Tangible Assets | Concept, Types and Features

Last Updated :

30 Nov, 2023

What are Tangible Assets?

Tangible Assets can be described as assets that can be touched, seen, and felt. Tangible Assets have a physical appearance and need space. Assets like buildings, plants, furniture, cash, and inventory comprise tangible assets. Tangible Assets are of two types, Current Assets and Non-Current Assets. Current Assets are assets that are very liquid and can be converted into cash within 12 months. For example, Cash, Marketable Securities, Inventory, etc. However, Non-current Assets are assets that are not liquid and can be converted into cash during a longer period of time. For example, Buildings, Plants, Machinery, etc.

Types of Tangible Assets

Businesses own two types of Tangible Assets, namely,

1. Fixed Assets: Assets that are purchased for long-term use and are not likely to be converted quickly into cash, such as land, buildings, and equipment. Fixed Assets are held for longer use and they are not held for conversion into cash within 12 months. Fixed Assets lose their value over time as they incur normal wear and tear. Depreciation is charged on fixed assets as per their usable life or years of economic benefits. However, depreciation is not charged on Land. For example, Machinery, Plant, Property, Building, etc.

2. Current Assets: Assets that are held to be converted into cash within one year are known as Current Assets. Current Assets are not charged with depreciation, also the feature of Physical existence may or may not be presented in Current Assets. They help maintain day-to-day business operations and in financing those business operations. For example, Cash, Inventory, Debtors, Bills Receivable, Marketable Securities, etc.

Features of Tangible Assets

1. Tangible Assets possess physical form and substance, i.e. they can be felt or touched.

2. Tangible Assets occupy volume and area.

3. Tangible Assets are used in the normal business operations

4. Tangible Assets most of the time are depreciated over their useful life due to regular wear and tear

5. Tangible Assets employ huge business capital hence they are capital expenditures.

6. Tangible Assets provide long-term benefits to business.

How to value Tangible Assets?

Basic Formula to calculate Tangible Assets = Total Assets- Intangible Assets

OR

Tangible Assets= Fixed Assets+ Current Assets

Example:

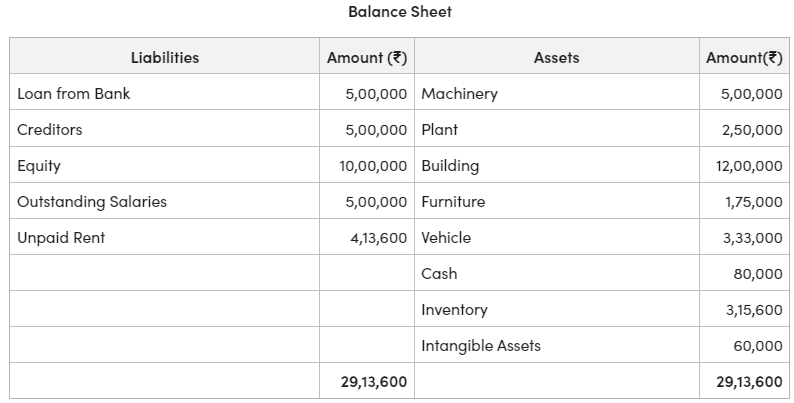

The following figures are observed from the balance sheet of GFG Pvt Ltd. You are required to calculate the value of tangible assets.

Solution:

Tangible Assets = Total Fixed Assets + Current Assets

= Machinery + Plant + Building + Furniture + Vehicles + Cash + Inventory

= 5,00,000+ 2,50,000 + 12,00,000 + 1,75,000+ 3,33,000 + 80,000 + 3,15,600 = 28,53,600

How Tangible Assets are shown in the Balance Sheet?

Share your thoughts in the comments

Please Login to comment...