A market including all institutions, organisations, and instruments providing medium and long-term funds is known as a Capital Market.

A market that serves as a link between the savers and borrowers by transferring the capital or money from those who have a surplus amount of money to those who are in need of money or investment is known as Financial Market. Simply put, Financial Market is a market that creates and exchanges financial assets. In general, the investors are known as the surplus units and business enterprises are known as the deficit units. Hence, a financial market acts as a link between surplus units and deficit units and brings the borrowers and lenders together. One can allocate funds with the help of the following two main ways:

- Through Banks

- Through Financial Markets

The households (who are the surplus units) may keep their savings in banks or they may use that amount for buying securities from the capital market. The financial market and banks, then lend the funds to the business firms (who are the deficit units). The banks and financial market compete with each other. Financial Markets are classified into two broad categories; namely, Capital Market(Primary Market and Secondary Market) and Money Market.

Capital Market

A market including all institutions, organisations, and instruments providing medium and long-term funds is known as a Capital Market. A capital market does not include institutions and instruments providing finance for a short term, i.e., up to one year. Some of the common instruments of a capital market are debentures, shares, bonds, public deposits, mutual funds, etc. An ideal capital market is one that allocates capital productively, provides sufficient information to the investors, facilitates economic growth, where finance is available to the traders at a reasonable cost, and where the market operations are fair, free, competitive, and transparent. A capital market is of two types; namely, Primary Market and Secondary Market.

According to V.K. Bhalla, “Capital Market can be defined as the mechanism which channelises saving into investment or productive use. Capital market allocates the capital resources amongst alternative uses. It intermediates flow of savings of those who save a part of their income from those who want to invest it in productive assets.”

Nature or Features of Capital Market

The features of a Capital Market are as follows:

1. Serves as a link between Savers and Investment Opportunities

A capital market serves as a crucial link between the saving process and investment process, as it transfers money from the savers to entrepreneurial borrowers.

2. Deals in Long-term Investment

A capital market provides funds for the medium and long term, and it does not deal with channelising savings for less than one year.

3. Utilises Intermediaries

A capital market works by making use of different intermediaries like underwriters, brokers, depositories, etc. The intermediaries of a capital market act as the working organs of the capital market. Hence, they are very crucial elements of a capital market.

4. Determinant of Capital Formation

The activities that take place in a capital market determine an economy’s rate of capital formation. This market offers various attractive opportunities to those who have surplus funds so that they can invest more and more in the capital market, and get encouragement in saving more for profitable opportunities.

5. Government Rules and Regulations

Even though a capital market operates freely, it works under the guidance of Government policies. A capital market functions within the framework of government rules and regulations. For example, the stock exchange works under the regulations of a government body, i.e., SEBI.

Classification of Capital Market

A capital market can be classified into two categories; viz., Primary Market and Secondary Market.

1. Primary Market (New Issue Market)

A market in which the securities are sold for the first time is known as a Primary Market. It means that under the primary market, new securities are issued from the company. Another name for the primary market is New Issue Market. This market contributes directly to the capital formation of a company, as the company directly goes to investors and uses the funds for investment in machines, land, building, equipment, etc.

