Economics (Code No. 58/5/1)

Time allowed : 3 hours

Maximum Marks: 80

General Instructions:

Read the following instructions very carefully and strictly follow them :

(i) This question paper comprises two sections – A and B. All questions are compulsory.

(ii) Question numbers 1 – 10 and 18 – 27 are very short-answer questions carrying 1 mark each. They are required to be answered in one word or one sentence each.

(iii) Question numbers 11 – 12 and 28 – 29 are short-answer questions carrying 3 marks each. Answers to them should not normally exceed 60 – 80 words each.

(iv) Question numbers 13 – 15 and 30 – 32 are also short-answer questions carrying 4 marks each. Answers to them should not normally exceed 80 – 100 words each.

(v) Question numbers 16 – 17 and 33 – 34 are long answer questions carrying 6 marks each. Answers to them should not normally exceed 100 – 150 words each.

(vi) Answers should be brief and to the point. Also, the above word limit is adhered to as far as possible.

(vii) There is no overall choice. However, an internal choice has been provided in 2 questions of one mark, 2 questions of three marks, 2 questions of four marks, and 2 questions of six marks. Only one of the choices in such questions has to be attempted.

(viii) In addition to this, separate instructions are given with each section and question, wherever necessary.

Section – A

(Macroeconomics)

1. In order to control the money supply in the economy, the Central Bank may ________. (Choose the correct alternative)

(A) buy securities in the open market

(B) sell securities in the open market

(C) reduce cash reserve ratio

(D) reduce repo rate

Answer: (C) reduce cash reserve ratio

2. _______ deficit includes interest payment by the Government on past loans. (Fill up the blanks with correct answer)

Answer: Primary

3. State, whether the following statement is true or false:

‘Inventory is a stock variable.’

Answer: True

Inventory is a stock variable since it is calculated at a certain moment in time rather than across a period of time.

4. Which of the following is NOT a ‘factor payment’? (Choose the correct alternative)

(A) Free uniform to defense personnel.

(B) Salaries to the Members of Parliament.

(C) Rent paid to the owner of a building.

(D) Scholarship given to the students.

Answer: (d) Scholarship given to the students.

5. In case of an underemployment equilibrium, which of the following alternative is NOT true? (Choose the correct alternative)

(A) Aggregate demand is equal to Aggregate supply.

(B) There exists excess production capacity in the economy.

(C) Resources are not fully and efficiently utilised.

(D) Resources are fully and efficiently utilised.

Answer: (d) Resources are fully and efficiently utilised

6. State, whether the following statement is true or false:

‘All financial Institutions are banking institutions.’

Answer: False.

Financial Institutions also include a broad range of business operations within the financial services sector such as trust companies, banks, investment dealers, brokerage firms, and insurance companies.

7. Combined factor income, which can’t be separated into various factor income components is known as ________. (Fill up the blanks with the correct answer)

Answer: mixed income of self employed

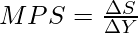

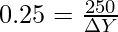

8. If the Marginal Propensity to Save (MPS) is 0.25 and the initial change in investment is 250 crores, then the final change in income would be ______. (Choose the correct alternative)

(A) 1,000 crores

(B) 1,200 crores

(C) 500 crores

(D) 3,500 crores

Answer: (a) ₹1,000 Crores

Change in Income = ₹1,000 Crores

9. Define the term ‘Public Goods’.

Answer: The goods or services which are consumed collectively are known as public goods. Excluding anyone from the enjoyment of public goods’ or services’ benefits is not possible. Also, if an individual consumes public goods, it does not reduce the availability of goods or services to others.

10. Net Domestic Fixed Capital Formation + Change in Stock = _________. (Fill up the blank with the correct answer)

Answer: Net Domestic Capital Formation

OR

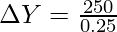

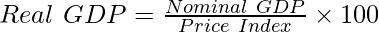

When the Nominal Gross Domestic Product (GDP) is ₹840 crores and the price Index is 120, then the Real Gross Domestic Product (GDP) will be ________.

(a) 700 crores

(b) 900 crores

(c) 800 crores

(d) 500 crores

Answer: (a) ₹700 Crores

Real GDP = ₹700 Crores

11. ‘Subsidies to the producers, should be treated as transfer payments.’

