Automated Trading using Python

Last Updated :

26 Sep, 2022

Using Python speeds up the trading process, and hence it is also called automated trading/ quantitative trading. The use of Python is credited to its highly functional libraries like TA-Lib, Zipline, Scipy, Pyplot, Matplotlib, NumPy, Pandas etc. Exploring the data at hand is called data analysis. Starting with Python. We will first learn to extract data using the Quandl API.

Using previous data is going to be our key to backtesting strategy. How a strategy works in a given circumstance can only be understood using historical data. We use historical data because in trends in the stock market tend to repeat itself over time.

Setting up work environment

The easiest way to get started is by installing Anaconda. Anaconda is a distribution of Python, and it offers different IDEs like Spyder, Jupyter, __, ___ etc.

Installing Quandl

Quandl will help us in retrieving the historical data of the stock. To install quandl type the below command in the terminal –

pip install quandl

Note: The Quandl Python module is free but you must have a Quandl API key in order to download data. To get your own API key, you will need to create a free Quandl account and set your API key.

Importing packages

Once Quandl is installed, the next step is to import packages. We will be using Pandas rigorously in this tutorial as backtesting requires a lot of data manipulation.

import pandas as pd

import quandl as qd

After the packages have been imported, we will extract data from Quandl, using the API key.

qd.ApiConfig.api_key = "<API key>”

Extracting data using Quandl

Python3

import pandas as pd

import quandl as qd

qd.ApiConfig.api_key = "API KEY"

msft_data = qd.get("EOD/MSFT",

start_date="2010-01-01",

end_date="2020-01-01")

msft_data.head()

|

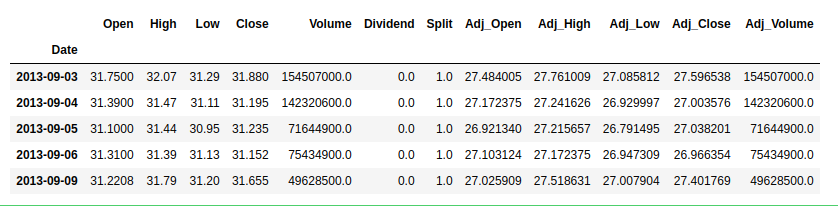

Output:

The above code will extract the data of MSFT stocks from 1st Jan 2010 to 1st Jan 2020. data.head() will display first 5 rows of the data.

Important terminology: One should understand what the data represents and depicts.

- Open/ Close – The opening and closing price of the stock.

- High/ Low – The highest and the lowest price the stock has reached during the particular day.

- Adj_High/ Adj_Close – The impact of present dividend distribution, stock splits, or other corporate action on the historical data.

Calculating Returns

Returns is simply the profit gained or losses incurred by the stock after the trader/ investor has used long or short positions. We simply use the function pct_change()

Python3

import numpy as np

close_price = msft_data[['Adj_Close']]

daily_return = close_price.pct_change()

daily_return.fillna(0, inplace=True)

print(daily_return)

|

Output:

Adj_Close

Date

2013-09-03 0.000000

2013-09-04 -0.021487

2013-09-05 0.001282

2013-09-06 -0.002657

2013-09-09 0.016147

... ...

2017-12-21 -0.000234

2017-12-22 0.000117

2017-12-26 -0.001286

2017-12-27 0.003630

2017-12-28 0.000117

[1090 rows x 1 columns]

Formula used in daily return = (Price at ‘t’ – Price at 1)/Price at 1 (Price at any given time ‘t’ – opening price)/ opening price

Moving Averages

The concept of moving averages will lay the foundation for our momentum-based trade strategy. For finance, analysts also need to constantly test statistical measures over a sliding time period which is called moving period calculations. Let’s see how the rolling mean can be calculated over a 50-day window, and slide the window by 1 day.

Python3

adj_price = msft_data['Adj_Close']

mav = adj_price.rolling(window=50).mean()

print(mav[-10:])

|

Date

2017-12-14 78.769754

2017-12-15 78.987478

2017-12-18 79.195540

2017-12-19 79.387391

2017-12-20 79.573250

2017-12-21 79.756221

2017-12-22 79.925922

2017-12-26 80.086379

2017-12-27 80.249752

2017-12-28 80.414472

Name: Adj_Close, dtype: float64

Moving averages help smooth out any data anomalies or spikes, and provide you with a smoother curve for the company’s results.

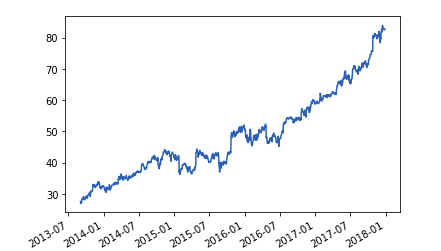

Plot and see the difference:

Python3

import matplotlib.pyplot as plt

adj_price.plot()

|

Output:

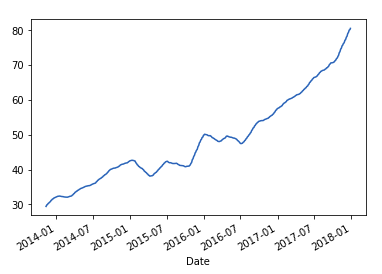

Observe the difference:

Output:

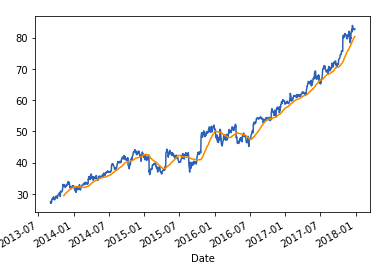

Plotting them together:

Python3

import matplotlib.pyplot as plt

adj_price.plot()

mav.plot()

|

Output:

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...