there is a large number of firms selling closely related products that can be differentiated is known as Monopolistic Competition. The products of monopolistic competition include toothpaste, shampoo, soap, etc. For example, the market for soap enjoys full competition from different brands and has freedom of entry showing the features of a perfect competition market. However, every soap has its own different feature, which allows the firms to charge a different price for them. It shows the features of a Monopoly Market.

4. Oligopoly

A market situation where the number of big sellers of a commodity is less and the number of buyers is more is known as Oligopoly Market. As the number of sellers in this market is less, the price and output decision of one seller impacts the price and output decision of other sellers in the market. In other words, the interdependence among the sellers of a commodity is high. For example, luxury car producers like BMW, Audi, Ford, etc., come under Oligopoly Market, as the number of sellers of luxury cars is less and its buyers are more.

Market – FAQs

What factors determine the demand and supply in a market?

Demand is determined by factors such as price, income, tastes and preferences, and the prices of related goods. Supply is influenced by factors like production costs, technology, government policies, and the number of suppliers.

What is equilibrium price and quantity in a market?

Equilibrium price is the price at which the quantity demanded equals the quantity supplied in the market, leading to market stability. Equilibrium quantity is the quantity of goods or services bought and sold at the equilibrium price.

How does government intervention impact markets?

Governments intervene in markets through policies such as price controls, taxes, subsidies, and regulations to address market failures, ensure fair competition, promote consumer welfare, and achieve economic objectives like price stability and equity.

What role do markets play in the Indian economy?

Markets play a crucial role in the Indian economy by facilitating the exchange of goods and services, allocating resources efficiently, fostering competition, promoting innovation and entrepreneurship, and contributing to economic growth and development.

Share your thoughts in the comments

Please Login to comment...