Overall Profitability Ratio: Meaning, Formula, Significance, and Examples

Last Updated :

08 Jun, 2023

For any business entity, the ultimate goal is to make profits. No business runs on charity and instead, it expects some returns against all the operations being performed in the business. Return on Investment or Return on Capital Employed measures the Overall Profitability and is used to analyze the capital efficiency of the firm.

What is Return on Investment (R.O.I) or Return on Capital Employed?

Return on Investment ratio indicates the overall profitability of any business. This is done through a comparison between the total capital invested and the total profit or income generated using the employed capital. For the same reason, it is also known as ‘Rate of Return’ or ‘Yield on Capital’ or ‘Return on Capital Employed’. This ratio is calculated in the form of percentage.

Profit before interest, tax, and dividends is considered to calculate this ratio. The term ‘capital employed’ basically refers to the investments or the long-term finances employed in the business. This money basically belongs to the shareholders of the business enterprise.

Formula:

Where,

Capital Employed = Shareholder’s Fund + Long-term Debts

or

Capital Employed = Total Assets – Current Liabilities

or

Capital Employed = Fixed Assets + Current Assets – Current Liabilities

or

Capital Employed = Fixed Assets + Working Capital

Significance of Profitability Ratios:

- Since any business’s main goal is to earn profits, so this goal best aligns with what exactly the overall profitability ratio measures. The profitability ratio gives the best criteria to measure the comprehensive performance of the business.

- This ratio helps to determine the profit-yielding capacity of the net investments or the assets employed in the business enterprise.

- This ratio also serves the purpose of having a comparative analysis of two business enterprises that are dissimilar to each other. Through the profitability ratios of both enterprises, the performance of both enterprises can be analyzed against each other.

- Moreover, this ratio can also be used to determine the borrowing policy or capacity of any business entity. For example, if the profitability ratio for the business comes out to be 18% and the borrowing rate is 20%, it indicates that the borrowing rate is higher than the return on investment.

- Calculation of R.O.I. also helps to decide if the business is performing its operations in the right direction and if there is any diversion, then what are the areas that require more improvement.

Illustration 1:

The financial statement of Radhey Shyam as on March 31, 2022 is as follows:

Notes:

1. Reserves & Surplus:

- Reserves = ₹5,00,000

- Profits (After Interest) = ₹17,00,000

2. Long-term Borrowings (on 10%)= ₹15,00,000

3. Other Current Assets:

Share Issue Expenses = ₹11,00,000

Calculate Return on Investment.

Solution:

So, Profit before Interest = Total Profit + Interest on Long-term Borrowings

= 17,00,000 + 1,50,000

= ₹18,50,000

Capital Invested = Share Capital + Reserves & Surplus + Long-term Borrowings – Share Issue Expenses

= 25,00,000 + 22,00,000 + 15,00,000 – 11,00,000

= ₹51,00,000

So,

= 36.27%

Illustration 2:

Following are the financial details of XYZ ltd:

Find out the Return on Capital Employed.

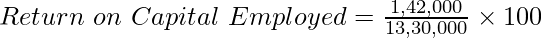

Solution:

Profit before interest and tax = Net Profit + Interest on Borrowings

= 1,00,000 + 42,000

= ₹1,42,000

Capital Employed = Equity Share Capital + Preference Share Capital + Reserves & Surplus + Long-term Borrowings – Discount on Shares + Net Profits

= 4,20,000 + 1,20,000 + 2,95,000 + 4,20,000 – 25,000 + 1,00,000

= ₹13,30,000

= 10.67 %

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...