Chapter: Introduction

Net Investment = Gross Investment – Depreciation

Net Indirect Tax = Indirect Taxes – Subsidies

Market Price = Factor Cost + Net Indirect Taxes

OR

= Factor Cost + (Indirect Taxes – Subsidies)

Net Factor Income from Abroad = Factor income earned from abroad – Factor income paid abroad

OR

Net Factor Income from Abroad = Net Compensation of Employees + Net Income from Property and Entrepreneurship + Net Retained Earnings

National Income = Domestic Income + NFIA

Depreciation = Gross Value – Net Value

7. Leakages in Different Types of Economies

Leakages in Different Types of Economies |

|---|

| Two-Sector Economy (with Financial Market) | Savings |

| Two-Sector Economy (without Financial Market) | No Leakages |

| Three-Sector Economy | Savings + Taxes |

| Four-Sector Economy | Savings + Taxes + Imports |

8. Injections in Different Types of Economies

Injections in Different Types of Economies |

|---|

| Two-Sector Economy (with Financial Market) | Investment |

| Two-Sector Economy (without Financial Market) | No Injection |

| Three-Sector Economy | Investment + Government Expenditure |

| Four-Sector Economy | Investment + Government Expenditure + Exports |

Chapter: National Income Accounting

- Gross Domestic Product at Factor Cost (GDPFC)

GDPFC = GDPMP – Net Indirect Taxes

- Net Domestic Product at Market Price (NDPMP)

NDPMP = GDPMP – Depreciation

- Net Domestic Product at Factor Cost (NDPFC) or Domestic Income

NDPFC = GDPMP – Net Indirect Taxes – Depreciation

- Gross National Product at Market Price (GNPMP)

GNPMP = GDPMP + Net Factor Income from Abroad

- Gross National Product at Factor Cost (GNPFC)

GNPFC = GNPMP – Net Indirect Taxes

- Net National Product at Market Price (NNPMP)

NNPMP = GNPMP – Depreciation

- Net National Product at Factor Cost (NNPFC) or National Income

NNPFC = GNPMP – Net Indirect Taxes – Depreciation

2. Domestic Income

Income from Domestic Product accruing to Private Sector = NDPFC – Income from Property and Entrepreneurship accruing to Government Administrative Departments – Savings of Non-Departmental Enterprises

3. Private Income

Private Income = Factor Income earned (within domestic territory + from rest of the world) + Transfer Income received (within domestic territory + from rest of the world)

OR

= Income from Domestic Product Accruing to Private Sector + NFIA + Interest on National Debt + Current Transfers from Government + Net Current Transfer from Rest of the World

4. Personal Disposable Income

Personal Disposable Income = Personal Income – Personal Taxes Miscellaneous Receipts of Government

OR

= Personal Consumption Expenditure + Personal Savings

5. National Disposable Income

National Disposable Income = National Income + Net Indirect Taxes + Net Current Transfers from the rest of the world

OR

= National Consumption Expenditure + National Savings

6. Gross National Disposable Income

Gross National Disposable Income = Net National Disposable Income + Depreciation

- GDPMP using Value Added Method

∑GVAMP = GDPMP

Value Added = Value of Output – Intermediate Consumption

- Value of Output when the whole output is sold in a financial year

Value of Output = Sales

- Value of Output when the whole output is not sold in a financial year

Value of Output = Sales + Change in Stock

Change in Stock = Closing Stock – Opening Stock

Value of Output = (Quantity × Price) + Change in Stock

- National Income using Value Added Method

National Income or NNPFC = GDPMP – Depreciation – Net Indirect Taxes + NFIA

OR

= Domestic Income or NDPFC + NFIA

- GDPMP using Expenditure Method

GDPMP = ∑ Final Expenditure

∑ Final Expenditure = Private Final Consumption Expenditure (PFCE) + Government Final Consumption Expenditure (GFCE) + Gross Domestic Capital Formation (GDCF) + Net Exports (NX)

- Private Final Consumption Expenditure (PFCE)

PFCE = Household Final Consumption Expenditure + Non-profit Private Institutions Final Consumption Expenditure

- Government Final Consumption Expenditure (GFCE)

GFCE = Intermediate Consumption of Government + COE paid by Government +Direct purchases from abroad for embassies and consulates located abroad – Sale of goods and services produced by general government

- Gross Domestic Capital Formation (GDCF)

GDFC = Gross Fixed Capital formation + Inventory Investment

or

= Gross Business Fixed Investment + Gross Residential Construction Investment + Gross Public Investment + Inventory Investment

Net Exports = Exports – Imports or (X-M)

- National Income using Expenditure Method

National Income or NNPFC = ∑Final Expenditure or GDPMP – Depreciation – Indirect taxes + NFIA

OR

= Domestic Income or NDPFC + NFIA

Profit = Corporate Tax + Dividend + Retained Earnings

Operating Surplus = Rent + Royalty + Interest + Profit

or

= Value of Output – Intermediate Consumption – Compensation of Employees – Mixed Income – Consumption of Fixed Capital – Net Indirect Taxes

