Adjustment of Prepaid Expenses in Final Accounts (Financial Statements)

Last Updated :

07 Dec, 2023

Prepaid expenses refer to those expenses which are paid in advance by the firm but the benefit of which are availed in the next accounting period. So, these expenses have to be adjusted, which have not been incurred in the current accounting period to know the true figure of Profit/ Loss.

Adjustment:

A. If Prepaid Expenses are given outside the trial balance: In such case, two entries will be passed:

- Will be deducted from the related Expenses A/c in the Dr. side of the Trading A/c or Profit & Loss A/c

- Will be shown in the Assets side of the Balance Sheet ( Because it is a Representative Personal A/c the benefit of which will be received in the next year)

B. If Prepaid Expenses are given inside the trial balance: It will only be shown on the Assets side of the Balance Sheet. (Because it is a Representative Personal A/c and has a Dr. balance)

Illustration:

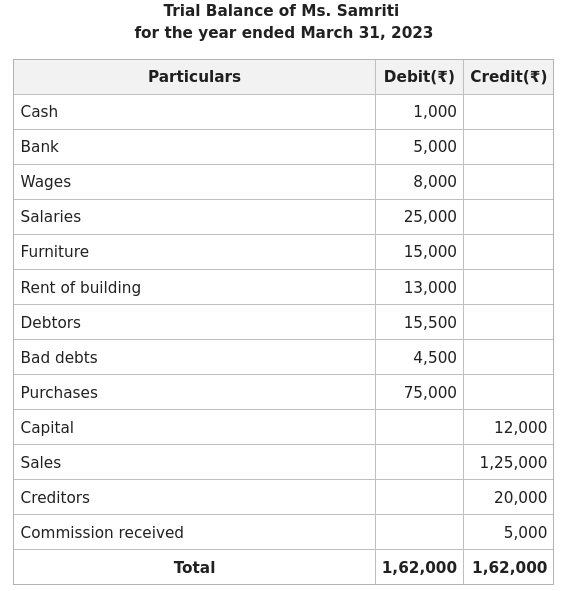

The Trial Balance of Ms. Samriti for the year ended March 31 2023, appears as follows:

The following adjustments were noted on that date:

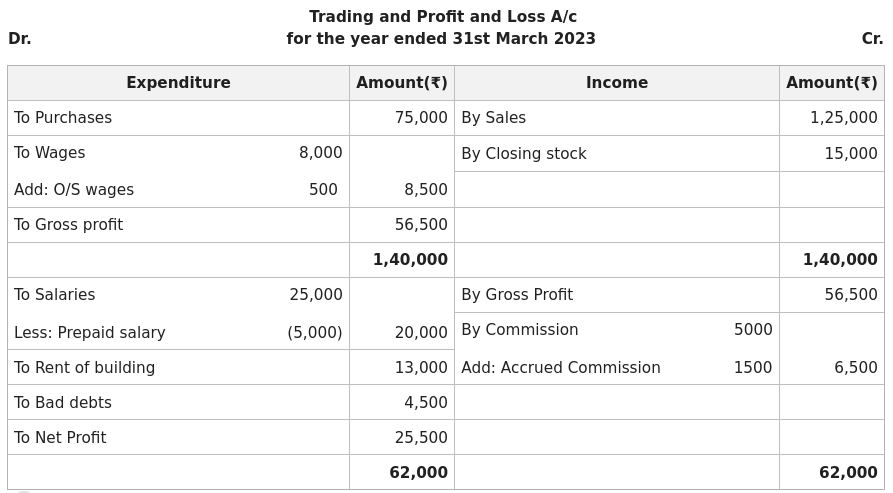

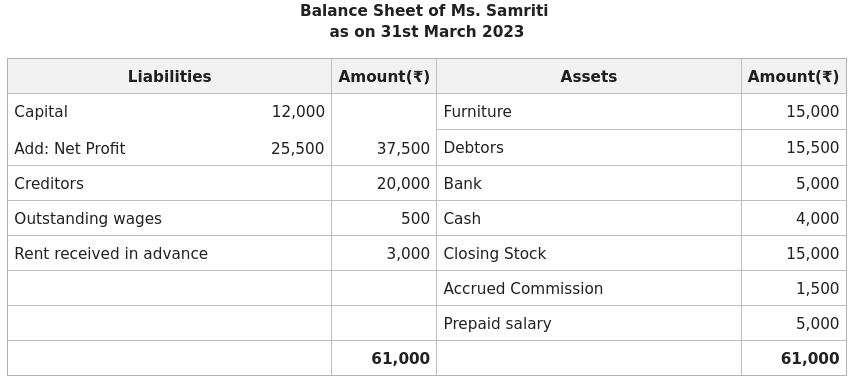

1. Salary paid in advance amounting to ₹5,000.

2. Amount of Closing stock on 31st March 2022 was ₹15,000.

3. Outstanding wages amounting to ₹500.

4. Commission amounting to ₹1,500 is still to be received.

5. Rent received in advance amounts to ₹3,000.

Prepare Trading and Profit and Loss A/c and balance sheet after taking the following adjustments into consideration.

Solution:

Share your thoughts in the comments

Please Login to comment...