Types of ITR | Which ITR Should I File?

Last Updated :

10 May, 2023

What are ITRs?

Income Tax Returns or ITRs are specially designed tax filing forms to be filled by all taxpayers at the end of every financial year within the deadline issued by the Income Tax Department.

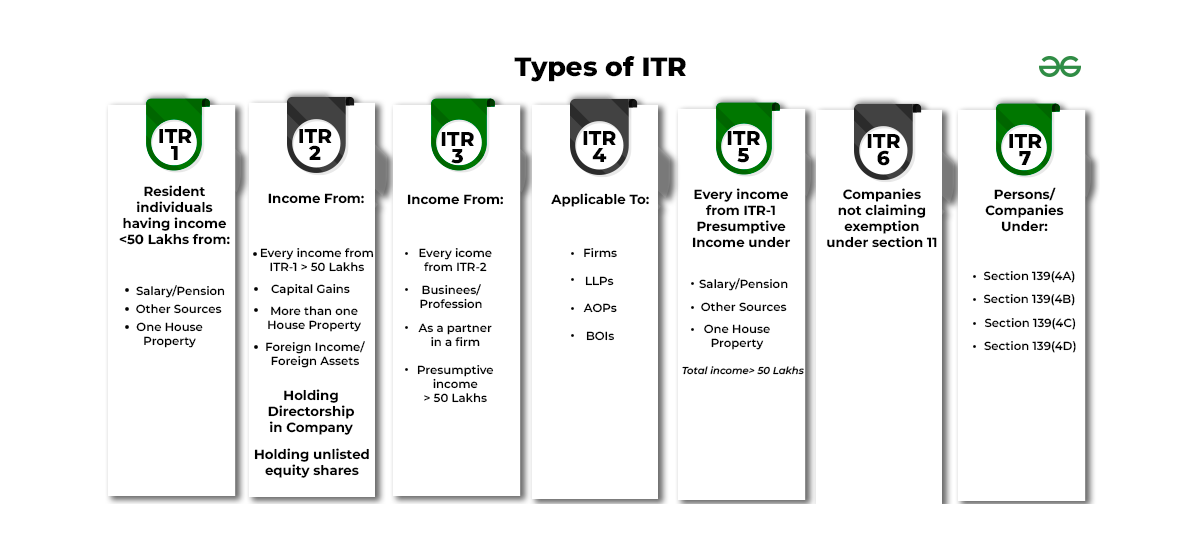

With the help of different types of ITRs, taxpayers disclose all the income and assets held to the Income Tax Department of India, which can determine the actual tax liability of the individual taxpayer, help them to apply for refunds if the actual tax liability of that individual is less than the tax paid by the individual, and also helps individuals to schedule tax payments. All the different sources of income are considered be it salary, capital gains, dividends, interests, income from foreign assets, or other sources in filing ITRs. There are seven different types of ITR, i.e., ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7 applicable for different types of taxpayers depending upon their category, and income type.

Let us discuss these seven types of Income Tax Return forms and their eligibility and ineligibility:

1. ITR-1:

This form is also known as the Sahaj form. This is applicable for those resident individuals whose source of income is from Salary or Pension. Individuals or HUFs whose source of income is from House Property or Other Sources are also eligible for filing ITR-1, but with some conditions (stated below). This form is not eligible for those taxpayers whose annual income exceeds ₹50 Lakh or if any income from foreign assets is received.

Who is eligible to file ITR-1?

- Any individual whose source of income is from salary or pension.

- Any income received from a single-house property (excluding cases where loss is brought forward from the previous financial year).

- Income received from other sources of income (excluding winning a lottery and race house).

- Income received from agricultural activities doesn’t exceed ₹5,000.

- Income received from the above sources doesn’t exceed ₹50 Lakh.

Who is ineligible to file ITR-1?

- If income exceeds ₹50 Lakh for any individual or HUFs.

- If any income is received from capital gains and businesses.

- If the taxpayer is a director in any company.

- If the taxpayer is receiving income from many house properties.

- If the individuals are Non-resident Indians (NRIs).

