What is Capital Structure?

Last Updated :

06 Apr, 2023

Finance being the life force of every organization, needs to be estimated, raised and utilized properly to maximize the returns from such investments. A correct estimate of current and future needs of capital needs to be made to have an optimum capital structure which shall help the organization to run its work smoothly and without any hassles. Hence, Capital Structure refers to the relationship between the various long-term forms of financing such as debenture, preference share capital and equity share capital. It is concerned with the qualitative aspect of the financial planning of an enterprise since it deals with the proportion among the different types of securities.

According to J.J. Hampton, ‘Capital structure is the combination of debt and equity securities that comprise a firm’s financing of its assets’.

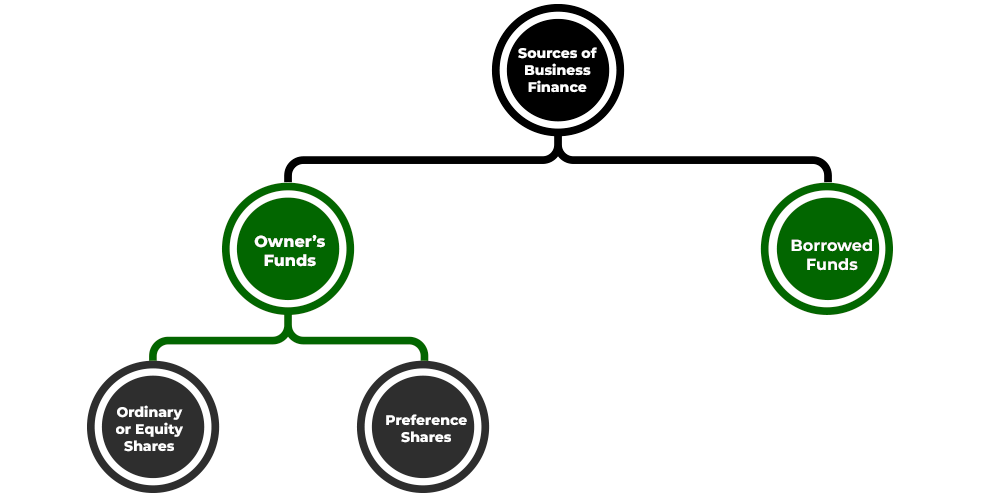

Sources of Business Finance

Two main sources of business finance are described as follows:

1. Owner’s Funds: These are classified into two types:

- Ordinary or Equity Shares: These shares represent the owner’s capital in the company. The holders of equity shares represent the real owners of the company. The dividend on equity shares is paid only after paying it to the preference shareholders. These are redeemed only in the event of the winding up of the company.

- Preference Shares: These shares enjoy two preferences over equity shares: dividend is paid on them prior to equity shares and repayment of the share capital at the time of liquidation. Equity shareholders will be paid only after settling all accounts of preference shareholders. Preference shares are paid a fixed rate of dividend.

2. Borrowed Funds: They are in the form of loans, debentures, public deposits, etc. These may be borrowed from banks, other financial institutions, debenture holders and public.

Some noteworthy points about Debt and Equity

- Debt refers to the funds owed by the company towards outside parties, while equity refers to the funds raised by the company by way of issuing shares.

- Creditors are paid interest on the amounts lent by them to the company, while the shareholders are paid remuneration in the form of dividends on their holdings.

- Fixed-rate of interest is to be paid on debenture and bonds, while bank loan interest may be fixed or floating. The rate of dividend on shares depends on the amount of available profits and the policies devised by the Board of Directors.

- Debt is more risky for the company as compared to equity since it creates a permanent charge against the assets and income statement. Equity shares do not cause any charge against the income statement since dividends can be paid only if there is profit.

Financial Leverage or Trading on Equity

The proportion of debt in the overall capital is known as Financial Leverage. It is computed as:

Financial Leverage = Debt/ Equity

Financial Leverage or Trading on Equity raises the return, i.e., earning per share of the equity shareholders by making use of fixed cost which is debt in the capital structure. This happens because:

- The cost of debt is lower than the cost of equity because the lender’s risk is lower than the risk of shareholders.

