Whenever a partner retires, the capital of the remaining partners is changed. As a result of this, some partners may have to bring in desired additional capital to fill in the deficit of their capital and some may have to withdraw the excess capital to match the requirement. The partners in the case of retirement can adjust their capital in any of the following ways:

Case 1: When the total capital of the new firm is given:

When the capital of the new firm is already given, the following steps are to be followed to make the necessary adjustments in the capital of the remaining partners:

1. Calculate the Adjusted capital of the continuing partners after making all the necessary adjustments.

2. On the basis of the capital of the new firm and the new profit-sharing ratio. ascertain the proportionate capital of the continuing partners.

3. Find the surplus or deficit in the capital of each such partner using the given formula:

Surplus Capital = Adjusted Capital − Proportionate Capital

Deficit Capital = Proportionate Capital −Adjusted Capital

- In the case of surplus capital, the capital of the continuing partners is adjusted by withdrawing the desired amount or by transferring it to the credit side of the current account of the concerned partner.

Journal Entry:

- In the case of deficit capital, the capital of the continuing partners is adjusted by bringing in the desired amount or by transferring it to the debit side of the current account of the concerned partner.

Journal Entry:

Illustration:

Ajit, Vijeet, and Vinita are partners sharing profit and losses in the ratio of 2 : 3: 2. Ajit decides to get retired on 31st March 2021 and the other partners decide to carry on the business with a new ratio of 4 : 3. Their Balance Sheet on the same date stood as:

Additional Information:

- Land and Building appreciated by 30%.

- Machinery depreciated by 20%.

- Bad Debts are to be raised by ₹ 14,000.

- Workmen Compensation Fund to be maintained at ₹ 16,000.

- The capital of the new firm will be the same as before retirement of the Ajit.

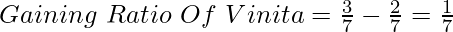

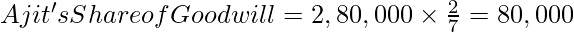

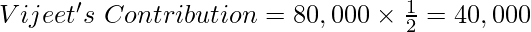

- Goodwill is valued at ₹ 2,80,000. The share of goodwill of Ajit is to be adjusted against the capital account of the remaining partners.

- Amount due to Ajit is to be settled by transferring it to the Loan’s Account.

Prepare the Revaluation Account, Capital Account, and Balance Sheet of the New Firm.

Solution:

Working Notes:

1. Balance of Workmen Compensation Fund to be distributed among the partners in a ratio of 2: 3: 2, i.e., 30,000 − 16,000 =₹ 14,000.

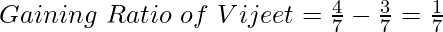

2. Old Profit-Sharing Ratio of Ajit, Vijeet, and Vinita = 2 : 3 : 2

New Profit-Sharing Ratio of Vijeet and Vinita = 4 : 3

Gaining Ratio = 1 : 1.

3.

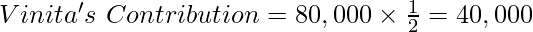

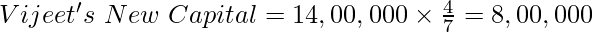

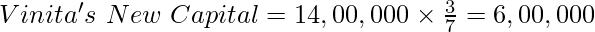

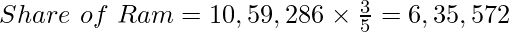

4. Calculation of share of remaining partners in the capital of the New Firm:

Total Capital of the new firm= ₹ 14,00,000

New Profit-Sharing Ratio of Vijeet and Vinita = 4 : 3

(Proportionate Capital)

(Proportionate Capital)

(Proportionate Capital)

(Proportionate Capital)

Adjusted Capital :

Vijeet’s = 6,36,000 – 46,000 = ₹ 5,90,000

Vinita’s = 4,24,000 – 44,000 = ₹ 3,80,000

Deficit Capital:

Vijeet’s = 8,00,000 – 5,90,000 = ₹ 2,10,000

Vinita’s = 6,00,00 – 3,80,000 = ₹ 2,20,000

Case 2: When the total capital of the new firm is not given:

Steps to be followed to adjust the capital of the remaining partner when the total capital of the new firm is not given:

1. Calculate the adjusted capital of the continuing partners after making all the necessary adjustments.

2. Determine the Total Capital of the New Firm using the given formula:

Total Capital of the New Firm = Total of the Adjusted Capital of the remaining partners.

3. Calculate the New Capital of each remaining partner by dividing the Total Capital of the New Firm in the new ratio (Proportionate Capital).

4. Find the surplus or deficit in the capital of each such partner using the given formula:

Surplus Capital = Adjusted Capital − Proportionate Capital

Deficit Capital = Proportionate Capital −Adjusted Capital

- In the case of surplus capital, the capital of the continuing partners is adjusted by withdrawing the desired amount or by transferring it to the credit side of the current account of the concerned partner.

