Old Tax Regime Vs New Tax Regime With Latest Update 2023-24

Last Updated :

08 Feb, 2024

Depending on their level of income, individual taxpayers in India are subject to an income tax. An individual is subject to a slab system of taxation if their income exceeds the minimum threshold limit (i.e. basic exemption limit). Under a slab system, separate tax rates are established for various income groups. It implies that a taxpayer’s tax rate will increase as his or her income does. The government can establish progressive and equitable taxes with the help of this kind of taxation. The way taxes were collected changed beginning with the 2020–21 fiscal year. A new tax system was introduced, and both the tax rates and the amount that might be saved in taxes were drastically lowered. Finance Minister Nirmala Sitharaman has suggested a new tax system that will create seven income tax bands and lower tax rates on income up to Rs 15 lakh, bringing about a radical change in direct tax rates.

All companies are required under a CBDT circular released on April 13, 2020, to ask employees if they want to choose the new tax regime. At the time of submitting the return, employees would still have the option of choosing between the tax regimes. People who choose the new system must sacrifice some exemptions and deductions that were available under the old system.

New Tax Regime:

Six tax bands are available under the new tax system, with rates cut on income up to Rs. 15 lakh. Multiple exemptions and deductions are not available here because of the different tax rates and income slabs.

Pros of New Tax Regime:

- The current tax system is still in effect, and as a taxpayer, you have the option of selecting the one that is most advantageous to you, i.e., the old tax system or the new tax system. The new tax system is not mandatory, according to the government.

- The new tax system gives the taxpayer the freedom to invest their money anyway they see fit. With the new plan, there is no longer a compulsion for participants to participate in insurance and tax-saving plans that may not be in line with their financial objectives.

- Because there are many tax brackets, you, the taxpayer, will fall into the bracket that best matches your yearly income.

Cons of New Tax Regime:

- The current exemptions will be evaluated gradually and slowly eliminated from the new tax system.

- The total taxable amount will be larger than it was under the previous tax system if there are no exemptions.

- Despite the six tax brackets, it might not be advantageous for all taxpayers if the income-tax authorities decide to entirely abolish the previous system.

Old Tax Regime:

To put it mildly, the current tax structure is convoluted. There are several ways to reduce the tax liability despite the high tax rates. While exemptions, like the House Rent Allowance (HRA) and Leave Travel Allowance (LTA), are included in the pay, deductions let individuals pay less in taxes by investing, saving, or spending money on certain things. The largest deduction is available under Section 80 C, which allows users to reduce your taxable income by Rs. 1.5 lakh. In addition to this, there are numerous other features that allow consumers to write off taxes as costs. Health insurance payments and loan interest on both home and student loans are among them.

Pros of Old Tax Regime:

- By forcing investments in specialized tax-saving mechanisms, the previous income tax system gradually ingrained in people a culture of saving. It encourages saving for upcoming occasions like marriage, education, property purchases, medical expenses, etc.

Cons of Old Tax Regime:

- Liquidity is harmed by the investment lock-in period.

- Current level of consumption as a result of committed investment amounts.

- Only a small number of investments can lower taxes.

- Maintaining records of claimed deductions is troublesome.

- Not favorable for taxpayers with zero or fewer tax-deductible transactions.

The Difference Between Old Vs New Tax Regime:

- The difference in slab rates is the primary distinction between the old and new tax regimes. In India, taxpayers are required to pay income tax based on the tax slab system into which they are classified. The average income of the individuals is taken into account while creating the tax slab. As a result, tax obligations for taxpayers with greater earnings will be higher.

- Another significant distinction between the old and new tax systems is the ability to cut taxes. The old tax system had several alternatives available to a taxpayer, while the current tax system does not allow for any deductions.

- While the old tax code provided roughly 70 deductions and exemptions to reduce taxable income, the new tax code allows the taxpayer to claim zero deduction or exemption alternatives. Taxpayers can use deductions to lower their tax obligations by saving, investing, or spending money on specific goods.