- National Income using Income Method

NNPFC = NDPFC + NFIA

Where,

NDPFC = Compensation of Employees + Profit + Rent & Royalty + Interest + Mixed income

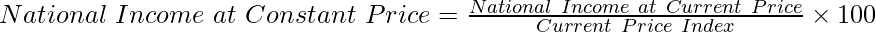

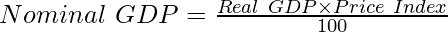

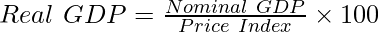

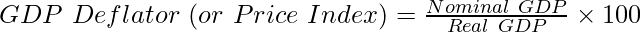

10. National Income at Constant Price

Chapter: Money and Banking

M1 = Currency and coins with public + Demand deposits of commercial banks + Other deposits with Reserve Bank of India

M2 = M1 + Savings Deposits with Post Office Saving Bank

M3 = M1 + Net Time Deposits with Banks

M4 = M3 + Total Deposits with Post Office Saving Bank

Chapter: Determination of Income and Employment

Aggregate Demand (AD) = C + I + G + (X – M)

= Private Consumption Expenditure + Investment Expenditure + Government Expenditure + Net Exports (Exports – Imports)

2. Aggregate Supply

Aggregate Supply (AS) or National Income (Y) = Consumption (C) + Saving (S)

3. Consumption Function

C = f(Y)

Where,

C = Consumption

f = Functional Relationship

Y = National Income

6. Saving Function

S = f(Y)

Where,

S = Saving

f = Functional Relationship

Y = National Income

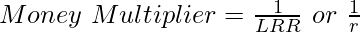

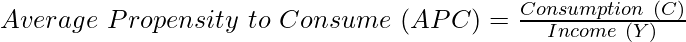

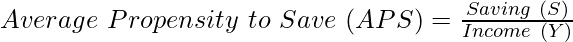

9. Relationship between APC ad APS

APC + APS = 1

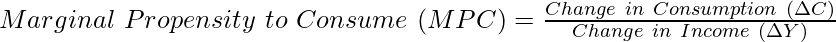

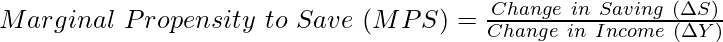

10. Relationship between MPC and MPS

MPC + MPS = 1

11. Values of APC, APS, MPC, and MPS

Value

| APC

| APS

| MPC

| MPS

|

|---|

Negative

(less than zero)

| APC can never be less than zero, because of the presence of

| APS can be less than zero when C>Y; i.e., before Break-even Point.

| MPC can never be less than zero, as  can never be more than can never be more than

| MPS can never be less than zero, as  can never be more than can never be more than

|

Zero

| APC can never be zero, because of the presence of

| APS can be zero when C=Y; i.e., at Break-even Point.

| MPC can never be zero, when

| MPS can never be zero, when

|

One

| APC can be one when C=Y; i.e., at BEP

| APS can never by one as savings can never be equal to income

| MPC can never be zero, when

| MPS can never be zero, when

|

More than One

| APC can be more than one when C>Y; i.e., before Break-even Point.

| APS can never be more than one as savings can never be more than income

| MPC can never be less than zero, as  can never be more than can never be more than

| MPS can never be less than zero, as  can never be more than can never be more than

|

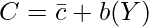

12. Equation of Consumption Function

Where,

C = Consumption

b = MPC

Y = Income

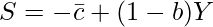

13. Equation of Saving Function

Where,

S = Saving

1-b = MPS

Y = Income

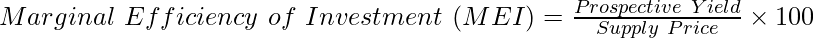

14. Marginal Efficiency of Investment (MEI)

15. Two Approaches for Determination of Equilibrium Level

- Aggregate Demand-Aggregate Supply Approach (AD-AS Approach): Equilibrium will be achieved when,

AD = AS

- Saving-Investment Approach (S-I Approach): Equilibrium will be achieved when,

S = I

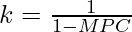

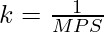

16. Investment Multiplier

OR

OR

The maximum value of the Multiplier is ∞ when MPC = 1

The minimum value of Multiplier is 1 when MPC = 0

Revenue Deficit = Revenue Expenditure – Revenue Receipts

Fiscal Deficit = Total Expenditure – Total Receipts (except borrowings)

OR

= (Revenue Expenditure + Capital Expenditure) – (Revenue Receipts + Capital Receipts excluding Borrowings)

OR

= (Revenue Expenditure – Revenue Receipts) + (Capital Expenditure – Capital Receipts excluding Borrowings)

OR

= Revenue Deficit + (Capital Expenditure – Capital Receipts excluding Borrowings)

Primary Deficit = Fiscal Deficit – Interest Payment

Balance of Trade = Exports of Goods – Imports of Goods

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...