Activity Ratio: Meaning, Formula and Significance

Last Updated :

08 Jun, 2023

What is Activity Ratio?

Activity ratios, also known as turnover ratios, are essential metrics in the field of accountancy. These ratios enable the evaluation of a company’s operational efficiency and effectiveness. By analyzing various activity ratios, such as the Inventory/Stock Turnover Ratio, Trade Receivables Turnover Ratio, Trade Payables Turnover Ratio, and Working Capital Turnover Ratio, stakeholders can gain valuable insights into a company’s performance.

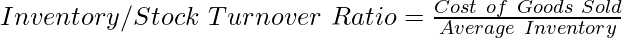

1. Inventory/Stock Turnover Ratio:

The Inventory/Stock Turnover Ratio provides insights into how efficiently a company manages its inventory and converts it into sales. This ratio indicates the number of times inventory is sold and replaced during a specific period. The effectiveness of a company’s sales practices is calculated by Inventory Turnover Ratio.

Formula:

Significance:

The Inventory/Stock Turnover Ratio is significant as it helps assess a company’s inventory management efficiency. A higher ratio suggests effective inventory management and a faster turnover rate, indicating that the company is swiftly converting inventory into sales. