International Monetary Fund (IMF): Objectives and Functions

Last Updated :

06 Apr, 2023

What is International Monetary Fund(IMF)?

International Monetary Fund came into existence on 27th December 1945 and has its headquarters located in Washington DC, United States. It has 190 countries as its members as of December 2022. Its board is constituted of members from as many as more than 180 countries worldwide, thus each representing its own nation. Such representation is congruent to the level of importance a particular nation holds as regards to its financial position in the world.

The major idea underlying the setting up of IMF is to evolve an orderly international monetary system, thereby facilitating a system of international payments and adjustments in exchange rates among national currencies. Furthermore, its policies and practices aimed at bringing down the global poverty rate and promoting international trade, thus supporting the economies worldwide.

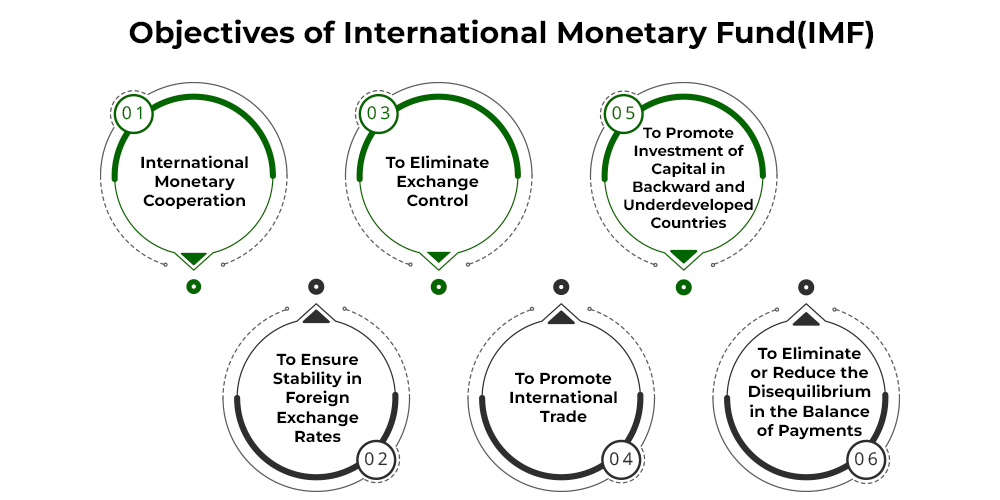

Objectives of International Monetary Fund(IMF)

The objectives of the International Monetary Fund are as follows:

- International Monetary Cooperation: The most important objective of the IMF was to establish monetary cooperation among the various member countries. One of the major causes of the Second World War was the absence of monetary cooperation amongst the countries of the world. Hence it was considered necessary to establish international monetary cooperation to prevent the outbreak of war in future.

- To Ensure Stability in Foreign Exchange Rates: There was a lot of instability in foreign exchange rates before the Second World War, which produced adverse repercussions on international trade. So, IMF was established to eliminate this instability of foreign exchange.

- To Eliminate Exchange Control: Every country has resorted to exchange control as a device to fix its exchange rate at a particular level before the Second World War, which produced adverse effects on international trade. So IMF came up to remove or relax these exchange controls.

- To Promote International Trade: Another important objective of the IMF was to promote international trade by removing all the obstacles and hindrances, which had the effect of restricting it.

- To Promote Investment of Capital in Backward and Underdeveloped Countries: IMF exports capital from the richer to the poorer countries so that the poor countries can develop their economic resources for achieving a higher standard of living.

- To Eliminate or Reduce the Disequilibrium in the Balance of Payments: IMF helps to reduce the disequilibrium in the balance of payments by selling or lending foreign currencies to the member nations.

Functions of International Monetary Fund

The functions of the International Monetary Fund are as follows:

- Stability in Foreign Exchange Rate: IMF helps to achieve stability in foreign exchange rates. The rates of exchange under the IMF had not fluctuated as much as they used to before the establishment of the IMF.

- Currency Reservoir: IMF serves as a repository for all of the member countries’ currencies, from which a borrowing nation may borrow funds from other countries. All member countries can park their surplus funds with the IMF. These parked funds are then utilized to extend credit to the members, which need funds the most at a given point of time.

- Advisory and Technical Assistance: IMF helps its member countries through its policy advice and technical assistance in formulating sound policies and building strong institutions.

- Support for Low-Income Countries: IMF provided help to its low-income members with policy advice, technical assistance and loans for poverty reduction and reducing the debt burden.

- Establishment of a Monetary Reserve Fund: IMF helps to establish monetary reserve by accumulating a sizeable stock of the national currencies of different countries. It is out of this stock that the Fund meets the foreign exchange requirements of the member countries.

- Setting up of a Multilateral Trade and Payment System: IMF helps to set up multilateral trade and payment system. Member countries were allowed to impose exchange control on commercial transactions, but it was hoped that these restrictions on foreign trade would be eliminated.

- Check on Competitive Currency Devaluation: For boosting exports, different countries of the world would often resort to competitive currency devaluation before the establishment of the IMF. IMF helps to keep a check on competitive currency devaluation.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...