Wholly Owned Subsidiaries: Meaning, Advantages, and Disadvantages

Last Updated :

06 Apr, 2023

A subsidiary is a corporation that is controlled or owned by another. The controlling company is referred to as the parent company, while the subsidiary is referred to as the daughter company. A corporation or a limited liability company can be established. It might also be owned by the government or the state.

What are Wholly Owned Subsidiaries?

Companies that seek complete control over their overseas operations use this way of international business entry. The parent company gains complete control of the foreign company by investing 100% in its equity capital.

A wholly owned subsidiary in a foreign market might be formed in one of the following two ways :

1) Establishing a completely new company to begin operations in a foreign nation often known as a green field enterprise.

2) Acquiring an existing business in a foreign country and utilising that firm to manufacture and/or market its products in the host country.

A wholly-owned subsidiary is located in a country different from the parent company. The subsidiary will almost certainly have its own management team, products, and customers. With a wholly-owned subsidiary in a foreign country, the parent company may be able to continue to operate in various geographic areas, markets, or industries. These components help with market, geopolitical, and trade practice changes. This increases the parent company’s earnings, which may then be invested in other assets and businesses.

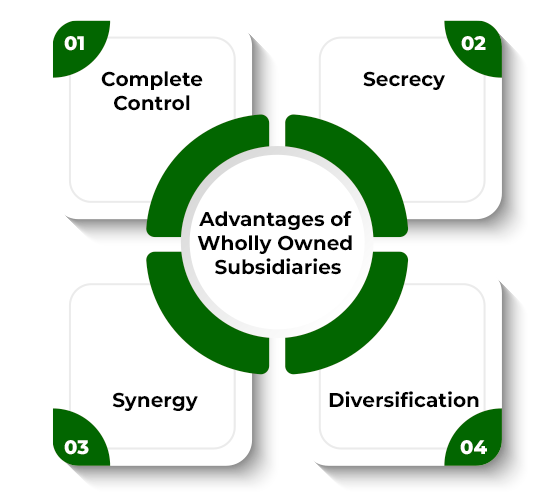

Advantages of Wholly Owned Subsidiaries

The following are the primary advantages of establishing a completely owned subsidiary in a foreign country :

- Complete Control: The parent company has complete control over its activities in other countries.

- Secrecy: Since the parent company manages the whole operation of the foreign subsidiary on its own, it is not compelled to reveal its technology or trade secrets to outsiders.

- Synergy: Synergies between the two firms in many sectors, such as information technology, finance, marketing, and so on can benefit both the parent company and the subsidiary in terms of cost savings and strategic positioning. When two firms collaborate, research and development accelerate. The strategic assistance is long-lasting, instilling trust in the wholly-owned subsidiary.

- Diversification: Since the wholly-owned subsidiary is backed by a parent company, it can afford to take risks by diversifying its operations and entering new markets. In fact, if the parent purchases a foreign subsidiary, it might utilise it to enhance its presence in that country.

Disadvantages of Wholly Owned Subsidiaries

The following are some of the disadvantages of establishing a wholly-owned subsidiary in another country :

- Not ideal for Small Businesses: The parent company must invest 100% of its equity in foreign subsidiaries. As a result, this type of foreign company is not ideal for small and medium-sized companies that do not have the finances to invest abroad.

- Burden of Entire Loss: Since the parent firm owns 100 percent of the foreign company, it must suffer the entire loss arising from the collapse of its foreign activities.

- Political Risk: Some countries oppose foreigners establishing wholly-owned subsidiaries in their countries. As a result, this type of international business operation is subject to more political risk.

- Diverse Rules and Regulations: Every country has its own set of rules and regulations for conducting business. Managing a wholly-owned subsidiary headquartered in a foreign nation might be difficult since you may be unfamiliar with the country’s laws and industry rules. As a result, you may need to engage additional personnel to manage your wholly-owned subsidiary in a foreign country. This might add to the financial load.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...