Journal Entry for Interest Receivable

Last Updated :

28 Jan, 2024

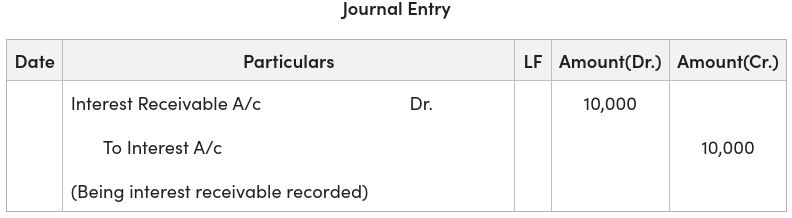

Interest receivable is the amount of interest that a business has earned but has not yet been received in cash. When interest is accrued but not yet collected, it is recorded as an asset on the balance sheet. Interest receivable journal entry is recorded by debiting Interest Receivable A/c and crediting Interest A/c

Interest Receivable Journal Entry

Journal Entry:

Example 1:

Interest Receivable was ₹10,000 for the month of January. Record the necessary journal entry.

Solution:

Example 2:

Interest received ₹24,000 for eight months but the interest of four months i.e. ₹12,000 remains receivable. Record the necessary journal entry.

Solution:

Share your thoughts in the comments

Please Login to comment...