What is Issue of Shares?

Share capital is capital obtained through the issuance of shares. A company’s capital is divided into small units called shares. Each share has a nominal value. For example, a company can issue 2,00,000 shares of Rs. 10 each for a total of Rs. 20,00,000. The person who holds the shares is referred to as the shareholder. A company raises its capital through the issue of shares.

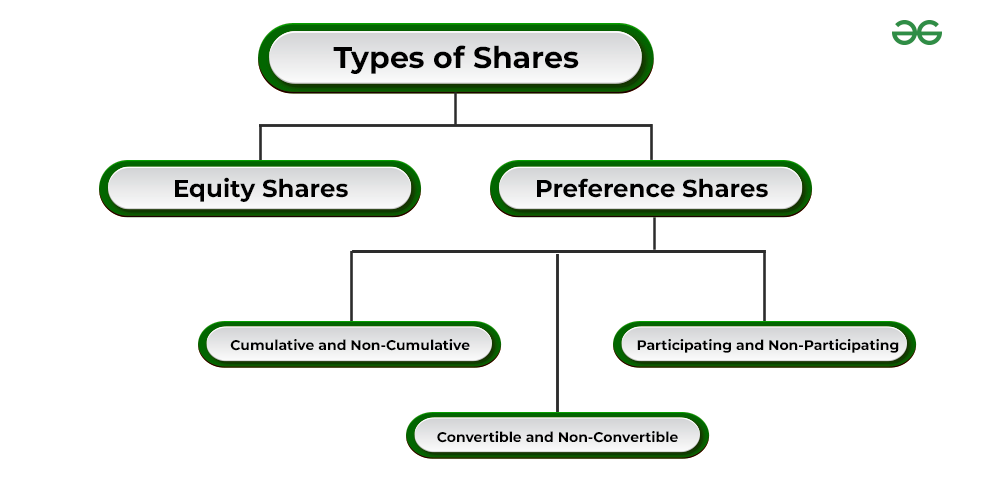

A company typically issues two types of shares Equity and Preference shares. The money raised by issuing equity shares is referred to as Equity Share Capital; whereas, money raised by issuing preference shares is referred to as Preference Share Capital.

Types of Shares

1. Equity Shares

A company’s most important source of long-term capital is equity shares. Because equity shares represent a company’s ownership, the capital raised through the issuance of such shares is known as ownership capital or owner’s funds. A company must have equity share capital in order to be established.

Equity shareholders are paid on the basis of the company’s earnings rather than a fixed dividend. They are known as “residual owners” since they receive what remains after all other claims on the company’s income and assets have been satisfied. They gain from the reward while also bearing the risk of ownership. Their liability is limited to the amount of capital they invested in the company.

Features of Equity Shares

1. Primary Risk Bearers: The equity shareholders of a company are its primary risk bearers. It means that if the company faces a loss, then its shareholders will have to bear the loss. Also, before paying the equity shareholders their due payment, it is first given to the company’s creditors.

2. Basis for Loans: A company can raise loans based on its equity share capital. The amount of equity share capital adds up to the credibility of the company and thus increases the confidence of the creditors.

3. Claim over Residual Income: The equity shareholders of a company have a claim over its leftover income only. It means that, after satisfying all the claims of every creditor, outsider, and preference shareholder, if the company is still left with income, the equity shareholders can claim that money.

4. Higher Profit: The rate of interest of debenture holders and the rate of dividend for preference shareholders are fixed; however, there is no fixed rate for equity shareholders. Therefore, in the case of profit, the debenture holders and preference shareholders will get the fixed income only; however, the equity shareholders will enjoy a higher profit.

5. Control: The equity shareholders have control over the activities of a company. They have voting rights and thus can case vote for the selection of the Board of Directors. The Board of Directors are those who control and manage the company’s affairs.

6. Pre-emptive Rights: The provisions of Companies Act gives Pre-emptive rights to the shareholders. This right states that, whenever a company plans to issue new equity shares, first of all, it must offer the shares to its existing shareholders. If they refuse to buy the new shares, then only the company shall offer the shares to the general public. By doing this, the right protects the equity shareholder’s controlling rights.

7. Permanent Capital: The equity shareholders of a company provide it with permanent funds. The company does not commit to return the money or pay dividends at a fixed rate.

Merits and Demerits of Equity Shares: The merits of equity shares include source of fixed capital, no charge on fixed assets, democratic management, etc. and demerits of equity shares include risk of fluctuating returns, legal formalities, etc.

2. Preference Shares

Preference share capital is the capital acquired through the issuance of preferred shares. There are two ways in which preference shareholders are in a better position than equity shareholders :

- Receiving a fixed rate of dividend before any dividend is paid to equity shareholders out of the company’s net profits.

- Receiving their capital at the time of the company’s liquidation after the debts of its creditors have been settled.

In comparison to equity shareholders, preference shareholders have a preferential claim to dividends and capital repayment. Preference shares are similar to debentures in that they have a fixed rate of return. Furthermore, As the dividend is paid only at the discretion of the directors and only from profit after tax, these are similar to equity shares in that context. As a result, preference shares share some characteristics of both equity and debentures.

Features of Preference Shares

1. Fixed Rate of Dividend: Preference shareholders get dividend before equity shareholders at a fixed rate.

2. No Security: The preference shareholders do not get any security from the company against their shares. Besides, preference share capital is a part of the owner’s fund capital of the company.

3. Hybrid Security: As preference shares consist of the features of both equity shares and debentures, they are known as Hybrid Securties. Just like equity shares, the preference shareholders get dividend only when the company earns a profit and just like debentures, preference shareholders get a fixed rate of return.

4. Voting Rights: Under general conditions, the preference shareholders do not have voting rights. However, if the dividends are not paid for two years or more, the preference shareholders get voting rights.

5. Help to Collect Large Amount of Funds: As cautious investors and financial institutions prefer to invest in preference shares of a company, it helps them collect a huge amount of funds. Besides, preference shares attract more public because of their fixed rate of return.

6. No Fixed Liability: Preference shareholders get dividend only when the company earns profit. Therefore, in case of losses, the company is not obliged to pay dividend to the preference shareholders.

Merits and Demerits of Preference Shares: Merits of preference shares include consistent income, no charge on assets, trading on equity, etc., and demerits of preference shares include limited appeal, no tax benefits, etc.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...