Advance Tax is defined as an income tax paid on an estimated annual income to the government before the end of the financial year. The taxpayers estimate their total annual income for the financial year, calculate their tax liability based on this estimate, and make periodic payments of taxes. This means instead of paying a lump-sum tax amount at the end of a financial year, taxes are paid in installments on specific due dates decided by the tax authority.

Key takeaways from Advance Tax:

- Advance Tax is based on the principle of “Pay-as-you-earn”.

- In India, every person whose estimated tax liability for the year is ₹10,000 or more, shall pay “Advance Tax” [Section 208, Income Tax Act].

- A system of advance tax benefits both the government and the taxpayer. For the government, the advance tax system ensures a regular and timely inflow of revenue, and for taxpayers, it reduces the burden of paying lump-sum amounts at the end of a financial period.

Who Should Pay Advance Tax?

Advance Tax is typically applicable to individuals, businesses, and corporate entities whose estimated tax liability for the financial year exceeds a certain threshold. This can be explained as:

1. Salaried Individuals with Additional Income: Salaried individuals who have additional sources of income, such as interest income, rental income, capital gains, or any other form of income that is not subject to Tax Deducted at Source (TDS), may be liable to pay advance tax if their overall tax liability is ₹10,000 or more.

2. Individuals with Income from Business or Profession: Self-employed individuals, freelancers, and professionals who earn income through business or freelance work are subject to pay advance tax if their tax liability exceeds ₹10,000. However, Businesses who opt for the presumptive taxation scheme under Section 44AD and Professionals opting for the presumptive taxation scheme under Section 44ADA, shall pay the whole amount of the advance tax in one instalment on or before 15 March or have the option to pay the tax dues by 31 March.

3. Corporate Entities: Companies, firms, and corporations are subject to pay advance tax if their estimated tax liability for the financial year exceeds the prescribed limit.

Note:

- Individuals aged 60 years or above (Senior citizens), and do not run a business, are exempt from paying advance tax.

- Non-payment of the advance tax or underpayment might result in interest or penalties imposed by the tax authorities.

Advance Tax Due Dates For FY 2023-24

The following table help us to understand the due dates for payment of advance tax.

I. Payment of Advance Tax for all Assessees except for those opting for section 44AD or section 44ADA:

|

On or before the 15th of June

|

15% of the advance tax liability

|

|

On or before the 15th of September

|

45% of the advance tax liability

|

|

On or before the 15th of December

|

75% of the advance tax liability

|

|

On or before the 15th of March

|

100% of the advance tax liability

|

II. Payment of Advance Tax for all Assessees falling under section 44AD or section 44ADA:

|

On or before the 15th of March

|

100% of the advance tax liability

|

How to Pay Advance Tax Online?

The following steps are to be followed to pay advance tax online:

Step 1: Visit the e-filing portal of the Income Tax Department of India.

Step 2: Click on ‘Quick Links’ on the left side of the home page and then click on ‘e-pay Tax’.

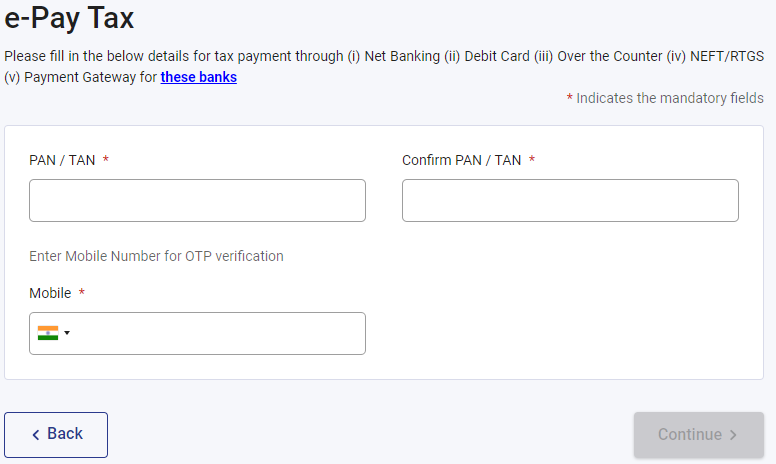

Step 3: Enter the ‘PAN Number‘ and ‘Mobile Number’ and click on ‘Continue‘ to proceed.

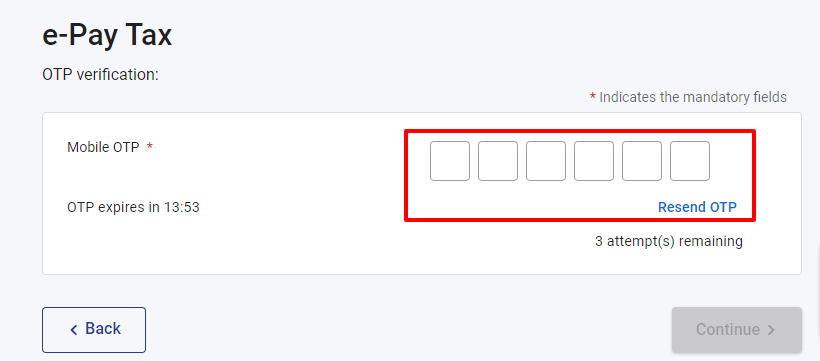

Step 4: Enter the 6-digit OTP received on your mobile number and ‘Continue’.