Journal Entry:

- In the case of deficit capital, the capital of the continuing partners is adjusted by bringing in the desired amount or by transferring it to the debit side of the current account of the concerned partner.

Journal Entry:

Illustration:

Ram, Leela, and Madan were partners sharing profits and losses in a ratio of 2: 2: 3. The Balance Sheet of their firm on 31st March 2021 stood as:

Leela retired on 31st March, 2021 on the following terms:

- Land and Building appreciated by ₹ 1,20,000, and Machinery depreciated by 10%.

- 50% of the Investment at Book value is taken by Leela.

- A Debtor worth ₹ 5,000 already written as bad debts, verbally promised to pay ₹3,500 in full settlement.

- Provision for Doubt Debts is to be created @ 5%.

- Closing Stock is valued at a Market price of ₹ 3,50,000.

- Goodwill is valued at ₹ 2,80,000. The share of goodwill of Leela is to be adjusted against the capital account of the remaining partners in their New-Profit Sharing Ratio of 3: 2.

- The amount due to Leela is to be transferred to her Loan Account.

Prepare the Revaluation Account, Capital Account, and Balance Sheet of the New Firm when the Capital of the new firm is not given.

Solution:

Working Notes

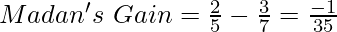

1. Calculation of Gaining Ratio:

It is clear that Ram is only the gaining partner.

2. Adjustment of Goodwill:

(to be paid by Ram)

(to be paid by Ram)

(to be paid by Ram)

(to be paid by Ram)

3. Since the bad debts of ₹5,000 is been promised to be paid verbally, they shall not be treated as bad debts recovered.., hence not considered.

4. Employee’s Provident Fund is not distributed among the partners as it is a liability.

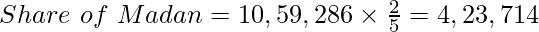

5. Calculating Capital of the New Firm:

Total Capital of the New Firm = Total of the Adjusted Capital of the remaining partners.

Capital of the New Firm = 5,32,714 + 5,26,571 = ₹10,59,285

Case 3: When the outgoing partner is to be paid through cash brought by the continuing partners in such a way as to make their capital proportionate to their new Profit Sharing ratio.

Steps to make Capital Adjustments:

1. Calculate the adjusted capital of the continuing partners after making all the necessary adjustments.

2. Determine the Total Capital of the New Firm using the given formula:

Total Capital of the New Firm = Total of the Adjusted Capital of the remaining partners + Shortage to be brought in by the remaining partners to make payment to retiring partner.

3. Calculate the New Capital of each remaining partner by dividing the Total Capital of the New Firm in the new ratio (Proportionate Capital).

4. Find the surplus or deficit in the capital of each such partner by comparing Step 3 and Step 1.

- In the case of surplus capital, the capital of the continuing partners is adjusted by withdrawing the desired amount or by transferring it to the credit side of the current account of the concerned partner.

Journal Entry:

- In the case of deficit capital, the capital of the continuing partners is adjusted by bringing in the desired amount or by transferring it to the debit side of the current account of the concerned partner.

Journal Entry:

Illustration:

Bala, Mohan, and Gopal were partners having equal shares in the firm. Mohan decides to retire on 31st March 2022 and the remaining partners decide to continue the business as equal partners. Their Balance Sheet on the same date was :

Addition Information:

- The goodwill of the firm is valued at ₹ 1,15,200.

- Provision for Doubt Debts is to be maintained @ 10% on Debtors.

- Land and Building increased to ₹ 2,64,000.

- Furniture reduced by ₹ 16,000.

- The rent outstanding is to be charged ₹ 3,000.

The remaining partners decided to bring in a sufficient amount to make payment to Mohan. Calculate the capital of the New Firm and prepare necessary accounts with the Balance Sheet of the new firm.

Solution:

Working Notes:

1. The old ratio and new ratio of the remaining partners are the same i,e., 1: 1, therefore, the Gaining Ratio = 1: 1.

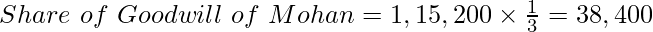

2. Adjustment of Goodwill:

Bala’s Contribution = ₹ 19,200

Gopal’s Contribution = ₹ 19,200

3. Calculation of Capital of the New Firm:

Total of the Adjusted Capital of the remaining partners = 1,26,800 +70,800 = ₹1,97,600

Shortage to be brought in by the remaining partners to make payment to retiring partner = Amount to be paid to the retiring partner − Present Bank Balance

Shortage to be brought in by the remaining partners to make payment to retiring partner = 1,44,400 − 40,000 =₹ 1,04,400

Total Capital of the New Firm = Total of the Adjusted Capital of the remaining partners + Shortage to be brought in by the remaining partners to make payment to retiring partner.

Total Capital of the New Firm = 1,97,600 + 1,04,400 = ₹3,02,000.

Share of each remaining partner = ₹ 1,51,000.

4. Calculating the amount to be brought in:

5. Calculating Bank Balance:

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...