What is an Overdue Invoice?

When an invoice is overdue, the recipient, whether a consumer or business partner, has failed to make payment within the specified timeframe outlined on the invoice. This delay in payment can have significant repercussions, disrupting normal business operations and causing financial strain. Unpaid invoices can lead to cash flow problems, as firms may find themselves financing services or products without timely compensation. This delay can stress liquidity and limit the firm’s ability to fulfill its financial commitments. Therefore, businesses must promptly address overdue invoices to ensure that payments are received on time and maintain a healthy cash flow, which is vital for sustaining business operations and growth.

Geeky Takeaways:

- An overdue invoice occurs when payment is not made within the specified timeframe outlined on the invoice. It can lead to disruptions in business operations and financial strain.

- Businesses may face cash flow problems as they finance services or products without timely compensation.

- Delayed payments strain liquidity and hinder the ability to fulfill financial commitments.

- Promptly addressing overdue invoices is crucial to ensuring timely payments and maintaining a healthy cash flow.

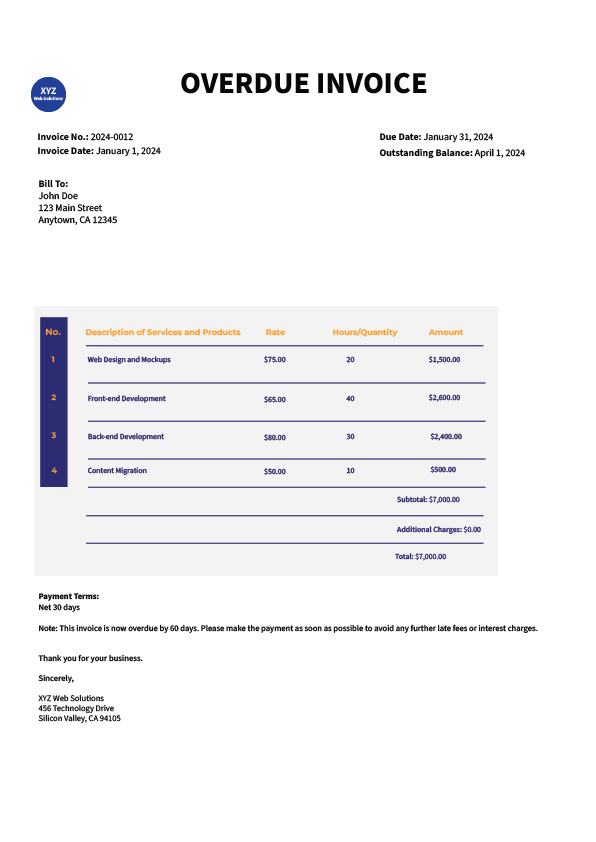

- An example of an overdue invoice format includes essential details such as invoice number, date, due date, outstanding balance, and customer information.

Features of Overdue Invoice

1. Understanding Unpaid Bills: An unpaid bill, commonly referred to as an overdue invoice, pertains to a bill or invoice that remains outstanding past its due date. This occurrence often triggers a series of actions by the involved parties to facilitate payment.

2. Triggering Actions for Collection: When an invoice becomes overdue, it prompts firms or individuals to initiate distinct actions aimed at collecting the outstanding payment. These actions may include sending reminders, making phone calls, or resorting to legal measures such as involving collection agencies or legal proceedings.

3. Determining the Follow-Up Timeframe: The timeframe for following up on overdue invoices is dependent upon several factors, including customer relationships, industry norms, and agreement terms. Generally, firms send reminders shortly after the due date, escalating communication as necessary and assessing the need for further action if the invoice remains unresolved.

4. Essential Communication Elements: Effective communication regarding overdue invoices necessitates the inclusion of key elements. These elements encompass maintaining a polite and professional tone, providing clear subject lines, specifying invoice details, issuing friendly reminders, requesting payment, outlining payment options or alternatives, furnishing contact information, delineating the consequences of non-payment, and concluding with a polite closing.

