What is Oversubscription ? | Accounting Treatment and Benefits

Last Updated :

14 Mar, 2024

When applications to buy the shares exceed the actual shares offered by the company, it is known as the Oversubscription of Shares. Under Oversubscription of Shares, investors apply for more shares than offered shares, creating a situation of oversubscription. The situation of oversubscription commonly arises in the case of an Initial Public Offer (IPO), where the demand size is relatively broader as compared to the supply size.

Oversubscription typically occurs when investors have a significant image of the company in mind. The high demand for company stocks indicates its strong financial health and brand value as more and more people want to buy it. When excess applications are received in order to purchase the shares of the company, practices like declining applications and pro-rata allotment are practised by the company.

According to the guidelines of SEBI (Securities and Exchange Board of India), companies cannot reject the applications outright. However, they can do so in case of incomplete information in applications, absence of required documents, discrepancies with signature, submission of incorrect application amount, etc. Oversubscription may lead to disappointment in the mind of investors as they become eligible to receive less or no shares. These practices help the company to allocate limited resources among a large number of applications.

Shares Applications > Shares Offered

Key takeaways from Oversubscription of Shares:

- This type of situation is very common in Initial Public offer (IPO).

- More demand for shares represents the company’s strong financial position, leading to increased prices of shares in the market.

- Major handling procedure of Oversubscription of Shares includes declining applications, and/or allotting shares on a pro-rata basis.

- Some applications can get rejected, which in turn creates a sense of disappointment in the minds of investors.

Accounting Treatment of Oversubscription

As stated above, when the situation of oversubscription arises, companies follow practices like acceptance of some applications in full, rejection, pro-rata allotment, and/or combinations of both to optimally issue shares to investors. A company cannot allot more shares than it has offered to the public for subscription. At times of oversubscription of shares, a company has various alternatives. These alternatives are:

1. Full allotment to some applications and rejections of excess applications

Under this alternative, the company makes full allotment to some applications and rejects excess applications and refunds money to those applicants.

2. Pro-rata Allotment

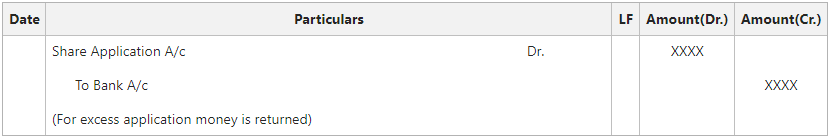

Pro-rata Allotment is a situation in which a company allots shares on a proportionate basis. And adjusts the excess money first on the allotment and then on subsequent calls. If the money still remains in surplus, it is returned to the applicants at the time of allotment. The entry for the same will be as follows:

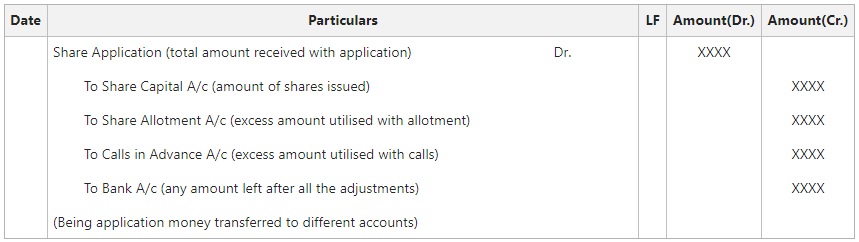

3. Combination of Full allotment, Pro-rata allotment and no allotment

The directors of a company can use a combination of the first two methods. The entry for the same will be as follows:

Benefits of Oversubscription

1. Indicator of Public Interest: Oversubscription can indicate strong public interest in the company, which can be a positive factor in building its reputation and increasing its visibility in the market. Market prices of shares can touch the sky due to their good image in the minds of investors.

2. Diversification of Investors: Oversubscription provides the company with a larger pool of potential investors, allowing them to select the best and most reliable investors based on their trading history.

3. Increased capital: If the share demand exceeds the supply, the company can either increase the prices of shares or issue additional shares to meet the demand. It can result in the company raising more capital than originally planned.

4. Revenue for Underwriters: Oversubscription can result in higher fees for the underwriters, as more applications and more demand can lead to higher revenue.

Share your thoughts in the comments

Please Login to comment...