Interest on Debentures

Last Updated :

16 Mar, 2023

A debenture can be described as a debt instrument issued by a company to the public in order to raise funds for medium or long-term usage. It is just like a bank loan, with debt obligation and liability for interest payment, but instead of borrowing from a bank, these are issued and traded in the capital market. A debenture is a legal document that states the amount invested or lent, interest due, and the repayment plan. At the conclusion of the term, the investor receives the principal and interest.

According to Section 2 (12) of the Indian Companies Act 1956, “A debenture is a document which either creates a debt or acknowledges it.”

Generally, debentures are issued with a fixed rate of interest, which is called the Coupon Rate. A debenture holder receives interest according to the coupon rate specified in the debenture certificate. The rate of interest on a particular debenture is specified before the name of such debenture as 8% debentures, 12% debentures, etc., and is always provided at the face value of the said debentures.

Interest on debentures is an expense and has to be paid irrespective of any profits in a particular financial year or not. It creates a charge against the profits of the organization and is thus, debited to the Profit & Loss Account.

Accounting Treatment of Interest on Debentures:

Case 1: Interest Accrued and interest due

Interest Accrued and interest due refers to a situation where interest has been accumulated up to a certain date and is also due for payment on that date itself. Say, a company pays interest on debentures half-yearly on 30th June and 31st December while closing its books on 31st December itself. In this case, whatever amount of interest is accrued from 1st July to 31st December, becomes immediately due for payment on 31st December and is recorded in the following manner:

Journal Entries:

1. When interest is due and tax is deducted at source(TDS):

2. On payment of debenture interest to the Debenture holder:

3. On Payment of tax deducted at source to the Government:

4. On transfer of debenture interest to Profit & Loss A/c at the end of the year

Illustration:

Madden Ltd. issued 6000, 12% debentures of ₹100 each at 10% discount on 1 January 2023. Madden Ltd. pays interest half yearly on 30th June and 31st December every year, TDS being 5%. The firm closes its books on 31st December. Pass the necessary Journal entries.

Solution:

Case 2: Interest accrued but not due

Interest Accrued but not due refers to a situation where interest has been accumulated up to a certain date but is not due for payment on that date itself. A company paying interest half-yearly on 30th June and 31st December while closing its books on 31st March has accumulated interest on its debentures from 1st January to 31st March, but is not yet liable to pay it until the next 30th June.

Journal Entries:

1. When interest is accrued but not due:

2. When interest is paid:

Illustration:

Ghariyal Ltd. issued 5000, 15% debentures of ₹100 each at 5% discount on 1 May 2022. It pays interest on debentures on 30th June and 31st December every year, TDS being 5%. Pass the necessary Journal entries, if the books are closed on 31 March every year.

Solution:

Working Notes:

1. Number of months from 1 May 2022 to 30 June 2022 = 2

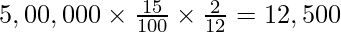

Interest =

2. Number of months from 1 July 2022 to 31 December 2022 = 6

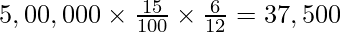

Interest =

3. Number of months from 1 Jan 2023 to 31 March 2023 = 3

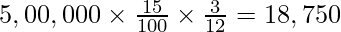

Interest =

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...