Terms of Credit – Class 10 Economics

Last Updated :

02 Aug, 2023

The economy runs with a proper cash flow in the market, and the banks maintain this cash flow by lending loans to people and institutions. However, as there is a variety of loans that banks offer, similarly every loan has its special terms and conditions.

Terms of Credit

Loan and credit help the economy move forward as it leads to development, thus leading to economic growth. However, in some cases, some loan becomes bad loan (when the borrower is not able to repay the loan). Thus the GOI and RBI have issued some strict guidelines for the issuance of the loan, based on which the credit is offered in India. The loan and terms of credit are discussed in detail below in this article.

What is Credit or a Loan?

A credit or a loan can be simply referred to as a certain amount of money borrowed by a bank or any other financial institution. The borrowed amount must be returned by the borrower to the bank along with the application within a specified timeline. If a person/institution fails to do so, the banks have the right to acquire and sell the collateral kept as the security of the loan.

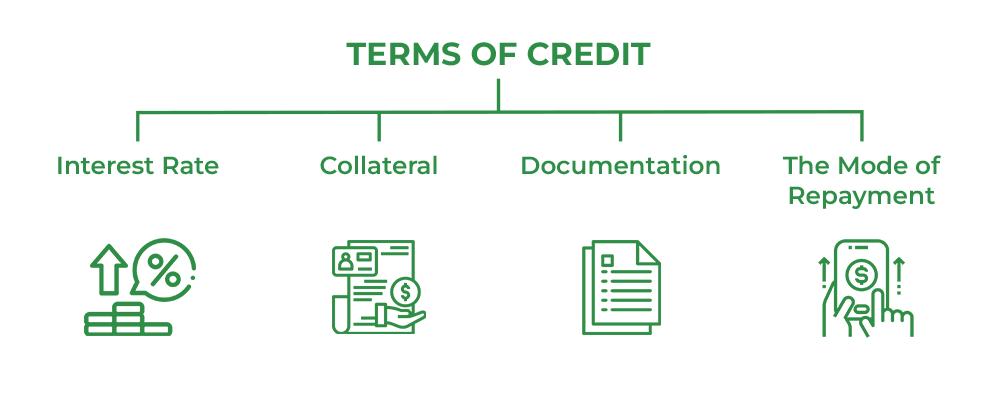

What are the Terms of Credit?

Each loan has a certain rate of interest that a borrower needs to pay along with the principal amount. Also along with the rate of interest, there are certain terms and conditions of every loan. For example, the borrower must repay the principal amount along with the interest within the specified time. In addition to this in some loans banks also keep collaterals as security of the loan (Collateral can be any asset such as land, vehicle, bank deposits, buildings, etc. that has a certain value.

In case a borrower failed to repay the loan amount then the bank is free to sell these collaterals and recover the loan amount. Each loan in India has its different terms and conditions and some of the common types of loans are discussed below:

Rate of Interest

Rate of interest is one of the primary terms of credit that applies to almost all kinds of loans except education loans. Whenever a bank offers a loan of a certain amount to a borrower, the bank charges a specified rate of interest on it. And this rate of interest needs to be paid off by the borrower to the bank along with the principal amount. The rate of interest may vary with the type of loan, the personal loan’s rate of interest ranges between 10.5% – 21% per annum.

Collaterals

Collaterals can be simply understood as an asset, or belonging that has a certain value, which is kept as loan security by the bank while offering the loan to the borrower. Collateral can be land, vehicle, precious metals, bank deposits, bonds, etc. The collateral plays a crucial role in a loan if a borrower fails to repay the loan within a specified period of time. Then the bank can sell that collateral to recover the loan amount.

Documentation Required

Taking a loan is a quite tedious process and requires plenty of documentation. The documents required for a loan may vary with the type of loan you are applying for. However, there are certain documents that as a borrower you need to submit to the bank such as your income statement, current debt, details of assets, your residence proof, identity proof, etc.

Mode of Repayment

The mode of repayment includes the mode of payment via which the loan amount is going to be prepared, the number of installments, and the duration of the loan. The borrower must need to repay the whole loan within a specified time, and if someone fails to do so, can face bank penalties, can lose their collaterals, and even in some critical cases may also need to face judicial custody.

House Loan

It’s one of the most common loans, that many banks offer in India. The housing sector has been one of the major indicators of economic growth for the past many years. That’s the reason why banks are also offering housing loans at lower interest rates. To be eligible for a house loan, the borrower first needs to submit all the legal documents to the bank. Once these documents get approved bank verifies the collateral that is to be kept as loan security. Once the loan is approved by the bank, the borrower gets the amount in certain installments as per the agreed terms. The terms of credit in a house loan mainly include the documents, rate of interest, mode of payment, collateral, and the duration of the loan.

FAQs on Terms of Credit

Q 1. What is the average rate of interest on home loans?

Answer-

The average rate of interest on home loans in India varies between 6%-15% per annum, and this rate varies with the banks.

Q 2. Is collateral necessary in all loans?

Answer-

No, not all loans require collateral, there are many financial institutions that do offer loans without collateral but they are unsecured loans, while the ones with collateral are secured ones.

Q 3. Do all come with interest?

Answer-

No, there are many loans that are interest-free such as education loans, interest-free car, home loans, etc.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...