5. Strategies for Prevention: Firms employ distinct strategies to prevent the occurrence of overdue invoices. These strategies encompass adopting clear and concise invoicing practices, establishing explicit payment terms, sending timely reminders, implementing late fees, and utilizing distinct layouts for overdue invoices to prompt timely payment.

6. Handling Overdue Invoices: The process of handling overdue invoices involves multiple steps, including reminding customers of outstanding payments, examining reasons for non-payment, and resorting to further actions such as engaging collection agencies or legal representation if deemed necessary.

7. Proactive Measures for Resolution: Proactive measures aimed at resolving overdue invoices entail understanding customers’ payment behaviors, establishing clear payment terms and policies, collecting advance payments where applicable, and leveraging accounting software to proficiently track outstanding invoices.

1. Subject Line: The subject line of the email should concisely convey the purpose of the communication. It ensures that the recipient immediately understands the urgency and relevance of the message.

2. Greeting: Start crafting the email with a polite greeting, addressing the recipient by name, if known. A courteous greeting sets a positive tone for the remainder of the communication and fosters a professional relationship with the recipient.

3. Invoice Details: Include all mandatory details related to the overdue invoice, such as the invoice number, date of issue, amount due, and the original due date. Providing these details helps the recipient easily detect the specific invoice in question and facilitates prompt action.

4. Friendly Reminder: Politely remind the recipient that the payment for the invoice is overdue. Mention the specific due date and express understanding for any oversight or delay on their part. It demonstrates empathy while also emphasizing the importance of timely payment.

5. Request for Payment: Communicate the immediate need for payment. Provide instructions on acceptable payment methods, such as credit card, bank transfer, or check. Clarity in payment instructions shall streamline the payment process and limit any potential confusion for the recipient.

6. Payment Options or Alternatives: If applicable, present information on alternative payment arrangements, such as installment plans, to demonstrate flexibility and accommodate the recipient’s financial situation. Offering payment alternatives can facilitate cooperation and increase the likelihood of prompt payment.

7. Contact Information: Include your contact details, notably your email address and phone number, for any queries or clarifications the recipient may have regarding the overdue invoice or payment process. Accessibility to contact information promotes open communication and efficiently resolves any potential concerns.

8. Consequences of Non-Payment: In a professional and non-threatening manner, outline potential consequences of continued non-payment, such as service suspension or the imposition of late fees. Clearly stating the consequences underscores the seriousness of the situation while encouraging a timely resolution.

9. Closing: End the email with a genuine closing, expressing gratitude for the recipient’s attention and prompt payment. A polite conclusion leaves a positive impression and encourages continued cooperation in resolving the overdue invoice.

10. Follow-Up Plan: If necessary, outline the next steps or follow-up actions that will be taken if the payment remains outstanding. It demonstrates proactive management of the situation and ensures clarity regarding future expectations.

Overdue Invoice – FAQs

Why is the invoice date significant?

The invoice date marks the official recording of transactions and billing of goods. It plays a critical role in payment management, determining the credit duration and eventual due date, thus significantly influencing the invoicing process.

What defines a past-due invoice?

A past due invoice indicates more recent invoices that have exceeded the payment deadline by approximately a week or two, whereas overdue invoices pertain to payments outstanding for a longer duration, ranging from 30 to 60 days.

How should an overdue invoice be titled in the subject line?

For instance, an overdue invoice by a week could have a subject line reading Reminder: Overdue Payment from (Your Business) – Due (Date Due). However, for invoices overdue by a month, a subject line like Urgent: Overdue Payment Notice from (Your Business) – Due (Date Due) would convey the urgency effectively.

Are there specific deadlines for invoices?

While invoices commonly expect payment within 30 days, there’s room for negotiation for later payment dates, particularly under favorable business relationships or unique sale conditions.

What are the requirements regarding invoice dates?

Invoices must include both the invoice date and the due date. Typically, the due date is set 30 days from the invoice date, though adjustments can be made through mutual agreement between parties.

How many invoices can be processed per day?

The number of invoices processed daily varies based on multiple factors. On average, an accountant can handle approximately 4-5 invoices in an hour, totaling around 32–40 invoices daily or 640–800 invoices monthly.

Share your thoughts in the comments

Please Login to comment...