What is FinTech?

Last Updated :

06 Dec, 2019

FinTech consists of two words, “Fin” and “Tech” refers to Financial Technology. Financial Technology is an emerging trend of technology in traditional financial services. FinTech is an advanced technology that provides various type of software that is used for financial product and services.

FinTech is an innovative creation of the 21st century that helps its consumers and businesses in financial transactions through digital delivery of financial products and services. Now FinTech helps financial industries to access their large number of customers digitally and provides them fast, easy and secure transactions. And their customers have no need to visit bank branches physically. FinTech attracts and retains customers by digitizing data. FinTech now also includes different industries and sectors related to Retail Banking, Education, Investment Management, and Fund-raising and also non-profit.

Adoption of FinTech

As we know technology has always played a key role in every sector. Likely, technology emerged with the financial sector and take this sector at peak. Now everyone can transact anything from anywhere. Today almost everyone is using financial technology and aware of FinTech. So, what is the starting point when we adopted the financial infrastructure?

- (1887- 1950) is an era when we started with technologies such as telegraph, railroads, and steamships that permitted for the first-time rapid transmission of financial information across borders.

- The 1950s brought us credit cards, the 1960s brought ATM, 1970s brought electronic stock trading, in 1980s there was a rise of bank mainframe computers and more sophisticated data and record-keeping systems. In the 1990s, the Internet and e-commerce business prospered.

- In the 21st century, we are using mobile wallets, payment apps, equity crowdfunding, Robo-advisors, cryptocurrency, and many more financial technology services which is not an enhancement to banking services but rather replacing banking services completely.