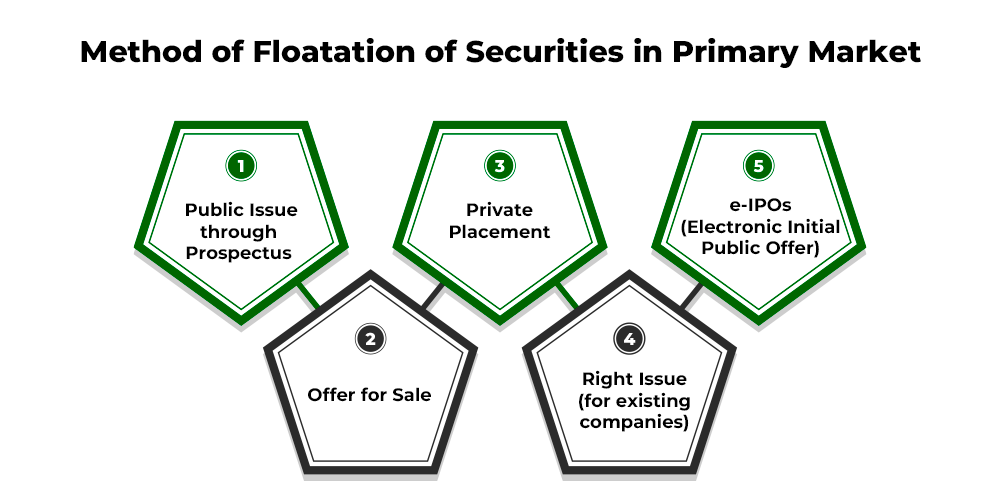

Method of Floatation of Securities in Primary Market

One can issue the securities in the primary market with the help of the following methods:

i) Public Issue through Prospectus

The first method of floatation of securities in a primary market is ‘Public Issue through Prospectur’. Under this method, a company issues a prospectus to inform the general public and attract them to invest in the company. The prospectus of a company contains information regarding the purpose for which it wants to raise funds, its past financial performance, its background, and future prospects. The information provided in the prospectus helps the general public, get to know about the earning potential of the company and the risks involved in investing in the company. Based on this information, the public decides whether or not they want to invest in the company. With the help of an IPO, a company can easily approach a large number of persons and can approach the public at large. Sometimes under this method, the companies take help of the intermediaries like underwriters, brokers, and bankers for raising capital from the general public.

ii) Offer for Sale

The second method is ‘Offer for Sale’ and under this method, the new securities are offered to the general public not by the company directly, but by an intermediary who has bought a whole lot of securities from the company. These intermediaries are generally the firms of brokers. As the intermediaries offer the new securities to the general public, the company is saved from the complexities and formalities of issuing the securities directly to the public.

The sale of securities through Offer for Sale takes place in two steps:

- Firstly, when the company issues the new securities to the intermediary at face value.

- Secondly, when the intermediaries issue securities to the general public at a higher price with the motive of earning profit.

iii) Private Placement

It is a method in which a company sells securities to an intermediary at a fixed price, and then the intermediaries sell these securities to selected clients at a higher price instead of the general public. The company issuing securities issues a prospectus providing details about the objective and future prospects of the company so that the reputed clients will prefer to purchase the securities from the intermediary. The selected clients to whom securities are issued by the intermediaries are LIC, UTI, General Insurance, etc. As the company does not have to incur expenses on manager fees, brokerage, underwriter fees, the listing of the company’s name on the stock exchange, agent’s commission, etc., it is considered as a cost-saving method. This method is preferred by small-scale companies and new companies that cannot afford to raise funds from the general public.

iv) Right Issue (For Existing Companies)

Under this method, new shares are issued to the existing shareholders of a company. It is known as the right issue because it is the pre-emptive right of the shareholders that the company must offer them the new issue of shares before subscribing them to outsiders. The existing shareholders have the right to subscribe to the new shares in the proportion of the shares they already hold.

The Companies Act, 1956 states that it is compulsory for a company to issue a Right Issue to the existing shareholders. It means that the stock exchange does not allow a company to issue new shares in the market before giving the pre-emptive rights to the existing shareholders. It is because if the company directly issues the new issue to the new subscribers, then the existing shareholders of the company may lose their share in the capital of the company and cannot have control over the company.

v) e-IPOs (Electronic Initial Public Offer)

A new method of issuing securities in which an online system of stock exchange is used is known as e-IPO. Under this method, a company appoints registered brokers to accept applications and place orders. The company which is issuing the security has to apply for the listing of its securities on any exchange. However, it cannot be the same exchange where it has earlier offered its securities. For this method, the manager coordinates the activities with the help of various intermediaries connected with the Issue.

2. Secondary Market (Stock Exchange)

A market in which the sale and purchase of newly issued securities and second-hand securities are made is known as a Secondary Market. In this market, a company does not directly issue its securities to the investors. Instead, the existing investors of the company sell the securities to other investors. The investor who wants to sell the securities and the one who wants to purchase meet each other in the secondary market and exchange the securities for cash with the help of an intermediary called a broker.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...