Defend or refute the given statement with a valid reason.

Answer:A transfer payment is a one-way payment made to an individual or group without any exchange of goods or services. Contrast this with a straightforward “payment,” which in economics is a money transfer in return for a good or service. In general, payments made by the government to people through social programs like welfare, student loans, and even Social Security are referred to as “transfer payments.”

The statement ‘Subsidies to the producers, should be treated as transfer payments’ is supported by the fact that subsidies are transfer payments. Governmental financial support given to producers to further their goals for social welfare is known as a subsidy. The government receives nothing in exchange for the same. It doesn’t contribute to the present flow of goods and services, and as a result, it doesn’t provide any value.

OR

Explain circular flow of income in a two sector economy.

Answer: The circular flow of income is an economic model that reflects how money or income flows through the different sectors of the economy. A simple economy assumes that there exist only two sectors, i.e., Households and Firms. Households are consumers of goods and services and the owners of the factors of production (land labour, capital, and enterprise). However, the firm sector produces goods and services and sells them to households.

Circular Flow in a Two-sector Economy (with Financial Market)

In the circular flow of an economy in a two-sector model without the financial market, it is assumed that no savings are made in the economy. It means that the households spend their entire income on the purchase of goods and services and every firm spends all the receipts from the sale of goods and services to make factor payments.

However, it does not happen in the actual world, i.e., households do not spend their entire income on the consumption of goods and services. Instead, they save a part of their income for the future. In the same way, the firms save some part of their receipts for the expansion of business or various other reasons. Besides, the firms also borrow money from outside to finance their expansion plans. All of these savings and borrowings happening in the economy are channelised through the financial market. Therefore, in a two-sector economy, the savings made by households accumulated in the financial market are used by the firms for investment purposes.

Financial Market refers to those institutions like insurance companies, banks, etc., which transacts loanable funds in the economy.

This concept can be better understood with the help of the following diagram:

12. Calculate Gross Value Added at Market Price :

Answer: The value added by each production company is also called Gross Value Added at Market Price (GVAMP).

Gross Value Added at Market Price (GVAMP) = Value of Output – Intermediate Consumption

or

= Sales + Change in Stock – Intermediate Consumption

In the given question domestic sales and exports are given separately; therefore, we will add them to obtain Sales value.

Hence, Gross Value Added at Market Price will be,

Gross Value Added at Market Price (GVAMP) = (Domestic Sales + Exports + Change in Stock) – Single Use Producer Goods

= [200 + 10 + (-10)] – 120

= 200 – 120

GVAMP = ₹80 Lakhs

13. ‘Taxation is an effective tool to reduce the inequalities of income.’

Justify the given statement with valid reasons.

Answer: The term taxation refers to the process through which a taxing body, often a government, charges or imposes a monetary obligation on its people or citizens. Since the dawn of civilisation, paying taxes to governments or authorities has been a fundamental social institution.

All involuntary taxes, including income, capital gains, and inheritance taxes, are referred to as taxation in this context. Even though it may be a verb or a noun, taxation is most often thought of as an action, and the resulting income is typically referred to as taxes.

The comment that is made is suitable. Richer people may be subjected to greater taxes from the government (direct and indirect taxes), which would have a negative impact on their purchasing power. The government may use the same tax money to help the less fortunate members of society by giving them access to products and services (for free or at a reduced cost).

14. In the given figure, what does the gap ‘KT’ represent? State and discuss any two fiscal measures to correct the situation.

Answer: In the above-given Income and Aggregate Demand graph, KT represents the inflationary gap.

An inflationary Gap is a gap by which the actual aggregate demand exceeds the aggregate demand required for the establishment of full employment equilibrium. This gap or excess demand happens due to the rise in money supply and availability of credit at easy terms. The inflationary gap can occur because of various reasons such as a rise in the propensity to consume, reduction in taxes, increase in investment, increase in government expenditure, deficit financing, etc.; and can have an impact on the output, employment, and general price level.