- Interest paid on debt is a deductible expense for computation of tax liability, whereas, dividends are paid out of after-tax profits.

Let us take some examples to understand how leverage enhances the returns on investment of a company under the following three circumstances:

Example 1. ABC Ltd. is a firm in the automobile industry. The tax rate in the industry is 40% p.a. and the firm’s earnings before interest and tax is ₹8,00,000. You are required to calculate the EPS in each of the following cases:

Case 1. When total funds are raised through Equity

Total Capital = ₹60 lakhs consisting of 6,00,000 shares @10 each

Debt = Nil

Solution:

| Particulars |

₹ |

|

EBIT

Less: Interest

|

8,00,000

Nil

|

|

Earning After Interest But Before Tax

Less: Tax @ 40% p.a.

|

8,00,000

(3,20,000)

|

| EAT(Earning After Tax) |

4,80,000 |

| Earning Per Share |

0.80 |

Case 2. When some part is raised through debt and balance from Equity

Total Capital = ₹40 lakhs consisting of 4,00,000 shares @10 each

Debt = ₹20,00,000

Solution:

| Particulars |

₹ |

|

EBIT

Less: Interest on debt @ 5%

|

8,00,000

1,00,000

|

|

Earning After Interest But Before Tax

Less: Tax @ 50% p.a.

|

7,00,000

2,80,000

|

| EAT(Earning After Tax) |

4,20,000 |

| Earning Per Share |

1.05 |

Clearly, by incorporating debt, the EPS increased from 0.80 to 1.05 .

Case 3. When the major part is raised through debt and some from Equity

Total Capital = ₹10 lakhs consisting of 1,00,000 shares @10 each

Debt = ₹70,00,000

Solution:

| Particulars |

₹ |

|

EBIT

Less: Interest on debt @ 5%

|

8,00,000

3,50,000

|

|

Earning After Interest But Before Tax

Less: Tax @ 50% p.a.

|

4,50,000

1,80,000

|

| EAT(Earning After Tax) |

2,70,000 |

| Earning Per Share |

2.7 |

Higher is the proportion of debt in the capital structure, greater is the return per share(1.05 to 2.70).

Example 2. Ram & Sons Ltd. is a firm in the transport industry. The tax rate in the industry is 50% p.a. and the firm’s earnings before interest and tax is ₹9,00,000. You are required to calculate the EPS in each of the following cases:

Case 1. When total funds are raised through Equity

- Total Capital = ₹80 lakhs consisting of 4,00,000 shares @20 each

- Debt = Nil

Solution:

| Particulars |

₹ |

|

EBIT

Less: Interest

|

9,00,000

Nil

|

|

Earning After Interest But Before Tax

Less: Tax @ 50% p.a.

|

9,00,000

4,50,000

|

| EAT(Earning After Tax) |

4,50,000 |

| Earning Per Share |

1.125 |

Case 2. When some part is raised through debt and balance from Equity

Total Capital = ₹60 lakhs consisting of 3,00,000 shares @20 each

Debt = ₹20 lakhs

Solution:

| Particulars |

₹ |

|

EBIT

Less: Interest on debt @ 5%

|

9,00,000

1,00,000

|

|

Earning After Interest But Before Tax

Less: Tax @ 50% p.a.

|

8,00,000

4,00,000

|

| EAT(Earning After Tax) |

4,00,000 |

| Earning Per Share |

1.34 |

By incorporating debt in the capital structure, the EPS increased from 1.125 to 1.34 .

Case 3. When the major part is raised through debt and some from Equity

Solution:

Total Capital = ₹30 lakhs consisting of 1,50,000 shares @20 each

Debt = ₹50 lakhs

| Particulars |

₹ |

|

EBIT

Less: Interest on debt @ 5%

|

9,00,000

2,50,000

|

|

Earning After Interest But Before Tax

Less: Tax @ 50% p.a.

|

6,50,000

3,25,000

|

| EAT(Earning After Tax) |

3,25,000 |

| Earning Per Share |

2.16 |

Higher is the proportion of debt in the capital structure, greater is the return per share(1.34 to 2.16).

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...