What are Intangible Assets?

Intangible Assets can be defined as those assets that are not physically present or have no physical form, i.e., they can not be touched or held, but still, they help the business to function and generate economic benefits for the business. Assets are categorized under two heads based on physical existence, Tangible Assets, and Intangible Assets. Tangible assets can be seen, felt, and touched, whereas Intangible assets are the opposite of tangible assets. Examples of Intangible Assets are Patents, Copyrights, Goodwill, Trademarks, etc.

According to AS-26, “Intangible asset is a non-monetary asset which is held for use in the production or supply of goods and services, or rentals to others, etc.

Businesses often deploy resources over the acquisition, development, and maintenance of Intangible Assets. Some of the Intangible Assets on which businesses invest their resources are scientific or technical knowledge, design and implementation of new processes or systems, licenses, intellectual property, market knowledge, and trademarks.

Types of Intangible Assets

1. Goodwill: When an entity acquires another entity, goodwill is the difference between the purchase price and the amount of the assets and liabilities acquired. Goodwill is the extra premium paid to acquire any entity. Goodwill does not independently generate cash flows for the acquiring entity. It is considered a Non-Current Asset and is not amortised like other intangible assets. Real Case Scenario: Walmart paid $13.6B as Goodwill to Flipkart while acquiring.

2. Research and Development: Companies nowadays have been investing a huge amount of their budget in R&D, as it has helped businesses acquire new business knowledge along with new potential business areas. Any Patent generated by R&D can provide greater economic value over the years, which helps any business grow by increasing their market offering and in turn capturing market share for them. Real Case scenario: Amazon spent the most on research and development in the fiscal year 2022, with over 73 billion U.S. dollars, which helped it to become the market leader.

3. Intellectual Property Rights (IPR): “Creative Mind is the biggest Asset anyone can have”, This holds as creativity, thinking or any design creates one of the most important intangible assets, i.e., Intellectual Property Rights. Any unique design, idea, technology, formula, etc., identified by any individual or entity is protected through these IPRs. IPRs are extremely valuable for any entity as they also, generate future economic benefits for the entity, in some cases, IPRs are the main source of revenue for entities. IPRs are extremely crucial for these entities to survive in the market. IPR can be patents, trademarks, copyrights, secret formulas, etc. Real Case Scenario: Under the new budget launched by the central government, the allocation for the IPR ecosystem has been raised by 15% to ₹329 crores.

4. License or Rights provided by Government: Entities engaged in mining, and exploration of minerals or natural resources. Requires licenses and rights by the government which authorises the entity to conduct the business activity for some time, on the land which is owned by the government or any private party. These rights and license helps the entity to earn revenue, and hence these act as a basis of intangible asset. Real Case Scenario: Aramco, a Saudi-based company has gained $161 billion worth of profit by exploring gases and petroleum.

5. Customer Database: In today’s world, where data is very crucial, entities emphasises their data, which contains the important data of customer like their buying patterns, demand structure, spending behaviour, and other customer-related data. They follow these basic data to generate new products and to maintain the demand and supply. By going through these insights provided, entities generate economic values from these databases and hence an intangible asset.

How to Value Intangible Assets?

AS-26 governs the concept of Intangible Assets as issued by the Institute of Chartered Accountants of India (ICAI), which establishes the parameters for when an asset shall be considered as an intangible asset and how an intangible asset shall be valued. Any asset qualifies to be an Intangible asset when:

1. Any Asset meets the definition of intangible asset.

2. It is probable that the expected future economic benefits that are attributable to the asset will flow to the entity.

3. The cost of the asset can be measured reliably.

Note: It is to be noted that while valuing any Intangible asset, not only the cost of acquisition is considered, but all the non-refundable taxes and duties are added along with the other direct costs incurred are also considered for the purpose of valuation.

Valuation of Intangible Assets

Assume that GFG Pvt Ltd. acquired an intangible Asset, and it is estimated that the asset will generate economic benefits for 5 Years. Following are the details of that purchase:

Actual Cost of acquisition (Excluding Taxes and Duties) = ₹5,00,000

Non-refundable Duties = ₹45,000

Refundable Taxes = ₹30,000

Installation Cost = ₹20,000

You are required to calculate the Value of Intangible Assets.

Solution:

As we know, while determining the value of any Intangible asset, not only the cost of acquisition is considered, but also all the non-refundable taxes and duties are added along with the other direct costs incurred are also considered for the purpose of valuation.

The following items shall be added to ascertain the value of Intangible Asset.

Actual Cost of acquisition = ₹5,00,000

Non-refundable Duties = ₹45,000

Installation Cost = ₹20,000

Total Cost of Asset = ₹5,65,000/- (Refundable taxes not to be included while calculating the cost of Intangible Asset)

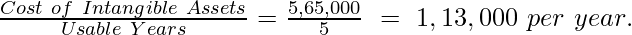

Calculation of Amortisation =

How are Intangible Assets shown in the Balance Sheet?

Share your thoughts in the comments

Please Login to comment...