The fiscal measures (fiscal measures or policies are the measures of the Central Government) to correct the situation of inflationary gap or excess demand are as follows:

- Decrease in Government Spending: Government spends a huge amount of money on infrastructural and administrative activities. To control the situation of inflationary gap, it should reduce its expenditure to the maximum possible limit. It should give more emphasis on the reduction of expenditure on defense and unproductive works. It is because expenditure on these activities rarely helps in the growth of a country. Hence, a reduction in government spending will reduce the level of aggregate demand in the economy and will ultimately help in correcting inflationary pressures in the economy.

- Increase in Taxes: When there is an inflationary gap, the Government increases the tax rates and even imposes some new taxes to reduce the level of aggregate expenditure in the economy. The rise in taxes ultimately helps in controlling the situation of excess demand or inflationary gap.

For Visually Impaired Candidates:

What is meant by deflationary gap? State and discuss any two fiscal measures to correct the situation of deflationary gap.

Answer: When the planned aggregate expenditure of an economy falls short of aggregate supply at the full employment level, the situation of deficient demand rises, which as a result gives rise to a deflationary gap. Hence, the deflationary gap is a gap by which the actual aggregate demand of an economy falls short of the aggregate demand required for the establishment of full employment equilibrium. The deflationary gap can occur because of various reasons such as a decrease in the propensity to consume, an increase in taxes, a rise in imports, a fall in investment expenditure, a decrease in government expenditure, etc., and can have an impact on the output, employment, and general price level.

The situation of deflationary gap happens because of a decrease in the money supply and availability of credit. The fiscal measures (fiscal measures or policies are the measures of the Central Government) to correct the situation of deflationary gap or deficient demand are as follows:

- Increase in Government Spending: Government spends money on infrastructural and administrative activities. To control the situation of deflationary gap, it should increase its expenditure on different public works such as the construction of flyovers, buildings, roads, etc., so that it can provide income to people hired for these public works. Hence, an increase in government spending will increase the level of aggregate demand and will ultimately help in correcting the situation of deflationary gap or deficient demand.

- Decrease in Taxes: When there is a deflationary gap, the Government decreases the tax rates and even abolishes some of the existing taxes. The decrease in taxes raises the purchasing power of people which as a result increases their disposable income, increasing their ability to spend more on investment and consumption. Hence, a decrease in taxes raises the level of aggregate demand and helps in controlling the situation of deflationary gap or deficient demand.

OR

Explain how the ‘Reverse Repo Rate’ helps in correcting excess demand in an economy.

Answer: Reverse Repo Rate is the exact opposite of repo rate. It means that Reverse Repo Rate is the rate at which the Reserve Bank of India borrows money from commercial banks. RBI borrows money from commercial banks when it feels that there is an excess money supply in the banking system of the country. Besides, banks also happily lend money to the central bank as their money is in safe hands and they also get a good interest rate.

To solve the problem of excess demand, the central bank can increase the reverse repo rate. An increase in the reverse repo rate induces commercial banks to transfer more money to RBI because of the attractive interest rates. Because of this, there will be a reduction in the credit-creating ability of commercial banks. Also, there will be a reduction in the consumption expenditure and investment expenditure, resulting in a reduction in Aggregate Demand.

15. Discuss the function of the Central Bank as a ‘Banker, Agent, and Advisor’ to the Government.

Answer: A central bank is a financial institution that is responsible for managing a country’s monetary policy and overseeing the banking system. It acts as the main regulator of the money supply and interest rates and plays a key role in promoting economic stability and growth. Central banks are typically independent of the government and have specific powers and responsibilities granted by law. One of the major functions of the Central Bank is that it acts as a Banker, Agent, and Advisor to the Government.

The Reserve Bank of India (Central Bank) acts as an agent, banker, and financial advisor to the Central Government and all the State Governments. As a banker, the Central bank carries out every banking business of the government, such as:

- To keep the cash balances of the Central and State Governments, the Central Bank maintains a current account.

- It accepts receipts and makes payments for the government and also carries out exchange, remittance, and other banking operations of the Central and State Governments.

- Ultimately, it gives loans and advances to the government for temporary periods. The government sells its treasury bills to the Central Bank in order to borrow money.

As an agent, the Reserve Bank of India (Central Bank) is responsible for the management of public debt.

As a financial advisor, it gives advice to the government from time to time on financial, monetary, and economic matters.

