Data Mining For Financial Data Analysis

Last Updated :

23 Feb, 2022

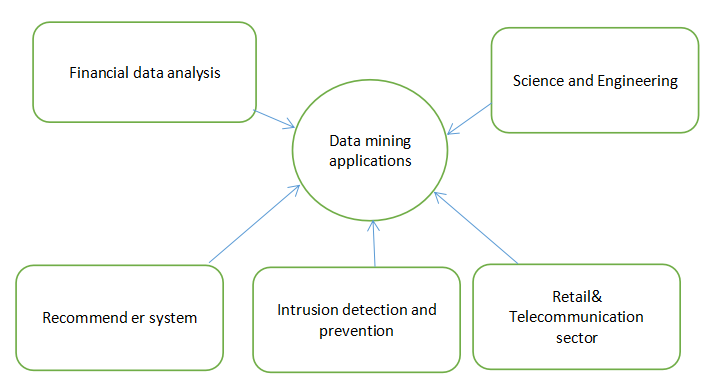

Data Mining is a quite strong field to execute advanced examination of data as well as it carries off techniques and mechanisms from statistics and machine learning. Business intelligence and advanced analytics applications use the information which is generated by it which involves the analysis of verified data.

Financial analysis of data is very important in order to analyze whether the business is stable and profitable to make a capital investment. Financial analysts focus their analysis on the balance sheet, cash flow statement, and income statement.

Data mining techniques have been used to extract hidden patterns and predict future trends and behaviors in financial markets. Advanced statistical, mathematical and artificial intelligence techniques are typically required for mining such data, especially the high-frequency financial data.

Benefits of Data Mining for financial data analysis:

- Efficient

- Effective

- Accurate

- Scalable

- Economical(Affordable)

Data Mining techniques related to finance can be utilized on categories which are given below:

- Peak Sales

- Gross Profit and Net Sales

- Stockpile

Instances/Examples:

- Financial risk models built using data mining tools by banks and credit card companies.

- Data mining also plays an important role in marketing(like detecting fraud, financial applications).

Data mining can help in the following fields:

- Detection of money laundering and other financial crimes: Money laundering is a criminal activity to convert black money into white money. In today’s world, data mining approaches have been developed in such a way that it considered appropriate techniques for identifying money laundering. The methodology of data mining presents an approach for bank clients in order to identify or to check the identification of the anti-money laundering effect.

- Loan payment prediction and customer credit policy analysis: Loan Distribution is the fundamental part of the business of every bank. The loan Prediction system automatically calculates the size of the features which is used in it and also tests data concerning its size. So data mining helps in it with managing all the vital data and their large databases with help of its models.

- Classification and clustering of customers for targeted marketing: The data mining approaches along with marketing work together to target a specific market, they also support and decide market decisions. With data mining, it helps retain profits, margin, etc and decide which product is best for different kinds of a costumer.

- Design and construction of data warehouses for multidimensional data analysis and data mining: The organization manages to recover or transfer the data into various large data warehouses, so different approaches or ways of data mining help a large amount of data that can be analyzed properly as well as accurately. It also checks a huge amount of transactions.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...