Types of FinTech Market

- Digital Lending and Credit

- Online Banking

- Mobile Banking

- Mobile Payment

- Insurance

- International Money Transfer

- Personal Finance

- Equity Financing

- Online Trading

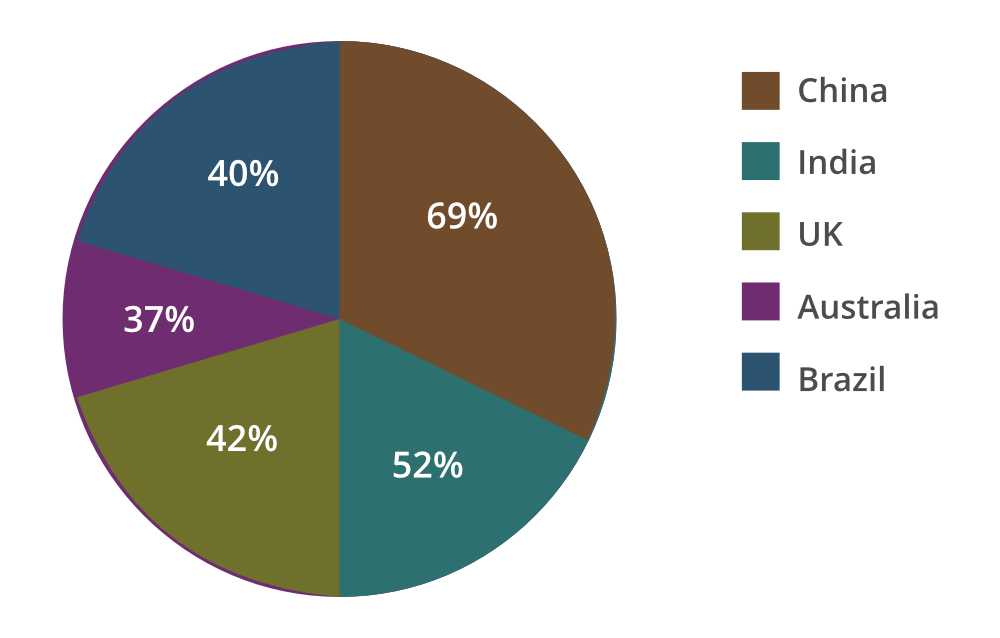

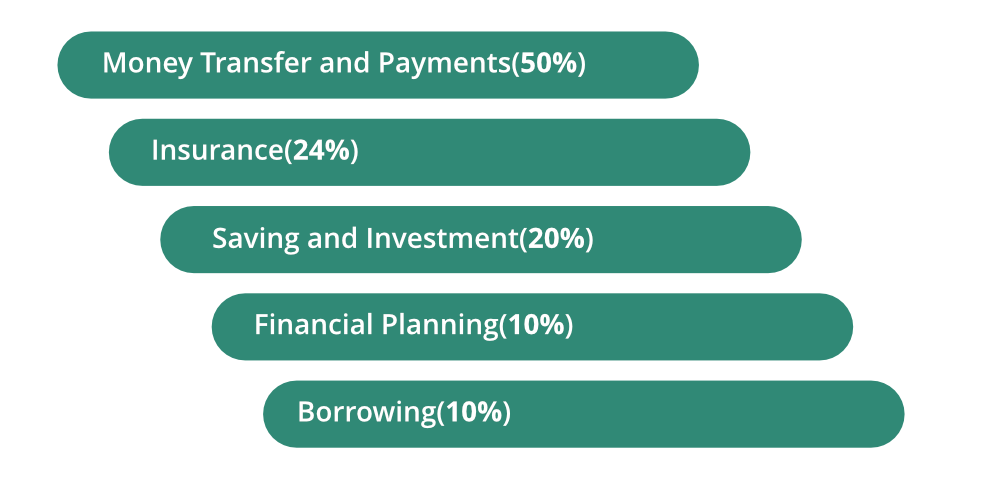

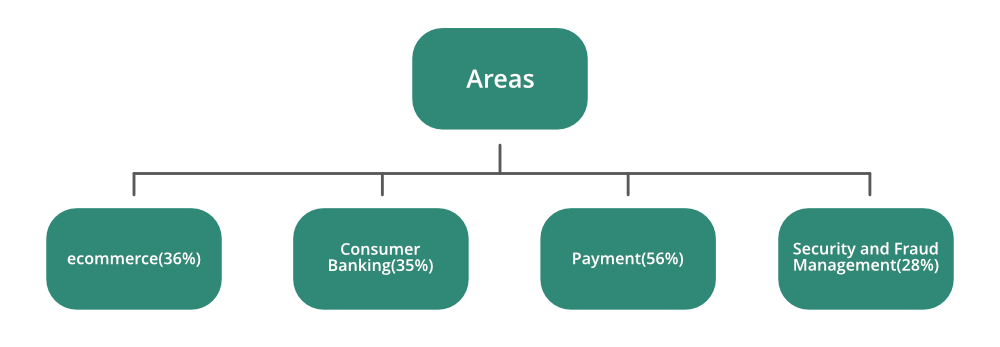

Below are the images to show the FinTech adoption rate, FinTech categories ranked by adoption rate, Investment into FinTech and greatest impact on financial services industries.

1. FinTech Adoption Rate

2. FinTech Categories Ranked By Adoption Rate

3. FinTech Investment Areas 2017

Technological Areas of Investment

- Data Analytics (74%)

- AI (64%)

- Mobile (51%)

- Cybersecurity (32%)

- Robotic process automation (30%)

- Biometrics and identity management (24%)

- Blockchain(21%)

- Public cloud infrastructure (14%)

FinTech Investment 2017

- In Asia, Investment in FinTech Companies hit $1.2B across 41 deals.

- Corporative VC participation remains at 23% of the total deal count in Asia in 2017.

Greatest Impact on the Financial Services Industry in 2018

- Robo-advisers (37%)

- Marketplace / P2P Lending (23%)

- Crowdfunding (15%)

- Blockchain technology (11%)

Pros and Cons of FinTech

Pros

- FinTech increases accessibility. A large number of people can access FinTech Market digitally.

- FinTech speed up the rate of approval of finance or insurance. FinTech assists in the approval process that can be completed within 24 hours.

- FinTech provides greater convenience to its customers by accessing their services through their mobile devices, tablets or laptop from anywhere.

- FinTech firms enjoy low operating costs and can also easily react to their customers need because they have greater access to information about their customers.

- FinTech companies are investing in major security to keep their customer’s data safe. For this, some of them are using like biometric data and encryption.

- Lower cost services.

Cons of FinTech:

- Limited access to soft information.

- FinTech has different standards, procedures, including business activities that are different from traditional banks. So, they might have to pay higher charges imposed by OCC. It means only those companies can survive which are top-performing; fulfill all requirements and fees imposed by OCC.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...