16. (a) Differentiate between the concepts of ‘demand for domestic goods and services’ and ‘domestic demand for goods and services’.

(b) Distinguish between ‘Current Account Deficit’ and ‘Current Account Surplus’.

Answer:

(a) Demand for domestic products and domestic demand for goods have comparable meanings in a closed economy. However, the terms demand for domestic products and services and domestic demand for goods and services have different meanings in an open economy. Demand for domestic products encompasses both internal and international demand. While domestic demand for products refers to the domestic market demand of a country, which may be met by local or foreign production (foreign countries).

The overall demand for products produced in both home and international nations is the total demand for goods produced domestically. While domestic demand is the total domestic demand for both domestic and imported products.

(b) Current Account Deficit (CAD): A situation when the current account’s receipts are less than its payments is known as Current Account Deficit. Simply put, this situation arises when the value of exports of goods and services is less than the value of imports of goods and services.

Current Account Surplus (CAS): A situation when the current account’s receipts are more than its payments is known as Current Account Surplus. Simply put, this situation arises when the value of exports of goods and services is more than the value of imports of goods and services. (The goods and services here consist of visible items, invisible items, and unilateral transfers.)

Difference between Current Account Deficit and Current Account Surplus:

Basis

| Current Account Deficit

| Current Account Surplus

|

|---|

| Meaning | A situation when the current account’s receipts are less than its payments. | A situation when the current account’s receipts are more than its payments. |

| Significance | Current Account Deficit signifies that the nation is a borrower from the rest of the world. | Current Account Surplus signifies that the nation is a lender to the rest of the world. |

17. Answer the following questions based on the data given below:

(i) Planned Investments = ₹100 crore.

(ii) C = 50 + 0.50 Y

(a) Determine the equilibrium level of income.

(b) Calculate the value of Savings at equilibrium level of National Income.

(c) Calculate the value of Investment Multiplier.

Answer: a) Keynesian theory says that in an economy, the equilibrium level of income is determined when the aggregate demand (represented by C + I curve) is equal to the aggregate supply (represented by C + S curve).

Aggregate Demand consists of two components; viz., Consumption Expenditure (C) and Investment Expenditure (I). The consumption expenditure varies directly with the income level; however, the investment expenditure is assumed to be independent of the income level.

Aggregate Supply refers to the total output of national income’s goods and services and is depicted by a 45° line.

In the given question, the planned investment is ₹100 Crores, and C = 50 + 0.5Y. Therefore the equilibrium level of income will be,

Y = C + I

Y = (50 + 0.5Y) + 100

Y = 150 + 0.5Y

Y – 0.5Y = 150

0.5Y= 150

At equilibrium, Y = ₹300 Crores

b) The saving and consumption expenditure at the equilibrium level of National Income will be,

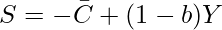

Saving Expenditure:

S = -50 + (1-0.5)300

S = -50 + (0.5 x 300)

S = -50 + 150

S = ₹100 Crores

Consumption Expenditure:

Y = C + S

300 = C + 100

C = ₹200 Crores

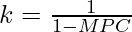

c) According to Keynes, an initial increment in the investment increases the final income by many times, and the relationship between an initial increment in investment and the resulting increase in the aggregate demand is expressed through a multiplier; i.e., Investment Multiplier.

Multiplier (k) is the ratio of an increase in the national income because of an increase in the investment. It can also be calculated with the help of MPC as there is a direct relationship between MPC and the value of multiplier, which is ‘Higher the MPC, more will be the value of the multiplier’. The formula for calculating k with the help of MPC is:

k = 2

OR

Discuss the working of the adjustment mechanism in the following situations:

(A) If Aggregate demand is greater than Aggregate supply.

(B) If Ex-Ante Investments are less than Ex-Ante Savings.

Answer:

a) Aggregate Demand refers to the total demand for finished goods and services in the economy over a specific period. It also refers to a country’s Gross Domestic Product (GDP) demand. Aggregate Supply is the total supply of finished goods and services in the economy over a specific period. When the planned spending of an economy; i.e., Aggregate Demand is more than the planned output; i.e., Aggregate Supply, then the AD (C + I) curve lies above the 45° line. It would mean that the consumers and firms collectively would be buying more goods than the willingness of the firms to produce. Because of this, the planned inventory of the firms would fall below the desired inventory level.

