Preparation of Revaluation Account, Capital Account and Balance Sheet

Last Updated :

05 Apr, 2023

Illustration 1:

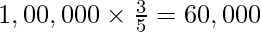

Amit and Sumit were partners sharing profit equally. A new partner, Ravi is admitted from 1st April 2022 for a  of the share in the profit. Following is the Balance Sheet of Amit and Sumit as on 31st March 2022:

of the share in the profit. Following is the Balance Sheet of Amit and Sumit as on 31st March 2022:

Additional Information:

- Ravi brought ₹40,000 as his Capital and ₹10,000 as his Share of Goodwill.

- Goodwill brought in by Ravi is withdrawn by the old partners.

- Machinery is depreciated by ₹4,000 and Furniture by ₹2,500.

- Provision for doubtful Debts shall be up to 5% on Debtors.

- Land and Building be appreciated by 20%.

- Stock is valued at ₹46,000.

- There is an unrecorded investment of ₹4,000.

- The electricity Bill of ₹10,000 was omitted from being recorded.

- Insurance Premium of ₹10,000 shall be carried forward as unexpired insurance.

Prepare the Revaluation Account, Partner’s Capital Account (Fluctuating method), and Balance Sheet of the new firm.

Solution:

Working Notes:

1. It is assumed that Ravi has acquired his share from Amit and Sumit in their old Profit-sharing ratio i.e.,1:1, since only the share of Ravi (new partner) is given in the question.

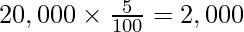

2. Provision for doubtful debts given = ₹ 1,000

Provision for doubtful debts to be created =

Amount to be Adjusted in Revaluation Account = 2,000 – 1,000 = ₹1,000

3.

Illustration 2:

Following is the Balance Sheet of the Partners named, Ram and Shyam sharing profits and losses in a ratio of 3: 2, respectively.

A new partner Krishna has been admitted on 1st April, 2022 on the followings terms:

- New Profit-Sharing Ratio shall be 4: 3: 2.

- Krishna brings ₹2,00,000 as his Capital.

- Krishna has to pay an amount equal to his share in the firm’s Goodwill, which is valued at twice the average profit of the last three years, which were ₹3,00,000, ₹2,60,000, and ₹2,50,000, respectively.

- Half of the amount of Goodwill is to be withdrawn by Ram and Shyam.

- Provision for Doubtful Debts is to be maintained at 5% on Debtors.

- There is an outstanding expense of ₹50,000.

- Unrecorded Accrued Income of ₹15,000.

- Ram takes over the Investments at the value of ₹60,000.

- Ram paid expenses on the Revaluation of ₹10,000.

- Stock is revalued at ₹1,58,000.

Prepare the Revaluation Account, Partner’s Capital and Current Accounts, and the Balance Sheet of the new firm.

Solution:

Working Notes:

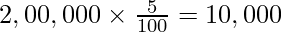

1. Provision for doubtful debts given = ₹ 8,000

Provision for doubtful debts to be created =

Amount to be Adjusted in Revaluation Account = 10,000 – 8,000 = ₹2,000.

2. General Reserve distributed among the old partners in their old ratio.

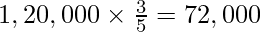

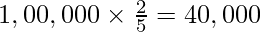

Ram =

Shyam =

3. Existing value of Goodwill written off among the old partners in their old ratio:

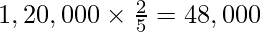

Ram =

Shyam =

4. Calculation of Sacrificing Ratio:

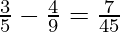

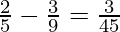

Ram =

Shyam =

Sacrificing Ratio of Ram and Shyam = 7:3

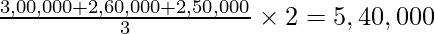

5. Calculation of value of the Firm’s Goodwill:

Value of The Firm’s Goodwill =

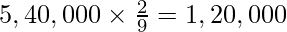

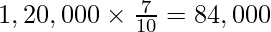

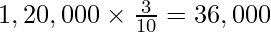

6. Krishna’s Share of goodwill (Premium for Goodwill) =

Ram and Shyam share in Premium for Goodwill (In sacrificing Ratio)

Ram =

Shyam =

7.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...