Modern Forms of Money

Last Updated :

24 Jan, 2024

Modern Forms of Money: Cash goes about as a transitional in the trade interaction and it is called the vehicle of trade. In a significant number of our everyday exchanges, products are being purchased and sold with the utilization of cash. The explanation concerning why exchanges are brought in cash is that an individual holding cash can without much of a stretch trade it for any product or administration that the person in question needs.

Modern Forms of Money

Credit

Credit is a plan by which the loan specialist moves cash to the borrower in light of a guarantee to pay the sum so moved in the future alongside a premium at the rate commonly concurred between them. So, credit is the action of getting and loaning cash between two gatherings. A moneylender can be a bank or an individual too. The reason for which individuals assume acknowledgment is the development and extension of business, everyday money needs of the business, schooling of kids, buying, and extension of the house, marriage or relatives, and so forth.

Money as a Medium of Exchange

Right all along, cash has been filling the significant role of the vehicle of trade in the general public. Cash works with exchanges of labor and products as a vehicle of trade. Makers offer their products to wholesalers in return for cash. Wholesalers, thus, offer their merchandise to the retailers and the retailers offer these products to the buyers in return for cash. Similarly, all areas of society sell their administrations in return for cash and with that cash, purchase labor and products which they need. Cash, functioning as a mechanism of trade, has wiped out bother which was looked at in deal exchanges.

The utilization of cash has eliminated the issue of two-fold occurrence of needs. The trade has now become helpful and clear. In old times when the idea of cash was not advanced, individuals used to execute through the bargain arrangement of trade.

Trade is an arrangement of trade where members in exchanges straightforwardly trade labor and products for different labor and products of their requirements. In any case, there were a few weaknesses of the trade framework like the twofold fortuitous event of needs, convoluted and tedious cycle, an indistinct technique for valuation of merchandise, and so forth, as a result of which it can’t be utilized for long in the becoming industrialist world.

The justification behind involving cash as opposed to different items as a method of trade is

- An individual holding cash can without much of a stretch trade it for any ware or administration that the person in question could need.

- In this manner everybody likes to get installments in cash and afterward trade the cash for things that they need.

- An exchange without cash can happen just when there is a twofold incident of needs.

- It is really serious about what an individual craving to sell is actually the thing different wishes to purchase in an economy where cash is being used, cash by giving the critical transitional advance disposes of the requirement for the twofold fortuitous event of needs.

- It is as of now excessive for the shoe producer to search for a rancher who will purchase his shoes and simultaneously sell him wheat.

- Since cash goes about as a middle-of-the-road in the trade interaction, it is known as a mode of trade.