2. ITR-2:

This is applicable for those resident individuals whose source of income from Salary, Pension, House Property, or other sources exceeds ₹50 Lakh. Individuals who receive income from outside of India can also file their returns through ITR-2.

Who is eligible to file ITR-2?

- Any individual whose source of income is from salary or pension.

- Any individual holding unlisted equity shares or ESOPs. Any individual whose source of income is from the sale of an asset or property.

- Any individual whose source of income includes a source of income from outside India.

- Income received from the above sources exceeds ₹50 Lakh.

Who is ineligible to file ITR-2?

- If the total income of any individual includes profits or gains from a business or other profession.

- If the total income of the individual is less than ₹50 Lakh.

3. ITR-3:

ITR-3 is mainly for those individuals who earn a living from a profession or business. It also includes salary, pension or other sources of income. Any income earned by salaried people from intraday stock exchange or futures and options trading should file ITR-3 as well.

Who is eligible to file ITR-3?

- Any individual who earns a living from a profession or business.

- Income received by any individual who is a Director of a company.

- Source of income can be either salary, pension or other sources of income.

- Income received by any individual who is a partner in a firm.

- Any individual who has invested in unlisted equity shares.

Who is ineligible to file ITR-3?

- Individuals or HUFs who don’t have a source of income from commercial or professional profit.

- Individuals whose business turnover doesn’t exceeds ₹2 Crores.

- Any other source of income apart from salary, bonus, commission, remuneration and interest received from the business.

4. ITR-4:

This form is also known as the Sugam form. Income earned by Indian residents HUFs, Partnership Firms (other than LLPs), and individuals from business or profession must file their income tax return through ITR-4. It can also be filled by those who have chosen a presumptive income scheme under Section 44AD, Section 44ADA, and Section 44AE of the Income Tax Act.

Who is eligible to file ITR-4?

- Indian residents HUFs, Partnership Firms (other than LLPs), and individuals.

- Any individual who has chosen a presumptive income scheme under Section 44AD and Section 44AE of the Income Tax Act.

- Any individual who has chosen a presumptive income scheme under Section 44ADA of the Income Tax Act

Who is ineligible to file ITR-4?

- If the total income exceeds ₹50 Lakh.

- If income is received from more than one house property.

- If any individual is owning any foreign assets.

- If any individual is receiving income from any source outside India.

5. ITR-5:

ITR-5 is opted by Investment Funds, Business Trusts, Estate of Insolvent, Estate of Deceased, Artificial Judicial Person, Body of Individuals (BOIs), Association of Persons (AOPs), Limited Liability Partnerships (LLPs), and firms.

Who is eligible to file ITR-5?

- Investment Funds

- Business Trusts

- Estate of Insolvent

- Estate of Deceased

- Artificial Judicial Person

- Body of Individuals (BOIs)

- Association of Persons (AOPs)

- Limited Liability Partnerships (LLPs)

- Local Government

Who is ineligible to file ITR-5?

- Any individual who is eligible to file ITR-1

- HUFs

- Any Business

- Individuals earning from capital gain.

6. ITR-6:

ITR-6 is filled by companies that are not claiming exemptions under section 11. This can only be filled electronically by the companies opting for it.

Who is eligible to file ITR-6?

- Companies that are not claiming exemptions under section 11.

- Any income earned from real estate.

- Income through profit from a business.

- Income from any other source.

Who is ineligible to file ITR-6?

- Income earned from capital gain.

- Individual income or income earned by HUFs.

7. ITR-7:

ITR-7 can be opted by companies filing the returns under various sections stated by the Income Tax Act of India.

Who is eligible to file ITR-7?

- Section 139(4A): Individuals owning property for charitable or religious purposes.

- Section 139(4B): Political parties and affiliates.

- Section 139(4C): News Agencies, Institutions covered under section 10 (23A), Associations or Institutions belonging to Section 10 (23B), and the Association of Scientific Research

- Section 139(4D): Colleges, Universities, and other institutions

Who is ineligible to file ITR-7?

- Any salaried individual or HUFs.

- Those who are eligible to file their returns via ITR-5.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...