A Bill Market is a market or institution which buys and sells Bills of Exchange. A bill of exchange is a written order that one party receives from another requiring them to pay the other a specific amount of money, either immediately or at a later date. It is important that such an order of payment should be unconditional and be accepted by both parties concerned, i.e., the creditor as well as the debtor. Since bills of exchange are official legal papers, the drawer has legal recourse if the drawee fails to pay the agreed-upon amount within the allotted time.

Traders and businessmen enjoy great benefits from the bill market. The trader purchasing goods does not have immediately pay cash to make the payment for the goods purchased. He can simply accept the bill drawn upon him and can have some time to arrange the money for payment. The seller can also get benefit from bills of exchange by securing the cost of getting the bill discounted whenever he wants. The Bill Market is also crucial for banks as it provides an outlet to the banks so they can invest their surplus funds in the short term.

Despite its advantages to traders, businessmen, and banks, when it comes to the development of the bill market in India (before independence), no attention was paid to the same. Even though the Central Banking Enquiry Committee forcefully recommended its development in India, British Government didn’t implement their recommendation. Some attention was given to the bill market by the Reserve Bank of India in 1952. The RBI implemented a bill development scheme on January 16, 1952, under which the scheduled banks got the opportunity to secure demand loans from the Reserve Bank against usance promissory notes. However, the Reserve Bank, instead of discounting the promissory notes, accepted them as a security for granting the scheduled banks with demand loans. There was one more condition for the scheme; i.e., the maturity period for the promissory notes was three months. In October 1958, export bills were also included in this scheme.

In November 1970, a new scheme (Bill Rediscounting Scheme) was enforced for encouraging the development of the bill market in the country. Under this scheme, the Reserve Bank agreed on rediscounting the bills of exchange which arose from the supply of goods to the government departments. The features of the Bill Rediscounting Scheme were as follows:

- The banks eligible for offering bills of exchange for rediscounting to the Reserve Bank consists of every licensed scheduled bank, including the nationalised banks.

- The bill of exchange covered under the scheme must be a genuine bill. It means that the bill must be based on a real sale transaction.

- The duration of the bill of exchange should not be more than 90 days.

- There should be at least two good signatures on the bill.

- The amount of a single bill that is presented for rediscounting should not be less than ₹5,000.

- Lastly, the total value of the bills offered to the Reserve Bank at a specific period of time should not be less than ₹50,000.

Besides these features, the Bill Rediscounting Scheme suffered a setback on account of the Reserve Bank’s general credit squeeze policy to curb the inflationary pressure of the country.

In May 2010, a new short-term instrument [Cash Management Bill (CMB)] was introduced to meet the government’s temporary cash flow mismatches. CMB is a non-standard, discounted instrument that was issued for maturities of less than 91 days.

Causes of the Underdevelopment of Bill Market

Even though the Reserve Bank made sustained efforts, it was not able to achieve the full development of the bill market in India. The major causes behind the underdevelopment of the Bill Market are as follows:

1. Preference to First-class Government Securities by the Indian Banks: In order to meet the requirements of the depositors, the Indian Banks have to keep a considerable amount of cash reserve with them. So to maintain the assets in liquid form, the Indian Banks prefer investing their funds in first-class government securities instead of bills of exchange. It is because, by investing in first-class government securities the banks are able to keep their assets in the liquid form and it also helps them in strengthening the public confidence in banking.

2. Difficulty in Rediscounting Bills of Exchange: Despite the efforts of the Reserve Bank, it has not been able to bring a developed bill market to the country. It is because the Reserve Bank prefers to give loans to scheduled banks against an approved security and does not encourage these banks to get their bills rediscounted with it. Also, the Indian Money Market faces a general shortage of bills of exchange.

3. Lack of Acceptance Houses: The Bill Market of India is underdeveloped because of the absence of Issue Houses and Acceptance Houses in the country. In Western countries, acceptance houses are an essential part of the money market. These institutions accept the exchange bills, which are then easily rediscounted by the banks. The exchange bills that have already been accepted by the acceptance houses, banks do not run any risk for them, and thus they are easily rediscounted.

4. Absence of Distinction between Commercial and Accommodation Bills: In India, there is no distinction between commercial bills and accommodation bills; therefore, the banks hesitate to rediscount them. As commercial bills are based upon commercial transactions, the banks do not have any objection to rediscounting them. But, the accommodations bills are not based upon genuine commercial transactions; therefore, the banks have strong objections to rediscounting them.

5. Diversity of Bills of Exchange: There are numerous forms and styles of bills of exchange in the country and these different exchange bills have varied languages and modes of writing. Therefore, it is not possible to develop an all-India bill market.

6. Preference to Cash Loans by Banks: In general, banks prefer to provide their customers with cash loans instead of discounting their bills of exchange. It is because banks can recall cash loans at any time before maturity according to their preference.

