Types of Accounting Ratios

Last Updated :

04 Apr, 2023

Accounting ratios are a set of financial metrics used to analyze different components of accounting information in order to derive proper conclusions to be further used by different users of such information for making informed decisions. They form an important part of the analysis and interpretation steps in the accounting process.

Accounting ratios are the quantifiable or numerical connection between two accounting data used to assess a company’s performance. Ratios are used to compare many aspects of a company, such as revenue, liquidity, solvency, and efficiency, and can be stated as a percentage, fraction, or decimal. Accounting ratios are those that are determined using financial data documented in a company’s financial statements.

Types of Accounting Ratios

Accounting ratios are broadly classified into 4 parts:

A. Liquidity Ratios (concerned with short-term assets and liquidity position)

B. Solvency Ratios (concerned with long-term debt and solvency)

C. Activity Ratios (concerned with turnover and accounts receivable/payable)

D. Profitability Ratios (concerned with gross, operating and net profits)

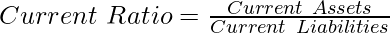

1. Current Ratio: Current ratio is one of the two main liquidity ratios. It is a very important accounting ratio that is used to depict the magnitude of current assets against current liabilities of a concern. The objective is to determine whether the firm holds enough current assets to pay off its current obligations, i.e., short-term liabilities or not. A higher current ratio implies that the firm can easily convert its assets into cash to pay off its dues and vice-versa. The creditors of a firm use the current ratio to ensure that the firm has enough resources to pay them back or not. It is also known as Working Capital Ratio and is given as:

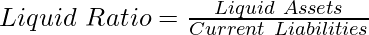

2. Liquid Ratio: Liquid ratio is one of the two main liquidity ratios. It is a very important accounting ratio that is used to depict the magnitude of liquid assets against the current liabilities of a concern. Liquid assets are the ones that are readily convertible in cash. In other words, all current assets excluding prepaid expenses and inventory are liquid assets. This ratio is used to determine whether the firm holds enough liquid assets to be able to pay off its current obligations or not. A higher liquid ratio implies higher that the firm has enough cash to pay off its dues and vice-versa. It is also called the quick ratio or acid-test ratio. The liquid ratio is calculated as:

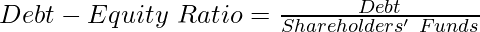

1. Debt-Equity Ratio: Debt-Equity Ratio is used to compare the magnitude of long-term debt and shareholders’ equity in the firm. The objective is to find the extent to which each of the sources has been utilized to raise funds by the firm, by comparing the magnitudes of both. A higher debt-equity ratio shows the firm in a risky position since it means that the firm owes more to the outside parties, whereas a lower debt-equity ratio means the firm has lower outside sources for raising funds and that its equity capital is sufficient. Debt-Equity Ratio is calculated by the following formula:

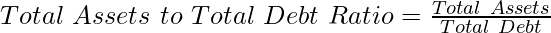

2. Total Assets to Debt Ratio: Total Assets to Debt Ratio is a very important solvency ratio used in accounting theory and practice. This ratio is used to compare the magnitude of assets owned by a firm and the amount borrowed by it from outside parties. This ratio is used to find the proportion of assets that have been funded by debt in the firm by comparing their magnitudes. The objective is to find the share of the business owned by shareholders and outside parties. A higher Total Assets to Debt Ratio means that a lot of assets were funded by debt, implying that the firm may become insolvent in the near future. The Total Assets to Debt Ratio is calculated by the following formula:

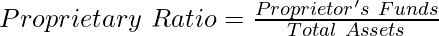

3. Proprietary Ratio: Proprietary ratio is an important solvency ratio that is used to measure the total contribution of shareholders towards the total assets of the firm. This ratio is also known by the names equity ratio, shareholder equity ratio, and net worth ratio. It is used to compare the magnitude of proprietors’ funds and the total assets of the firm to calculate the proportion to which the assets of the firm are backed by the shareholders’ equity. Generally, a higher proprietary ratio is considered a good sign since it implies that the firm did not have to raise funds through credit to finance its assets. The proprietary ratio is calculated using the following formula:

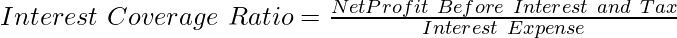

4. Interest Coverage Ratio: Interest Coverage Ratio, as its name suggests, is used to determine whether a firm is able to pay off its interest liability or not. Interest is incurred on debentures and other borrowings and has to be paid off whether a company has enough profits or not. This ratio is a measure of how frequently a firm can pay off its interest debt out of its profits before tax. It compares the values of EBIT and interest expense to be borne by the firm either on bank loans or debentures or other sources of credit and shows the portion of EBIT that would get spent in paying off interest expense. Interest Coverage Ratio is calculated using the following formula:

C. Activity Ratios

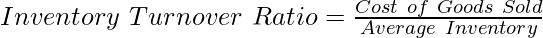

1. Inventory Turnover Ratio or Stock Turnover Ratio: The efficiency of a product-based business is measured by the rate at which it is able to convert its inventory into sales. This measurement is done with the help of the Inventory Turnover Ratio or Stock Turnover Ratio, which is a very important turnover ratio. The Inventory Turnover Ratio is used to express the relationship between the cost of goods sold and the inventory held by the firm. It depicts the number of times a firm was able to convert its inventory into sales in a given accounting period. A higher Stock Turnover Ratio implies the fast movement of goods and fast sales, whereas a lower stock turnover ratio means stagnant sales and that goods are stacked up in warehouses. The Inventory Turnover Ratio is calculated by the following formula:

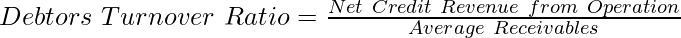

2. Debtors or Receivables Turnover Ratio: Receivables Turnover Ratio is used to measure how well a company can provide credit to its customers and also be able to recover the amount within the stipulated time. It depicts the number of times the firm is able to encash its accounts receivable in a given year. A higher Debtors or Receivables Turnover Ratio implies a robust credit policy of the firm, lower ratio shows a weaker credit policy. It is calculated as:

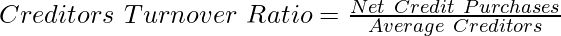

3. Creditors or Payables Turnover Ratio: This ratio is a measure of how promptly a firm is able to pay off the amounts it owes to its creditors. It depicts the number of times the firm is able to clear its accounts payable in a given year. A higher Payables Turnover Ratio implies that the working capital structure of the company is sound enough to pay off its dues and vice-versa. It is calculated as:

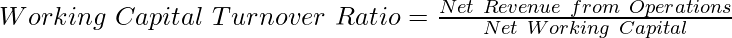

4. Working Capital Turnover Ratio: This ratio is a measure of the efficiency with which a company can generate sales with the help of its working capital. A higher Working Capital Turnover Ratio implies that the working capital is being utilized properly. A lower Working Capital Turnover Ratio shows that the business has too many debtors. It is calculated as:

D. Profitability Ratios

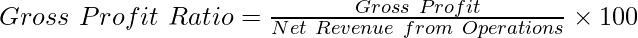

1. Gross Profit Ratio: It is a financial metric, which establishes a relationship between the gross profit of a company and its net revenue from operations. It is used to determine the profit earned by a firm after bearing all its direct expenses, i.e., the expenses directly tied to production. This ratio is used to determine the earning efficiency of the firm. Generally, a higher gross profit ratio indicates an increase in the profit margin. Gross profit ratio can be compared with the previous year’s ratio of the firm or with similar firms to see if it is up to the mark. It is calculated as:

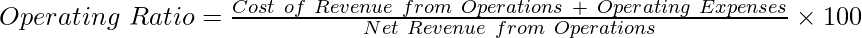

2. Operating Ratio: It is the comparison of a company’s cost of revenue from the operation and operating expenses to its revenue from operations. Operating Cost (cost of revenue from operation + operating expenses) is the sum total of all the expenses that are incurred in the operating activities of the business. It is calculated as:

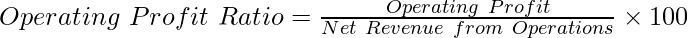

3. Operating Profit Ratio: Operating ratio is a financial metric that establishes a relationship between the operating profit of a company and its net sales. It is used to determine the revenue earned by a firm after bearing all its operating expenses, i.e., the expenses necessary to run a business. This ratio is used to determine the earning efficiency of the firm. Management is considered efficient when the ratio is higher and an improvement in the ratio over the previous period shows an improvement in the operational efficiency of the firm. It is calculated as:

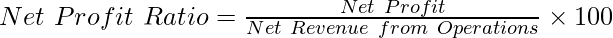

4. Net Profit Ratio: This ratio shows the relationship between the net profit of a firm and net sales. It is an important profitability ratio used by investors to determine if the firm is able to generate sufficient profits from its sales after deducting all kinds of expenses. Companies with larger net profit margins are more efficient in cost management and profit generation. It is calculated as:

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...