Difference between Audit and Review

Last Updated :

05 Jan, 2024

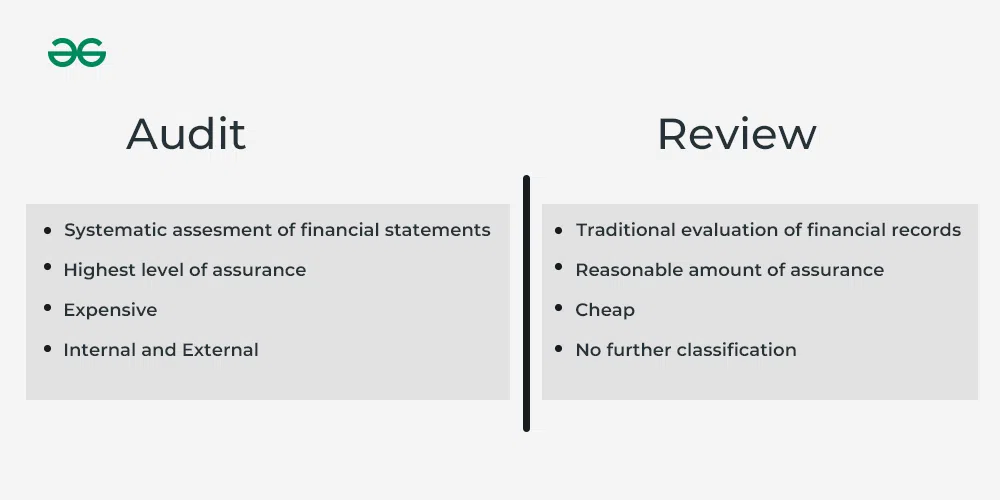

Review often comes in contrast with audit, but they are different in the sense that, an Audit thoroughly examines the financial information of an organization to give their opinion on the same. On the other hand, Review implies the formal assessment of the financial statement to introduce changes, if any.

Every organization deals with several things like buying, selling, borrowing, investing, etc. In these, a lot of money is involved in the form of various transactions. All these transactions are recorded properly, which requires a lot of paperwork. This paperwork or recording of transactions in the financial statement is then analyzed with the help of Audit and Review. Audits and Reviews are used by almost all organizations to have an analysis of their financial position and procedures.

What is Audit?

Audit means analyzing the financial status of any organization by assessing all the operations, records, and financial statements. An audit helps in tracking the financial situation of the company by which a company can plan its future goals accordingly. It helps in minimizing the risk of fraud and cut unnecessary costs. It helps an organization to gain confidence about the financial situation as it involves a detailed analysis of all the paperwork involved containing the financial accounts of any business. It is a critical process that determines a company’s strong and weak financial points.

There are two main aims for performing an audit:

- To check if the financial statements are correct and reflect the real financial situation of the organization.

- To check for forgeries, fraud, and mistakes in the financial accounts.

What is Review?

Review means conventional evaluation of financial procedures. A review can be defined as the evaluation of the financial records to check if there is any chance for a modification. This method of assessment is appropriate mostly for small companies, which operate on limited capital. Its scope is narrow as compared to auditing. Review can be done without getting any information about the internal governing structure of the organization. It is limited in nature as it does not provide the highest level of assurance, and it is only done for business evaluation to make required changes if needed.

There are two main aims for performing a review:

- To inquire about or discuss the trends and ratios extracted from the financial records of the company with the employees.

- To take corrective actions if necessary.

Difference between Audit and Review

| Meaning |

It is a process of assessment of financial operations and statements to get an idea of the financial status of the company. |

It is a traditional evaluation process of financial operations and records to implement changes if needed. |

| Emphasis |

The emphasis in Audit is on the examination and verification of financial statements and accounting records. |

The emphasis in Review is given to over-viewing of the accounting records. |

| Cost |

An audit is comparatively more costly than a review as it is a detailed process performed by professionals. |

Review is less costly as it does not involve deep analysis done by professionals. |

| Requirement |

A Certified Public Accounting Firm is needed to conduct the audit. |

It does not require any registered firm to conduct the review. |

| Assurance |

It provides the highest level of assurance. |

It does not provide a reasonable amount of assurance. |

| Categories |

An Audit can be of two types; Internal and External. |

Review is not divided into any further categories. |

| Margin of Error |

The audit has a very less chance of error, and it involves examination and deep verification. |

The review has a high chance of error as it is only concerned with over-viewing. |

| Information Needed |

Knowledge about internal controls of the company is required to conduct an Audit. |

Knowledge about internal controls of the company is not required to conduct the review process. |

| Need |

Generally, banks, creditors, and investors that want assurance need an Audit. |

It is suitable for small companies that want limited assurance provided in the report. |

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...