7. Issue of Treasury Bills: In order to meet their financial requirements, the Central and the State Governments issues treasury bills from time to time. The time period of these bills is 30 to 90 days. The Indian Banks prefer to invest their funds in treasury bills instead of rediscounting the bills of exchange. It is because the treasury bills are extremely safe and carry behind them, the full sanction of the government. Also, banks can easily realise money by selling treasury bills in the market whenever they need money.

8. Heavy Stamp Duty: The last reason behind the inadequacy of the bills of exchange is that the Government levies heavy stamp duty on these bills.

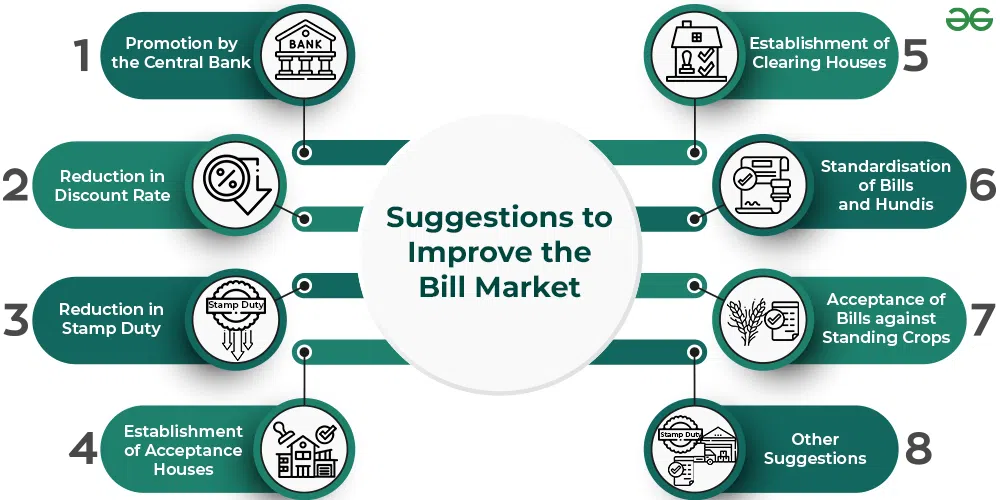

Suggestions to Improve the Bill Market

The following suggestions have been offered for the improvement of the Bill Market in India:

1. Promotion by the Central Bank: Even though the Reserve Bank of India was established in 1935, it did not pay attention to the development of the bill market till 1952. The Reserve Bank of India took some steps in January 1959 for the development of the bill market in India.

2. Reduction in Discount Rate: The banks charged high discounting rates on bills of exchange, making it unpopular among traders and businessmen. Therefore, it is important to bring down the discounting rates to a reasonable level so that there can be development of the bill market in the country.

3. Reduction in Stamp Duty: As discussed in the causes for the underdevelopment of bills of exchange, the use of bills of exchange has been unpopular in India due to the heavy stamp duty imposed on them by the Government. Because of this reason, the Central Banking Enquiry Committee advised the Government to reduce stamp duty on the bills of exchange. After this advisement, even though the stamp duty was reduced in the year 1940, it did not go far enough. In fact, because of this heavy stamp duty, the growth of the bill market in India is obstructed.

4. Establishment of Acceptance Houses: In order to properly develop the bill market in India, it is important to open a large number of acceptance houses in different parts of the country. It is essential because in general, Indian Banks hesitate in discounting bills of exchange as they do not have reliable information regarding the parties to these bills.

5. Establishment of Clearing Houses: Opening up a large number of clearing houses is also necessary to facilitate the payment of bills of exchange. Besides, the clearing houses can also render the same help in encashing the bills of exchange as they do in cheques.

6. Standardisation of Bills and Hundis: There is a vast variety of bills and hundis being used in India. Thus their forms and styles of writing also differ widely from one State to another. Therefore, in order to properly develop the bill market, it is essential to standardise the bills and hundis.

7. Acceptance of Bills against Standing Crops: Another suggestion for the improvement of the bill market is that the bills against standing crops should be accepted, and provisions should be made for granting loans against their security. With this, agricultural bills can be encouraged.

8. Other Suggestions: Besides the above suggestions, there are some other suggestions which were given from time to time for the improvement of the bills market. These are:

- Use of Hundis issued by Swadeshi Bankers should be Extended: In order to develop the Indian bill market, it is important to popularise the Hundis issued by Swadeshi Bankers. It is because the Swadeshi Bankers are an essential constituent of the Indian money market.

- Licensed Godowns should be Established: By establishing licensed godowns in different parts of the country, the use of bills would receive a stimulus. It is because, with the establishment of licensed godowns, the agricultural bills would be then written based on the produce deposited with them.

- Reduction in Stamp Duty for Converting Sight Bills into Time Bills: As we know, the Reserve Bank provides loans to the scheduled banks only against the time bills, and not the sight bills. Therefore, the scheduled banks have to convert their sight bills into time bills to get loans from RBI, for which they have to pay stamp duty to the government. This practice discourages banks from borrowing from RBI. Therefore, it is essential for the Reserve Bank of India to withdraw the duty on the conversion of sight bills into time bills.

Share your thoughts in the comments

Please Login to comment...