Bank Reconciliation Statement (BRS) : Without Correcting Cash Book

Last Updated :

10 Feb, 2024

The cash balance as shown in the bank statement and the cash balance as shown in the business’s cash book are compared in a bank reconciliation statement. It aids in locating and elucidating any discrepancies between the two balances brought on by mistakes, omissions, or variations in time. One of the two ways to generate a bank reconciliation statement is with or without cash book balance adjustments.

I. When Debit Balance of Cash Book is Given

Format:

Example 1:

The balance of the cash book as shown by the cash book of Sukant & Co. on 31st August 2023 was ₹8,400. On comparing it with the passbook, the following differences were notes,

(i) Cheques sent for collection amounting to ₹6,400 have not been cleared by the bank so far.

(ii) Cheques issued but not presented for payment ₹4,000.

(iii) Bank charges ₹200 not entered in the cash book.

(iv) There was a credit of ₹500 in the passbook in respect of interest which was not recorded in the cash book.

(v) A customer deposited ₹2,000 directly in the bank account and it was entered only in the passbook.

(vi) As per standing orders of Sukant & Co., the banker has made the following payments:

- Insurance Premium of ₹1,200

- Club fees amounting to ₹1,000

Prepare a bank reconciliation statement as of 31st August 2023.

Solution:

Example 2:

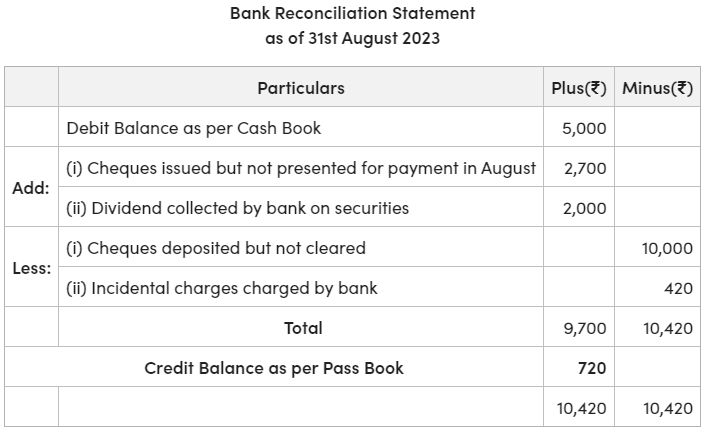

On 31st August 2023, the Cash Book of Sayeba & Co. showed a balance of ₹5,000 at the Bank. They spent cheques amounting to ₹27,000 for collection before 31st August, but it seems from the Pass Book that cheques for ₹17,000 had been credited by this date. Similarly, they issued cheques for ₹19,600 in August but cheques for ₹2,700 were presented in September 2023. The passbook revealed that the bank collected dividends on securities ₹2,000 as per standing instruction. The bank also charged ₹420 as incidental charges. Both of these entries were not passed in the Cash Book.

Prepare Bank Reconciliation Statement as of 31st August 2023.

Solution:

II. When Credit Balance of Cash Book is Given

Format:

Example 1:

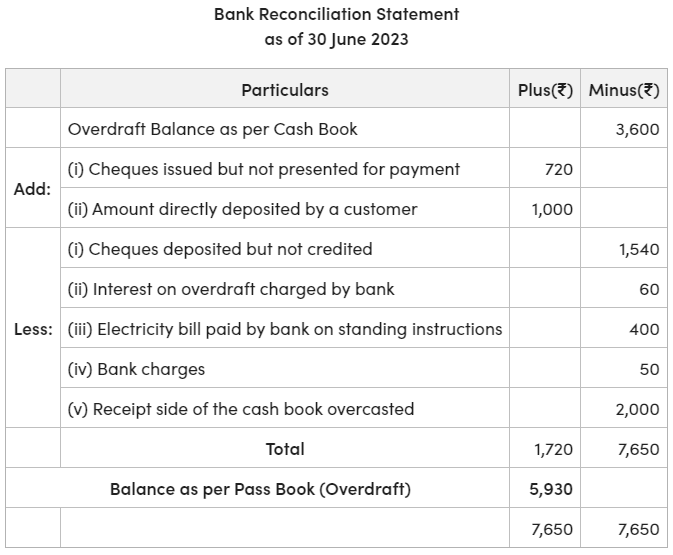

Prepare a Bank Reconciliation Statement from the following particulars as of 30th June 2023.

(i) Credit balance as per bank column of the Cash Book ₹3,600.

(ii) Cheque issued to a creditor but not presented for payment ₹720.

(iii) Cheque deposited into Bank for collection but not collected ₹1,540.

(iv) Interest on overdraft charged by Bank ₹60.

(v) A customer directly deposited into the bank ₹1,000.

(vi) The bank paid the electricity bill as per our standing instructions ₹400.

(vii) Bank charges ₹50.

(viii) The receipt side of the cash book is overcast by ₹2,000.

Solution:

Example 2:

On 31st August, 2023 Cash Book shows a bank overdraft of ₹4,415. Cheques for ₹1,000 were deposited in the bank on 20th August 2023, out of which only cheques for ₹750 have been credited so far. Cheques amounting to ₹2,500 were issued but out of them, only cheques of ₹2,000 have been cashed from the bank. ₹75 as interest on overdraft was found debited in the passbook. A cheque of ₹60 which was debited in the cash book could not be sent to the bank. The bank had given the wrong credit of ₹300 in the passbook. Prepare a Bank Reconciliation Statement.

Solution:

Share your thoughts in the comments

Please Login to comment...