Adjustment of Closing Stock in Final Accounts (Financial Statements)

Last Updated :

07 Dec, 2023

Value of unsold goods at the end of an accounting period is recorded as closing stock. Stock is the sum total of all the inventory of products or materials that a company holds for sale or production. The valuation of closing stock is reckoned on the base of its cost price or the realisable value, whichever is lower.

Adjustment:

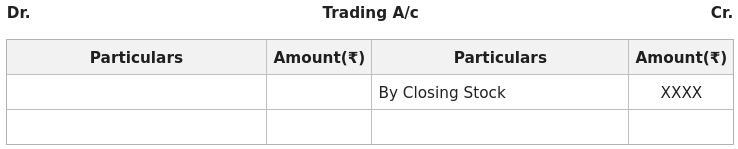

A. If Closing Stock is given outside the trial balance: Usually, closing stock is given outside the trial balance. In such case, two entries are passed:

- In the Cr. side of the Trading A/c.

- In the Assets side of the Balance Sheet.

B. If Closing Stock is given inside the trial balance: If Closing Stock is given in the trial balance, then it will be recorded only once on the Assets side of the Balance Sheet.

Illustration:

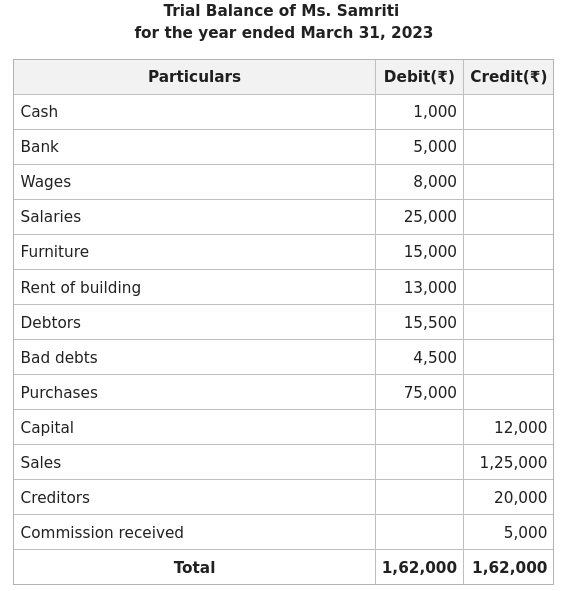

The Trial Balance of Ms. Samriti for the year ended March 31 2023, appears as follows:

The following adjustments were noted on that date:

1. Amount of Closing stock on 31st March 2022 was ₹15,000.

2. Outstanding wages amounting to ₹500.

3. Salary paid in advance amounting to ₹5,000.

4. Commission amounting to ₹1,500 is still to be received.

5. Rent received in advance amounts to ₹3,000.

Prepare Trading and Profit and Loss A/c and balance sheet after taking the following adjustments into consideration.

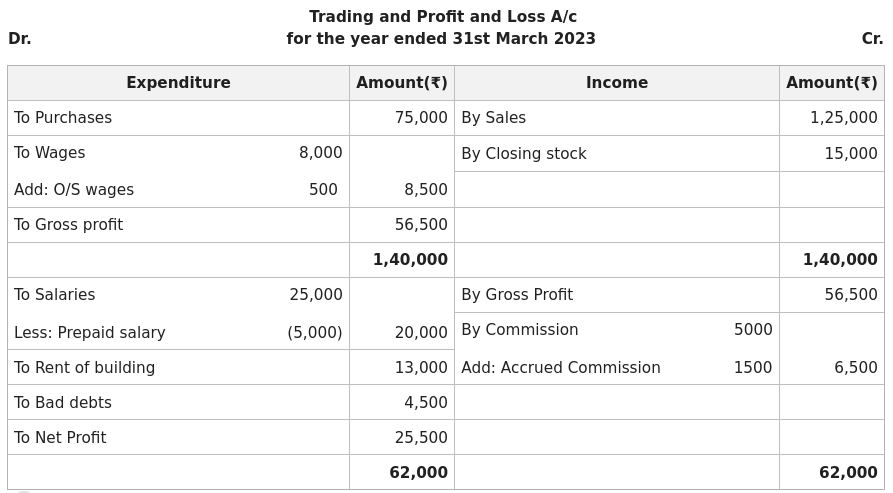

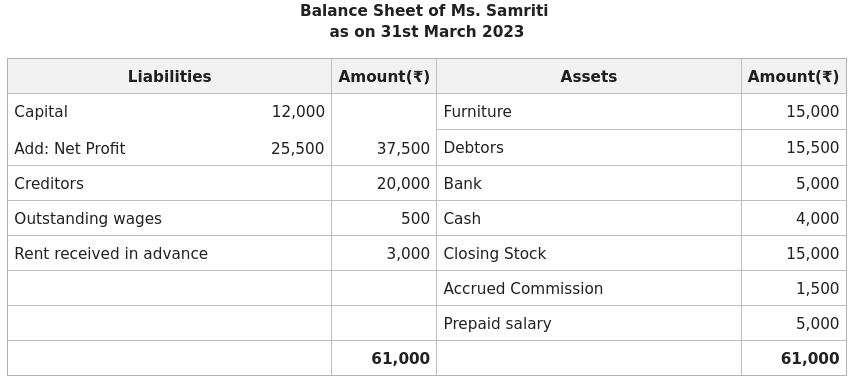

Solution:

Share your thoughts in the comments

Please Login to comment...