For bringing back the inventory to the desired level, the firms would resort to increase in employment and output until the economy gets back at output level OY, where AD ultimately becomes equal to AS and there is no more tendency to change.

b) When Ex-ante investments is less than ex-ante savings, it means that the buyers are planning to buy less than the output planned by producers for production resulting in unplanned inventories. In that situation, the producer reduces employment resulting in reduced output and income until the two forces; i.e., Ex-ante Savings and Ex-ante Investments become equal.

Section – B

(Indian Economic Development)

18. Policy of ‘Import Substitution’ was targeted to protect ______ industries. (Fill up the blank with the correct answer)

Answer: domestic

19. Which of the following is not used as a strategy for Sustainable Development?

(a) Use of bio-gas

(b) Use of solar power

(c) Use of thermal power

(d) Use of hydel power

Answer: (c) Use of thermal power

20. Maternal Mortality Rate is high in ________ (China/Pakistan). (Fill up the blank with the correct alternative)

Answer: Pakistan

21. State the meaning of ‘Marketed Surplus’.

Answer: Marketed Surplus is that portion of the agricultural produce which is sold by the farmers in the market. Simply put, it is the difference between the total output produced by the farmers and their self-consumption from that output.

Marketed Surplus = Total farm output produced by a farmer – Own Consumption of farm output

OR

State the meaning of ‘Subsidy’.

Answer: A subsidy is a benefit provided to a person, company, or institution, typically by the government. Either direct (like monetary payments) or indirect (such as tax breaks). The subsidy is often provided to reduce some sort of hardship and is frequently seen as being in the best interests of the general public because it supports a social good or an economic policy.

22. State, whether the following statement is true or false:

“As per the Human Development Report, 2018, India was ranked at 180th position.”

Answer: False.

As per the Human Development Report, 2018, India was ranked at 129th position.

23. If a construction site Manager hires two workers on a daily wage basis, such a situation is covered under ______ (formal/informal) sector. (Fill up the blank with the correct alternative)

Answer: informal

24. Which of the following countries initiated its process of Economic Reforms in the year 1991? (Choose the correct alternative)

(a) Pakistan

(b) India

(c) Russia

(d) China

Answer: (b) India

25. Greater proportion of women workers are found in ______ (urban/rural) areas as a component of the Indian workforce. (Choose the correct alternative)

Answer: Rural

26. State, whether the following statement is true or false:

“GATT was established in 1923 with 48 member countries.”

Answer: False.

GATT (General Agreement on Tariffs and Trade) was established on 30 October 1947, signed by 23 nations.

27. ‘GLF’ with respect to the People’s Republic of China is referred to as ______. (Choose the correct alternative)

(a) Giant Leap Forward

(b) Great Lead Forum

(c) Great Leap Forward

(d) Giant Lead Forum

Answer: (c) Great Leap Forward

28. Discuss briefly the concept of ‘Informalisation of workforce’ in India.

Answer: In recent years there has been unprecedented growth in the informal and unorganised sectors of India. Here, almost the whole agricultural sector and a large part of industrial and service sector units fall under the category of the informal sector. People employed in this sector are generally not entitled to get regular salary and other social security benefits. Therefore, Informalisation of the Workforce refers to a situation where the workforce in the informal sector increases to the total workforce of the country. According to the composition of the workforce in India, it has been divided into two categories; Formal or Organised Sector and Informal or Unorganised Sector. The Formal Sector consists of jobs that have specific working hours and fixed wages; whereas, the Informal sector is where the workers or employees don’t have fixed working hours and wages.

Besides, after keeping in view the growth of the informal sector and the various disadvantages attached to it, in recent times, the Indian Government has initiated its modernisation and provision of social security measures to the workers.

OR

State any three challenges facing rural development in India.

Answer: Rural Development is a continuous and comprehensive socio-economic process that attempts to improve all aspects of rural life. The challenges facing rural development in India are as follows:

1. Development of Human Resources: It is essential to improve the quality of human resource. It can be done by giving proper attention to better health facilities and literacy.

2. Development of Infrastructure: The infrastructure also needs improvement in electricity, credit, marketing, irrigation, and transport facilities.

