Types of Inflation

Last Updated :

14 Nov, 2023

Inflation can be simply defined as a decline in the value of a currency. Inflation directly affects the prices of essential goods and services. Also, it helps in calculating the increase in the price of certain goods and services in the past years. Inflation can be experienced when it requires more money to buy the same amount of goods. For example, if a pack of biscuits weighing 50 grams costs Rs. 5/Nos. in the year 2021 and the same pack of biscuits costs Rs. 8 in the year 2022 then it can be said that there is inflation. When a unit of currency can buy less than usual then it can be said that the nation is going through inflation. Inflation is measured in percentages, and the current rate of annual inflation in April of 2022 in India is 7.79%. Deflation is a state in which the prices of goods and services begin to fall with an increase in the value of the currency.

Read, What is Inflation

Inflation and its types

As a human, we need a set of goods and services like food grains, fuel, water, electricity, transportation, internet, and healthcare. Inflation doesn’t affect the prices of anyone or two goods and services if it affects them all. Because the prices of all the goods and services are interdependent For example if the fuel price increases transportation becomes costly and increases in basic goods. Inflation not only directly affects the pockets of every earning individual but also has a deep impact on the economy of the nation. The loss of value of a currency increases the prices of goods and services and affects the supply of goods and services.

Many economists believe that the cash flow or the money supply plays a crucial role in controlling inflation and in the economic growth of a nation. However, the cash flow is regulated by the central bank of the nation, thus the central bank adopts necessary measures to limit the cash flow in the market so that inflation can be controlled.

Read, Causes of Inflation

Types of Inflation

Inflation is broadly categorized into 3 types that are discussed below:

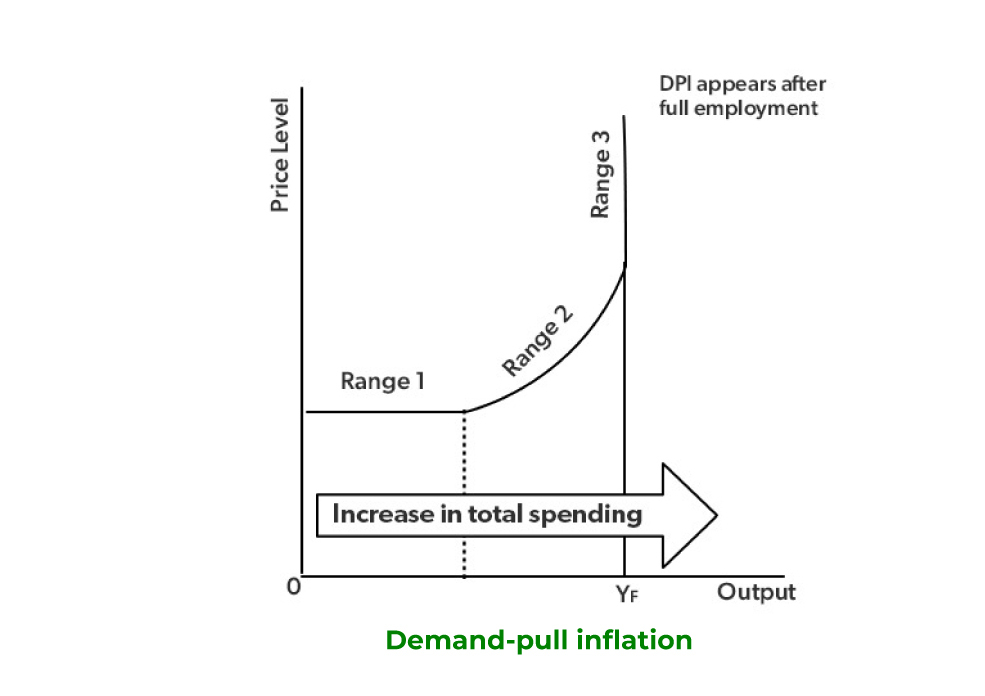

Demand-Pull Inflation

When the money supply increases in the market the purchasing power of individuals also increases, thus leading to increases in demand and a shortage in the supply causing Demand-Pull inflation. Due to higher demand and less supply, the prices of goods get increased. Thus this gap between the demand and supply leads to Demand-Pull inflation.

Demand Pull Inflation

Cost-Push Inflation

The Cost-push inflation is just contradictory to Demand-Pull inflation and this type of inflation occurs when the overall price of goods increases due to an increase in the cost of other commodities required in production like the machines, labour wages, etc. The increase in the production cost results in the rise of the value of the finished good.

Cost Push Inflation

Built-in Inflation

Built-in inflation refers to the inflation that is existing and is expected that it will also continue in the future. As the fuel prices, labor wages, and cost of machines keep on increasing that results in an increase in the final value of the good. Thus built-in inflation is the expected inflation rate that’s going to rise by a significant percentage every year.

Built-in Inflation

How is Inflation Measured?

Inflation can be easily calculated with the help of the simple mathematical formula mentioned below.

Inflation rate (%) =(Final CPI Index Value/Initial CPI Value)*100

You need to know the CPI to calculate the inflation rate from the above formula. So, every household needs certain goods and services for their daily life and they have a certain budget for it according to their income. So, the government conducts the survey and measures the purchasing capacity of random households based on certain essential goods and compares the purchasing capacity of households in the present year with the last year. And this average is known as the Consumer Price Index (CPI). These goods and services mainly include food, transportation, and medical care.

Advantages and Disadvantages of Inflation

Inflation has a different type of impact on every individual, the investors in real estate and stock markets enjoy inflation as the price of their assets increases they earn more profit. While on the other hand buyers that are planning to buy these assets wish that the inflation rate decreases so that they can buy these assets at a lower price. Inflation promotes growth and increases production capacity but also results in an increase in the value of goods and services. Inflation can be equally good or bad for an economy depending upon its rate of variation. Like if inflation is highly variable then it can badly affect the economy, while if it’s constant or slightly then it is a good sign for the economy of a nation.

Steps Adopted by the GOI to Tackle Inflation in India

- Under the Essential Commodities Act, 1955 & the Prevention of Black-marketing and Maintenance of Supplies of Essential Commodities Act, 1980 the state governments of India have been issued with advisories to take strict actions against the black marketers.

- The GOI launched a scheme called the Price Stabilization Fund in 2014-15 to control and regulate the volatility in agricultural products like pulses, and vegetables.

- To control the retail prices of pulses in India the GOI moved up the buffer stock from 1.5 MT to 20 MT.

- The GOI is constantly trying to provide the best MSP for the farmers so that the agricultural production increases and the government can ensure the availability of food grains.

FAQs on Types of Inflation

1. How many types of inflation are there?

There are 3 types of inflation:

- Demand-Pull Inflation

- Cost-Push Inflation

- Built-in Inflation

2. What is Cost-push inflation?

Cost-push inflation occurs when the overall price level in an economy is driven higher by increases in the cost of production for goods and services. In other words, the inflationary pressure comes from the supply side of the economy, primarily due to rising production costs.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...