Difference between Provisions and Reserves

Last Updated :

18 Apr, 2024

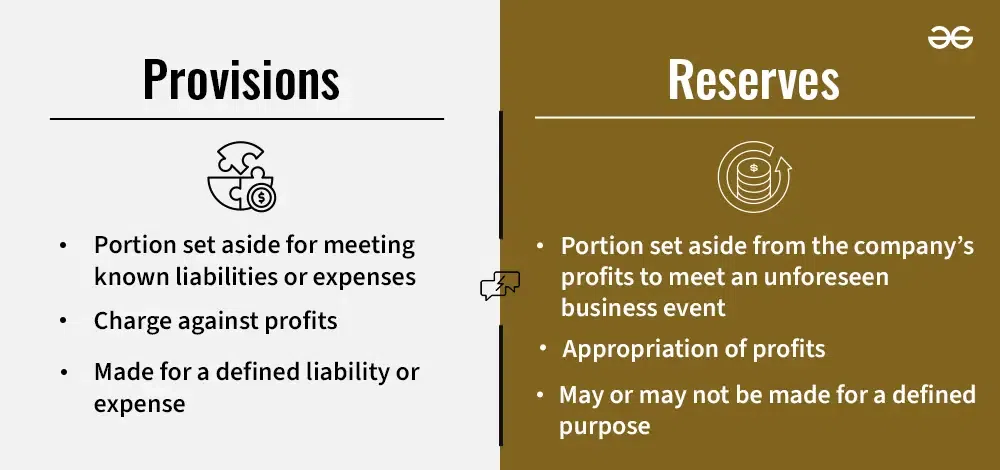

Preparation of Accounts in business firms is done by following the ‘Going Concern Concept’, which states that the firm will continue for a long period of time irrespective of everything. Keeping an eye on this, the profit of the firm is allocated in such a way that some amount of profit is kept for current and future contingencies. Provisions and Reserves are related to future needs of the business for which a part of the current year’s profit is set aside. There are some similarities, but both have their different purposes, tax treatment, and needs for a business. Both are very important for a business and have their own role to play in accounting.

What are Provisions?

Provisions are the present obligation (probability of occurrence is more than 51%) arising out of past events. Provision can be made by retaining the amount by way of providing for any known liability, the amount of which can not be determined accurately. It is a liability that can be measured only by using a substantial degree of estimation. It is an amount kept aside to cover the expenses that may occur in the future.

Example: As per the estimations, a firm believes that 20% of their Debtors may not pay their dues. So, the firm can make a provision for bad debts in the books to cover them.

It is shown as a current liability on the liabilities side of the balance sheet and recorded as expenses in the income statement. Provisions are tax-deductible expenses, which means that while calculating profit before tax (PBT), it should be taken as an expense. While making cash flows, provisions should not be taken as there is no cash outflow/inflow. Examples of provisions are Provision for Depreciation, Provision for Doubtful Debts, Provision for Taxation, Provision for repairs, etc.

What are Reserves?

Reserves are the amount kept aside from a company’s profits for specific purposes or unknown liability in the future, like buying a fixed asset, repayment of debentures, payment of dividends, etc., and also for general purposes as General Reserve. It is an appropriation of profit, and not a charge against profit. Reserves are a part of the owner’s capital/shareholder’s fund, and hence profit is not reduced by making any reserve.

It can also be said as a portion of available earnings that business firms keep aside to meet any sort of financial contingencies. Examples of reserves are General Reserve, Reserve for Expansion, Dividend Equalisation Reserve, Debenture Redemption Reserve, Investment Fluctuation Reserve, etc.

Reserves are mainly of two types-

1. Revenue Reserves: It is also known as Retained Earnings. It is made from the amount kept aside from the revenues of a business, which are primarily the earnings through primary operations of a business. It is majorly used for paying dividends to shareholders and expansion of business. Revenue Reserves are further classified into two categories:

(A) Specific Reserves: Specific reserves are created to meet some specific requirements of the business, and they can only be utilized for that purpose. Example: Debenture Redemption Reserve, Reserve for Asset replacement, etc.

(B) General Reserve: General Reserve is created from the retained earnings of the business for general purposes. These reserves are not created for any specific purposes. They are also called Free Reserves or Contingency Reserves.

2. Capital Reserves: Apart from the profit earned by business firms from their day-to-day work, they also earn money from other sources, which are not recurring in nature. Those incomes are termed capital earnings. Capital Reserves are created from the capital earnings of the company. Unlike revenue reserves, capital reserves cannot be distributed to shareholders as dividends. It is created as per the Companies Act, 2013 and the act lays down the areas where it can be utilised.

Difference between Provisions and Reserves

|

Basis

|

Provisions

|

Reserves

|

| Meaning |

The portion set aside for meeting known liabilities or expenses whose probability is certain. |

The portion set aside from the company’s profits to meet an unforeseen business event. |

| Nature |

It is a charge against profits, which means that they are created even if there is no profit. |

It is an appropriation of profits, which means that they are only created when the company is profitable. |

| Objective |

Provisions are always made for a defined liability or expense. |

Reserves may or may not be made for a defined purpose. Example- Debenture Redemption reserve/General reserve. |

| Purpose |

Provisions are created to meet a specific liability and fulfill the requirement of the law. |

Reserves are made to give strength to the financial position of the company. |

| Mode of Creation |

It is created by debiting Profit and Loss Account. |

It is created by debiting Profit and Loss Appropriation Account. |

| Necessity |

It is mandatory to create provisions as per various laws. |

It is not mandatory to create reserves. They are only created when the company has surplus profits. |

| Payment of Dividend |

Dividends cannot be paid from provisions. |

Dividends can be declared and paid from reserves to the shareholders. |

| Presentation in Balance Sheet |

They are always shown on the liabilities side as a current liability or reduced from the concerned asset for which it is made. |

Reserves are shown under the head of ‘Reserve and Surplus’ as the Owner’s Capital/Shareholders’ Fund on the liability side of the balance sheet. |

| Investment |

The amount of provision can never be invested outside the business. |

The amount of reserve can be invested outside the business, as in case of Debenture Redemption Reserve Investment |

| Utilisation |

Provisions can only be used for the specific purpose for which they are created. |

Reserves can be used to meet any unknown loss or liability. |

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...