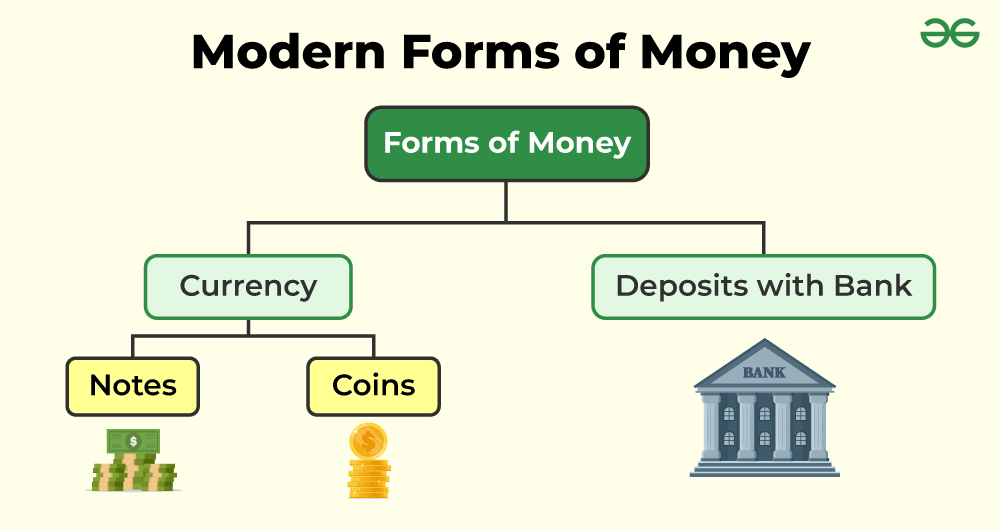

Modern Forms of Money

Current types of cash incorporate money — paper notes and coins. Not at all like the things that were utilized as cash before, present-day money isn’t made of valuable metals like gold, silver, and copper. What’s more, not normal for grain and dairy cattle, they are neither of regular use. The cutting edge cash is with practically no utilization of its own. Then, for what reason is it acknowledged as a vehicle of trade? It is acknowledged as a mechanism of trade on the grounds that the money is approved by the public authority of the country.

In India, the Reserve Bank of India issues cash notes in the interest of the local government. According to Indian regulation, no other individual or association is permitted to give money. In addition, the law legitimizes the utilization of a rupee as a mechanism of installment that can’t be denied in that frame of mind in India. No person in India can lawfully deny an installment made in rupees. Consequently, the rupee is broadly acknowledged as a mode of trade.

Deposit with Banks

The other structure is where individuals hold cash stores with banks. At a particular moment, individuals need just cash for their everyday necessities. For example, laborers who accept their pay rates toward the finish of every month have additional money toward the start of the month. How in all actuality do individuals manage this additional money? They store it with the banks by opening a ledger in their name. Banks acknowledge the stores and furthermore pay a financing cost on the stores. Along these lines, individuals’ cash is protected by the banks and it procures revenue. Individuals likewise have the arrangement to pull out the cash as and when they require it. Since the stores in the ledgers can be removed on request, these stores are called request stores.

Request stores offer another intriguing office. This office loans is the fundamental attributes of cash (that of a mode of trade). You would have known about installments being made by cheques rather than cash. For installment through a cheque, the payer who has a record with the bank makes out a cheque for a particular sum.

A cheque is a paper teaching the bank to pay a particular sum from the individual’s record to the individual in whose name the cheque has been made. Consequently, we see that request stores share the fundamental elements of cash. The office of checks against request stores makes it conceivable to settle installments without the utilization of money straightforwardly.

Since request stores are acknowledged generally for the purpose of installment, alongside cash, they comprise cash in the advanced economy. You should recall the job that the banks play here. Be that as it may, for the banks, there would be no interest stores and no installments by cheques against these stores. The advanced types of cash — money, and stores — are firmly connected to the working of the cutting edge financial framework.

Frequently Asked Questions

What are the upsides of keeping cash in the banks?

- Deposits with the banks are gainful for individuals since banks acknowledge the stores and furthermore pay a sum as revenue on the stores.

- Along these lines, individuals’ cash is protected by the banks and it acquires a measure of revenue.

- Banks utilize a significant part of the stores to expand credits for different monetary exercises. This makes business and pay to individuals of the country and adds to the public turn of events.

What are the benefits of bank deposits?

- An interesting store is a store with the bank where individuals have the arrangement to pull out the cash as and when they require it. Since the stores in the financial balances can be removed on request, these stores are called request stores.

- They go about as a mode of trade like cash. They comprise cash in the advanced economy. They are acknowledged broadly for installment via a cheque rather than cash.

” Types of cash have gone through a few changes since early times.” Elucidate.

- Before the presentation of coins, an assortment of articles is utilized.

- In the early ages, Indians involved grains and dairy cattle as cash. From there on came the utilization of metallic coins, for example, gold, silver, and copper coins. This was a stage that proceeded all the way into the last hundred years.

- Modern types of cash incorporate money — paper notes and coins. Dissimilar to the things that were utilized as cash before, present-day money isn’t made of valuable metals. The cutting edge cash is with no utilization of its own.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...