Net Profit Ratio

Last Updated :

02 May, 2023

What is Net Profit Ratio?

Net Profit Ratio shows the relationship between the net profit and net revenue from operations based on the all-inclusive concept of profit. It links operating revenue to net profit after operational and non-operational costs and incomes. Profitability is the primary goal of any firm. Profitability Ratios are determined to examine a company’s earning potential, which is the result of how well its resources are used. Net profit refers to the profit after tax (EAT).

Generally, a company with a high net profit ratio can successfully manage its costs and/or offer products or services for a price that is much higher than its costs. Consequently, a high ratio may be generated by:

- Optimal management

- Low prices (expenses)

- Effective pricing tactics

Whereas, a company that has a low net profit ratio either has an inefficient cost structure or uses bad pricing tactics. Consequently, a low ratio may be formed by:

- Inadequate management

- High prices (expenses)

- Poor pricing tactics

Investors should utilise the profit margin ratio’s figures as a general measure of a company’s profitability performance and, as necessary, initiate in-depth investigations of the factors that contribute to an increase or decrease in profitability.

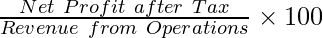

Formula of Net Profit Ratio

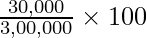

Net Profit Ratio =

Where,

Net Profit = Gross Profit – Indirect Expenses & Losses + Other Incomes – Tax

Indirect Expenses and Losses = Office Expenses + Selling Expenses + Interest on Long term borrowings + Accidental Losses

Explanation of Formula of Net Profit Ratio

In the formula, Net profit is calculated after deducting total expenses from total revenues. The Profit calculated from the Trading and Profit & Loss Account, i.e. Gross Profit, is taken. From the Gross Profit, indirect expenses are deducted, and other incomes are added to reach the Net Profit in Profit & Loss Account. The net profit percentage is calculated by dividing after-tax profits by net sales. It displays the residual profit after the recognition of income taxes and the deduction of all manufacturing, administrative, and financing costs from sales.

- Net Profit: The money company makes after deducting all operational, interest, and tax costs during a specific period is known as net profit. The bottom line of the financial statement is reflected by the net profit in the balance sheet.

- Revenue from Operations: The income a company generates from its regular, core business operations is known as revenue from operations, or operating revenue. It is considered to have been running effectively if the entity can provide a consistent stream of income from its operations.

Significance of Net Profit Ratio

The Net Profit Ratio measures the overall status of a firm, i.e. the amount of Net Profit generated by the company per revenue gained. After compensating all other stakeholders, including the government, the obligations of the shareholders of a company are resolved. Companies with larger net profit margins are more efficient in cost management and profit generation. It is expressed in the form of percentages because it is a profitability ratio.

Examples of Net Profit Ratio

Illustration 1:

Calculate the Net Profit Ratio from the following:

Solution:

To calculate Net profit, all expenses are deducted from Gross profit.

Gross Profit= Revenue from Operations – Cost of Revenue from Operations

= Revenue from Operations – (Opening inventory + Purchases + Wages + Carriage Inwards – Closing Inventory)

= 25,00,000 – ( 4,00,000 + 12,00,000 + 2,70,000 + 1,40,000 – 3,10,000)

= 25,00,000 – 17,00,000

= ₹8,00,000

Net Profit = Gross Profit – Administrative Expenses – Selling Expenses – Income Tax + Profit on sale of fixed assets

= 8,00,000 – 75,000 – 25,000 -50,000 + 25,000

= ₹6,75,000

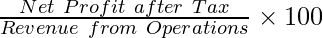

Net Profit Ratio =

= 27%

Illustration 2:

From the following calculate the Net Profit Ratio:

Solution:

Indirect Expenses and losses = Office Expenses + Interest on Debentures + Selling Expenses + Accidental losses

= 10,000 + 10,000 + 25,000 + 15,000

= ₹60,000

Other Income = Income from Rent + Commission Received

= 3,500 + 2,500

= ₹6,000

Net Profit = Gross Profit – Indirect Expenses & losses + Other Incomes

Net Profit = 84,000 – 60,000 + 6,000

Net Profit = ₹30,000

Revenue from Operations = ₹3,00,000

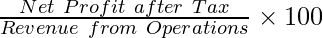

Net Profit Ratio =

= 10%

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...