Explain the working of Investment Multiplier.

Last Updated :

17 Mar, 2023

To understand the Working of Investment Multiplier, let us first understand the meaning of Investment Multiplier.

What is Investment Multiplier?

The term Investment Multiplier is an important contribution made by Prof. J.M. Keynes. Keynes felt that an initial rise in investment multiplies overall income by a large factor. The relationship between an initial increase in investment and the subsequent rise in total revenue is expressed by the multiplier. In reality, it has been seen that when investments are increased by a particular amount, the change in income does not only reflect the initial investment’s value but also increases by several times. In other words, a multiple of a change in investment equals a change in income. A multiplier explains how many times an increase in investment causes an increase in national income.

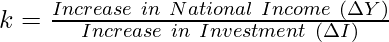

Hence, Multiplier (k) is the ratio of an increase in national income (ΔY) due to an increase in investment (ΔI).

Working of Multiplier

The principle of One person’s expenditure equals another person’s income explains how multiplier works. When you make an additional investment, your income rises many times faster than your investment. This can be understood with the help of an example:

- Consider that a ₹200 crore (ΔI) additional investment is made to build a road. This additional investment will result in an additional ₹200 crores in revenue in the first round.

- If MPC is taken to be 0.80, then those receiving this increased income will spend ₹160 crores, or 80% of ₹200 crores, on consumption, and the remaining amount will be saved. The second round will increase the revenue by ₹160 crores.

- In the next round, 80% of the extra income of ₹160 crores, or ₹128 crores, will be spent on consumption, with the remaining amount saved.

- The multiplier process will continue, and every round’s consumer expenditure will be equal to 0.80 times the extra income earned in the previous round.

To better understand this process, consider the table given below:

It can be concluded that an initial investment of ₹200 crores has resulted in a total increase of ₹1,000 crores in income.

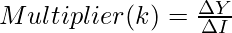

Thus, the multiplier will be,

k = 5

In the above graph, the X-axis represents income and the Y-axis represents Aggregate Demand. Assume that the initial equilibrium is established at point E, where the AD curve and AS curve intersects. OY is the equilibrium level of income. Assume that investment rises by ΔI, causing the new Aggregate Demand curve (AD1) to cross the Aggregate Supply curve (AS) at point ‘F’. As a result, OY1 is the new equilibrium level of income. Due to an initial increase in investment, the income increases from OY to OY1. The graph clearly shows that the income growth (YY1 or ΔY) is more than the investment growth (ΔI). Thus the value of the multiplier is provided by:

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...