Step 5: Select the first tab named as ‘Income Tax’ and then click on ‘Continue’.

Step 6: Select the ‘Assessment Year’ and ‘Type of Payment’ as ‘Advance Tax (100)’ and then click on ‘Continue’.

Step 7: Fill out all the tax details.

Step 8: Select the mode of payment and the bank and click on ‘Continue’.

Step 9: Preview the challan details and click on ‘Pay Now’ to make the payment. Click on ‘Edit’ on right side corner to edit any detail if required.

Step 10: Once the payment is completed, an acknowledgement will appear on the following screen. The BSR code and challan serial number will be displayed on the challan’s right side that need to be preserved as BSR code and challan number are needed to fill the tax return.

Note:

Those who are not comfortable with this online advance tax payment method may use the offline payment facility by submitting the challan at the Income Tax Department authorized bank branches.

Example for Advance Tax Calculation

Compute the amount of advance tax to be paid by Mr. Anil (age 45 years) from the following details provided by him (for the year 2023-24):

- Taxable business income ₹10,84,000.

- Interest on debenture ₹9,000 (after deduction of tax at source of ₹1,000).

- Deduction under section 80C, ₹81,333.

Answer:

Computation of taxable income and tax liability of Mr. Kapoor for the year 2023-24:

|

Profits and gains of business or profession

|

10,84,000

|

|

Income from other source

|

10,000

|

|

Gross total income

|

10,94,000

|

|

Less: Deduction under section 80C

|

(81,333)

|

|

Total Taxabe Income

|

10,12,667

|

|

Tax liability (WN)

|

1,16,300

|

|

Less: Rebate under section 87A

|

NIL

|

|

Tax liability after rebate under section 87A

|

1,16,300

|

|

Add: Health and Education Cess @ 4%

|

4,652

|

|

Tax liability before TDS

|

1,20, 952

|

|

Less: Tax deducted at source

|

1,000

|

|

Tax liability after TDS

|

1,19,952

|

Working Note:

|

Upto ₹2,50,000

|

NIL

|

|

5% on ₹2,50,001 – ₹5,00,000

|

5% on ₹2,50,000 = ₹12,500

|

|

20% on ₹5,00,001 – ₹10,00,000

|

20% on ₹5,00,000 = ₹1,00,000

|

|

30% on above ₹10,00,000

|

30% on ₹12,667 = ₹3,800

|

|

Total Tax Liability

|

₹1,16,300

|

Payment of Advance Tax:

|

On or before the 15th of June

|

15% of 1,19,952 i.e., 17,993

|

|

On or before the 15th of September

|

45% of 1,19,952 i.e., 53,978

|

|

On or before the 15th of December

|

75% of 1,19,952 i.e., 89,964

|

|

On or before the 15th of March

|

100% of 1,19,952 i.e., 1,19,952

|

FAQs on Advance Tax

1. What is Advance Tax?

Answer: Advance tax is a tax paid in advance on estimated annual income, as and when income is earned. It is based on the principle of “Pay-as-you-earn”.

2. Who is liable to pay advance tax?

Answer: As per section 208 of Income Tax Act, any person whose estimated tax liability for the current financial year is ₹10,000 or more, shall be liable to pay advance tax.

3. What happens if one fails to pay advance tax?

Answer: Non-payment or underpayment of advance tax attracts interest and penalty under section 234B and 234C.

4. Is an NRI liable for payment of advance tax?

Answer: Any NRI whose income accused in India exceeds a limit of ₹ 10,000, shall be liable to pay tax.

5. Is a 60 year old person earning an income from business, liable to pay advance tax?

Answer: Yes, any senior citizen earning any income from a business is liable to pay advance tax. However, an income from service or pension income is exempted from this section for senior citizens.

6. Can one pay more than the required advance tax?

Answer: Yes, if there is a possibility to earn more than the estimated income during the financial year, a person is advised to pay more than the estimated advance tax.

7. Can one revise the advance tax paid earlier?

Answer: Yes, if there is any change in estimated income, one can revise the advance tax paid earlier and can settle it in the subsequent installment.

8. How can one pay advance tax?

Answer: Advance Tax can be paid easily by visiting an online-portal of the tax department through online banking, NEFT, RTGS, or offline by visiting authorized bank branches.

9. What are benefits of Advance Tax System?

Answer: An Advance Tax System benefits both the government and the taxpayer. It ensures continuous inflow of revenue of the government, and reduces the burden of the taxpayer to pay the lump-sumamount of tax at the end of the year.

10. What if one fails to pay the last installment of an advance tax on the due date?

Answer: The due date for the payment of the last installment is on 15th March, but if someone fails to do so, he/she has an option to pay such installments till 31st March.

Share your thoughts in the comments

Please Login to comment...