Project Idea – Algorithmic Trading Bot

Last Updated :

04 Jul, 2021

Project Title: Algorithmic Trading Bot

Introduction :

Algorithmic trading uses algorithms that follow a trend and define a set of instructions to perform a trade. The trade can generate revenue at an inhuman and enhanced speed and frequency. The characterized sets of trading guidelines that are passed on to the program are reliant upon timing, value, amount, or any mathematical model. Aside from profitable openings for the trader, algo-trading renders the market more liquid and trading more precise by precluding the effect of human feelings on trading.

Purpose and Need of Project:

Algo trading is now a ‘prerequisite’ for surviving in tomorrow’s financial markets. Industry reports suggest global algorithmic trading market size is expected to grow from $11.1 bn in 2019 to $18.8 bn by 2024. So, the future of Algorithmic trading is yet to come. A lack of a “Simple yet Efficient Bot” for use by “Common-Man” has driven the need for this project

Objectives:

The global algorithmic trading market is expected to grow significantly between 2018 and 2026. Our project aims to further this revolution in the markets of tomorrow by providing an effective and efficient solution to overcome the drawbacks faced due to manual trading like –

- Trades are executed at the best possible prices.

- Trade request situation is instant and precise (there is a high possibility of execution at the ideal levels).

- Trades are coordinated effectively and immediately to keep away from huge value changes.

- Reduced exchange costs.

- Simultaneous automated checks with different market scenarios.

- Reduced hazard of manual mistakes when trading.

- Algo-trading can be back-tested utilizing historical and live data to check whether it is suitable for trading.

- Reduced the chance of errors by human traders as a result of emotional and psychological factors.

Problem Statement:

The problem statement is to build an Algorithmic Trading Bot which will work on Random Forest to work alongside effective strategies like Range Trading / SMA, Gold Cross, Multi Data Strategy, etc. for day-to-day (Intraday) trading and throughout the course of the day invest and trade with continuous modifications to ensure the best trade turnover for the day while reducing the transaction cost, hence enabling huge profits for concerned users be it Organizations or individuals.

Tools and Technologies :

Hardware

- Inter Core i7-9750H CPU

- 2.60GHz

- 8GB RAM

- TB HDD

Software

- Browser like Google Chrome, Mozilla Firefox, Microsoft Edge etc.

- Visual Studio Code Editor

- PgAdmin4 for PostgreSQL database

- Python 3.7

- Django Framework

- Alpaca Trading and Paper Trading Account

Architecture :

The Architecture Diagram of our proposed solution is shown below.

Architecture Diagram

We have two types of roles i.e. Trader and Bot. The Trader has access to trade orders, viewing market statistics, setting up a day trade strategy via the bot, and manage their account. The Bot will be validating and placing trades as per market and user statistics, will be sending notifications, and have access to the user wallet to execute trade orders. A few special features have been listed on top of the diagram.

Implementation :

Below is the implementation of our BOT.

Step 1: The User Registers by connecting their Trading account with the BOT. Then Login via username and Password.

Step 2: Portfolio page which displays Live Market Statistics, Bot Trade History, Account Details, Wallet, and Revenue opens.

Step 3: On the Portfolio page, the user will ‘Enable the Bot’. Enter Trading strategy, Stock names the user wants to trade in, Entry and Exit Points, Stop Loss value, and Strategy specific parameters (Eg: Moving Averages). Then Run the BOT.

Step 4: The BOT will constantly fetch and check the Live Market Scenario, current Open Positions, and User Wallet and Profit/Loss parameters to validate if a position can be taken for a stock in the market and decide what kind of trade is to be done. The BOT automatically calculates a number of shares to trade in keeping in mind the Targeted Profit, Stop Loss, Entry/Exit Points as well as preserving Wallet.

Step 5: The BOT will perform Automated Trading as per the Strategy and parameters set by the user and validating with the market to get Enhanced Performance and Revenue as compared to Manual Trading. The BOT will continue to do so until The Market Closes OR Exit POints/Stop Loss is reached OR The user sends a signal to stop.

Step 6: After Each action taken by BOT or as an alert system, instant Email Notifications sent to the user.

For our Machine Learning model, we have chosen Random Forest Regressor which shows an Accuracy Score of 0.96 for our BOT. The Random Forest Regressor is integrated with Python implemented Financial Strategies like Single Moving Average, Crossover Moving Average, Multiple Data, Gold Cross and Donchian Strategies.