3. Land Reforms: Land reforms consist of four things; viz., elimination of exploitation in land relations, increasing agricultural productivity, actualisation of the goal of land to the tiller, and improvement of socio-economic conditions of rural poor.

29. Compare and analyse the given data of India and China with valid reasons :

Answer: The given table related to the data of India and China shows the following aspects of its population growth and sex ratio:

- The annual growth rate of the population in China is less (0.5%) than the growth rate in India (1.2%) because of the “One Child Policy” in China. India too wanted to spread awareness among people related to family planning measures, but the decreasing rate of population is China is more than the decreasing rate in India.

- The number of females per 1000 males in India is less (929) than the number of females per 1000 males in China (941). It is because in India people prefer a son (male) as their child instead of a daughter (female).

30. Discuss briefly any two major steps taken by the Government of India on the ‘Financial Sector’ front under the Economic Reforms of 1991.

Answer: Two major steps taken by the Government of India on the ‘Financial Sector’ front under the Economic Reforms of 1991 were:

1. Change in the role of the Reserve Bank of India (RBI): A change in the RBI’s function transformed it from regulator to financial industry facilitator. This indicates that the financial sector now has more freedom to decide on a variety of issues without interference from the RBI. The Reserve Bank of India, the nation’s premier bank, took on the role of facilitator.

2. Origin of Private Banks: As a result of the reform process, both Indian and foreign private sector banks were established. Many participants grabbed the chance to compete with public sector banks as soon as the private sector’s banking industry arose. This resulted in the development of advantageous competition and the growth of the service industry for the benefit of customers.

31. Discuss briefly any two salient features of India’s pre-independence occupational structure.

Answer: Distributing working people across primary, secondary, and tertiary sectors of the economy is known as Occupational Structure. The primary sector consists of production units that exploit natural resources like water, land, etc. For example, mining, fishing, forestry, etc. The secondary sector consists of production units that transform one good into another good. For example, construction companies, power generation companies, etc. The tertiary or service sector consists of production units that are engaged in producing services. For example, finance, education, transport, etc.

The salient features of the occupational structure of India on the eve of Independence are as follows:

- Predominance of Primary Occupation: Largest share of the workforce; i.e., 70-75% were found in the agricultural sector. However, the manufacturing and service sector accounted for 10% and 15-20% respectively.

- Regional Variation: On the eve of independence, regional variation was growing. There was a decline in the dependence of the workforce on the agricultural sector in the states of Andhra Pradesh, Tamil Nadu, Karnataka, Kerala, West Bengal, and Maharashtra. However, the increase in the manufacturing and service sectors in these states was good. Also, during the same time, the share of the workforce in the agricultural sector in the states of Orissa, Punjab, and Rajasthan increased.

OR

DDiscuss briefly, the rationale behind “equity with growth” as planning objectives for Indian Economy.

Answer: Growth refers to an increase in the production capacity of goods & services of an economy. Simply put, the growth implies:

- Either a large size of supporting services like banking and transport;

- Or a larger stock of productive capital;

- Or an increase in the efficiency of productive capital & services.

Other goals focused on the development of the economy only. But only economic development is not sufficient. The five-year plan must focus on the development of society also. Equity concentrates on ensuring that all citizens of the nation have their basic needs for clothing, food, and shelter properly met. It also tries to reduce the inequality and wealth gap in society. In short, equity aims at raising the standard of living of people and promoting social justice.

32. State and discuss any two problems faced by the power sector in India.

Answer: Electricity or Power is a critical component of infrastructure and is often identified with the progress in modern civilization. During the last four decades of planning, Power development in India has been significant; however, power generation is still insufficient as compared to the required power. Because of this, in recent years, India is facing a serious power crisis. Some of the problems faced by the power sector in India are as follows:

- Inadequate Electricity Generation: The installed capacity of India to generate electricity is not enough to feed an annual economic growth of 7-8%. It is only able to add 20,000 MW per year and to fulfil the growing requirements of power, the commercial energy supply needs to grow at about 7%.

- Shortage of Inputs: The foundation of India’s power sector; i.e., the Thermal Power Plants is facing a shortage of raw materials and coal supplies.