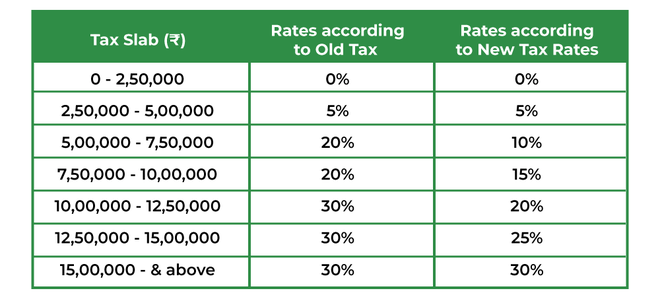

The Old and New Tax Slabs are contrasted in the Following Table:

The Difference in Slab Rates of Old Vs New Tax Regime

According to the new system, income between Rs. 5 lakh and Rs. 7.5 lakh would be subject to a 10% tax and income between Rs. 7.5 lakh and Rs. 10 lakh to a 15% tax. On the whole range for the current regime, this was 20% flat. With rates of 20% for Rs. 10-12.5 lakh, 25% for Rs. 12.5 lakh–15 lakh, and 30% for Rs. 15 lakh and beyond, the former Rs. 10 lakh+ slabs where you paid 30% has been divided into three parts.

Is it acceptable to bounce back and forth between the old and new taxation systems?

If you are a salaried person, you can choose this option each year. Every year, people with income from salaries, houses, capital gains, and other sources can choose to pay taxes under the old or new system. However, after choosing the new tax system, those with income from a business or profession only have one option to go back to the previous system. Only once in their lifetime may they choose the new tax system.

Which one is better?

According to the prescriptive, choosing the old tax system as opposed to the new one is a safer decision if your yearly income is on the higher side. Forget about all the tax breaks and exemptions the previous tax system offered if you wish to pick the new one. Due to the variety of deductions and exemptions available under the old tax system, such as PPF, ELSS, and Mediclaim, there are many investment opportunities for taxpayers. The new tax system is appropriate for new investors and individuals who have just started their jobs because their income has only recently started. Though choosing between the old and new tax regimes could appear challenging, if people approach the decision carefully, it is not that hard to make. What must one can do is as follows:

- Determine the total amount of exemptions you are receiving: If you were renting, then would be claiming HRA, the biggest wage exemption that is possible. In addition to the previously stated goods, other tax-free expenditures include LTA, meal expenses, phone bills, etc. All of them will now be taxable if you choose to move to the new tax regime.

- Examine the deductions you make: Two deductions that you receive automatically as a salaried employee are the standard deduction of Rs. 50,000 and your contribution to your Employee Provident Fund (EPF). Even while you will still make contributions to the EPF under the new system, you won’t be able to claim these deductions. Additionally, you are not allowed to deduct your home loan (if you have one) or insurance premiums, which up until now helped you lower your taxable income.

Once you’ve added up all of your exemptions and deductions, subtract them from your income to get your taxable income and what it would be if you didn’t take them into account. This should be your decisive element when choosing a regimen.

Conclusion:

The tax slabs, whether they were under the previous tax regime or the new one that was implemented in 2020, saw no significant changes in the Union Budget 2022. One must conduct a thorough examination and comparison of tax outlays and other criteria while deciding between the two regimes to determine which would be most helpful and fair to a taxpayer. Both systems have advantages and disadvantages of their own. The previous system had a large number of exemptions and deductions under several sections; in order to take advantage of some of these, people had to participate in tax-saving investment alternatives, which helped instill a sound investing habit. On the other hand, the new approach aims to streamline the procedure while giving consumers greater flexibility. It also fluctuates according to the slab you are in. But because the system is new, it makes sense to speak with a qualified tax professional who can advise you on the best course for reducing your taxes. In her budget, Finance Minister Nirmala Sitharaman stated that the government’s goal is for the country’s income tax system to be as straightforward as possible, therefore exemptions and deductions will be evaluated and gradually decreased in number. The success of the new system will reveal a lot about prospective future tax legislation when people compare the existing and new tax regimes in the upcoming fiscal year.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...