The ALgorithmic Trading BOT allows the user to do –

- Live Trading

- Paper Trading (Live Simulation Trading)

- Back-Testing of Strategies (See how effective your trading strategy is and the Bot’s on Historical data)

Output :

Look at the Trading BOT Go! Automated Trading with just a few steps !

The above video demonstrates How the BOT does Automate Trading and ensures Good Profits constantly without any Human Intervention. We can see the Instant Email alerts being received by the User on Bot’s actions.

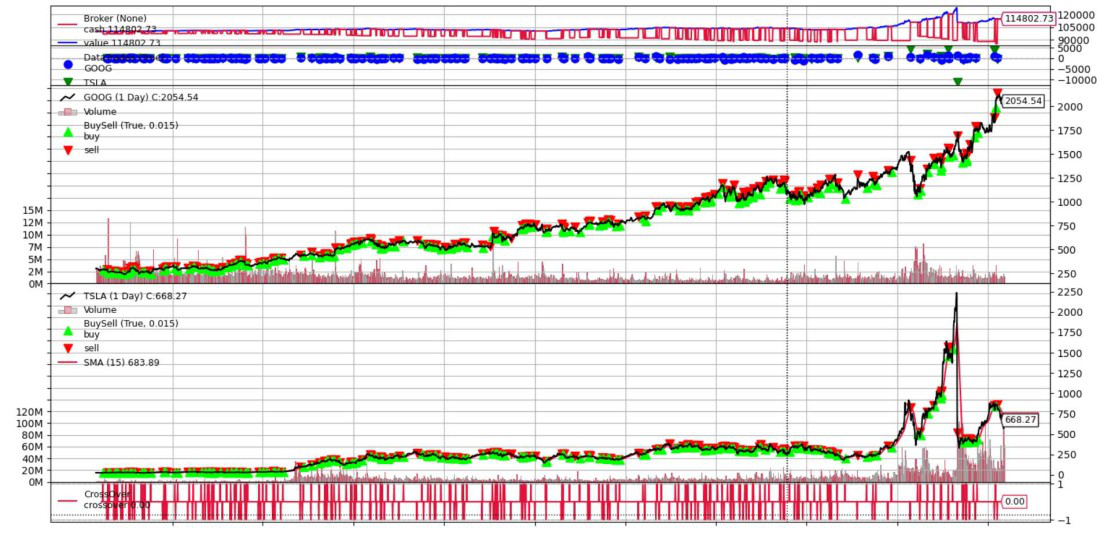

Back-Testing can also be done. Here below is a snippet that demonstrates the result and its analysis shown by the BOT after backtesting –

Note: Here the Multiple Data’s strategies have been Back-Tested with the BOT

Multiple Data’s Strategy Back-Testing

Here we see our Strategy and BOT together would have made a profit of $14802.73 !!

Conclusion :

- Algorithmic trading Bot not only provides Security, Cost, and Speed but is also a revolutionary technology for the future financial markets and economy.

- Algorithmic Trading Bot makes it easier for both new traders as well as established ones in getting profitable outcomes with minimized effort, time, and loss.

- The integration of Financial Knowledge with Machine Learning is a demand of future Trading and enhances both Performance and Revenue.

Further Work :

As the next step for our project, the following will be implemented –

- Integration of Random Forest with Financial strategies to enable them to work together to further improve bot efficiency.

- Interactive yet easy-to-use User Interface of the bot on a web platform.

- Integrating bot to the UI with Django framework.

- Longer periods of live testing of the overall complete bot to ensure best performance statistics.

Objectives to be met –

- Reduced transaction costs and Risks.

- Make bot secure.

- Enable cloud-based scheduling of trades.

Real-Life Application :

Even with prevailing solutions in the market, retail investors aka “The Common Man” or “Non-Organizational Traders” have not benefited and are still stuck with the traditional ways of trading which have higher vulnerability and lower profit – to – loss ratio.

The Institutional traders have built platforms such that those can be handled by the Technical team of their Organization. Currently, trading is happening in the span of microseconds and going on to Nanoseconds, with just one millisecond accounting for millions in revenue per year from market trades.

A lack of a User-Friendly, adaptable, and ease of understanding platform has resulted in the dominance of Institutions in the Trade market. Thus this system will have its use in the Future of Trading and can be used in Cryptocurrency trading as well in further versions of this System. Any trader is it established or new will get Enhanced Performance and Revenue.

Team Members :

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...