- Limited Role of Private and Foreign Entrepreneurs: The role of private sector power generators and foreign investors is limited. They are yet to play a major role in Power Infrastructure.

33.(a) Explain, how ‘Investment in Human Capital’ contributes to the growth of an economy.

(b) State the meaning of ‘Agricultural Marketing’.

Answer:

(a) Economic growth and human capital investment are strongly correlated. It is possible to describe how human capital generation contributes to economic growth as follows:

1. Rise in Labor Productivity: Spending on education, healthcare, and other aspects of human capital increases the productivity of labour as workers grow more physically healthy and proficient in their occupations. It promotes the effective use of capital and material resources. Productivity gains cause output to expand more quickly, which speeds up economic expansion.

2. Innovations: In order to produce knowledgeable scientists and researchers in a variety of fields who produce cutting-edge goods, technologies, and processes and so contribute to economic progress.

(b) Agricultural marketing is a decision-based process that includes pre- and post-harvest operations such as assembling, grading, storage, transportation, and distribution. It begins with the decision to produce a marketable farm product and includes all institutional and functional aspects of the market structure or system. One of the many issues that directly affect a cultivator’s ability to succeed is the selling of agricultural products. Agricultural marketing, in its broadest meaning, refers to all the activities involved in getting products and raw materials from the farm to the customer.

34. Critically examine the results of Poverty Alleviation Programmes implemented in India since independence.

Answer: Poverty is a particular issue that affects many countries around the world. There can not be a universally acknowledged definition of poverty. Broadly it can be said that: Poverty refers to a state in which an individual is unable to fulfil even the basic necessities of life. The minimum requirements include food, clothing, shelter, education, and health facilities. To remove poverty, the Government of India has taken various approaches such as Growth-orientation Approach, Minimum Needs Programme, and Poverty Alleviation Programmes.

Poverty Alleviation Programmes is the second approach initiated by the Government of India from the Third Five Year Plan and has been progressively enlarged since then. As the total number of poor people has remained the same over the last two decades because of the growth of population, the Government of India has specifically designed anti-poverty programmes under this approach for the generation of both self-employment and wage employment.

Because of the poverty alleviation programmes, the percentage of absolute poor people in some of the states of India has fallen below the national average of poverty. In spite of the fallen level of poverty, the problems of hunger, illiteracy, and malnourishment continued to exist in India, and the reason behind these problems are as follows:

- Lack of radical change in the ownership of assets.

- Inadequate resource allocation for the programmes.

- The Government officials who are responsible for the implementation of these programmes were ill-motivated and are not properly trained.

- Lastly, as there is unequal distribution of land and other assets, various benefits from these programmes have been appropriated by the non-poor.

Hence, it can be concluded that even though the poverty alleviation programmes helped in reducing poverty in India, the Government have not been able to achieve the desired results because of the improper implementation of these programmes.

OR

a) “Ujjawala Yojana has been a game changer for rural India.” State any three conventional fuels being targeted under the Ujjawala Yojana.

(b) “Economists believe that India should spend at least 6% of its GDP on Education for achieving desired results.” Justify the statement with valid reasons.

Answer:

a) Pradhan Mantri Ujjawala Yojana (PMUY) is a scheme that aims at safeguarding the health of women and children by providing them with clean cooking fuel (LPG) so that their health doesn’t get compromised in smoky kitchens or they don’t have to wander in unsafe areas for collecting firewood. As conventional sources of energy cause pollution in the environment, by providing free LPG gas cylinders to rural households, the Ujjwala Yojana scheme has become a game changer for rural India. The three conventional fuels being targeted under this scheme are Firewood, Coal, and Agricultural Waste and Dried Dung.

b) The given statement is correct, investment made in the education system of India has been a complete failure, because of which the economists believe that India should spend at least 6% of its GDP on Education.

In 1952, the spending on the education system was 0.6% of the nation’s GDP which rose to only 4% in 2014. The spending is shorter than the proposed 6% target by the Education Commission, 1964. Besides, the increase in education expenditure throughout this period has irregularly risen and fallen. If the government has spent the targeted percentage of GDP on the education system of India, the present education system would have been a lot better. Therefore, it is essential for the government to take the necessary steps in this regard.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...