Settlement of Amount due to a Retiring Partner: Transferred to Loan Account

Last Updated :

05 Apr, 2023

A Retiring Partner is entitled to receive an amount of his share in the partnership firm after making all the adjustments related to goodwill, profit/losses, reserves, and accumulated profits, salary, commission, interests, and drawings. Such an amount can be paid to the retiring partner immediately or if the firm is not in a situation to pay the amount due to the retiring partner instantly, then such an amount is considered a loan from the retiring partner and is transferred to his loan Account. The Retiring Partner’s Loan Account is shown on the liability side of the Balance Sheet.

Interest on Amount due to the Retiring Partner

In case of no Partnership Deed, the retiring partner is entitled to receive 6% interest per annum on the amount due to him until the date of payment. The partner also has an option, to take that share of the profit, which has been earned using such a due amount, instead of the interest (Section 37 of the Indian Partnership Act, 1932).

Accounting Treatment

When the amount payable to the retiring partner is not paid instantly, then such an amount is transferred to his Loan Account and appears in a Balance Sheet as a liability of a firm.

Journal Entries

Transferring Due Amount to Retiring Partner’s Loan Account:

Illustration:

Alizeh, Rumi, and Kiran were partners sharing profits and losses in the ratio of 3: 2: 1, respectively. The Balance Sheet of their firm as on 31st March 2022 stood as:

Rumi retires on 1st April 2022. It was agreed that the amount due to her shall be treated as a loan after making the following adjustments:

- Machinery depreciates by 10% and Van by 15%, respectively.

- Stock appreciates by 20% and Building by 10%, respectively.

- Provision for Workmen’s Compensation to be created of ₹ 1,650.

- Provision for Doubtful Debts to be created by ₹ 1,950.

- The goodwill of the firm is valued at ₹18,000, and Rumi’s share of goodwill is to be adjusted by the remaining partners’ capital account.

- The New Profit-Sharing Ratio of the remaining partners is 3: 2, respectively.

Prepare the Revaluation Account, Partners’ Capital Account, and Balance Sheet of the New Firm.

Solution:

Working Notes:

1. Calculation of Gaining Ratio:

Old Ratio of Alizeh, Rumi, and Kiran = 3: 2: 1

New Ratio of Alizeh and Kiran = 3: 2

Gaining Ratio = New Ratio – Old Ratio

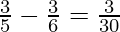

Gaining Ratio of Alizeh =

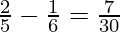

Gaining Ratio of Kiran =

Thus, Gaining Ratio of Alizeh and Kiran = 3: 7.

2. Calculation of Share of Goodwill of the Retiring Partner:

Value of Goodwill= ₹ 18,000

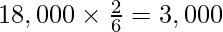

Share of Goodwill of Rumi=

This amount is to be debited from Alizeh’s Capital Account and Kiran’s Capital Account in their Gaining Ratio of 3: 7, i.e., 1,800 and 4,200, respectively.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...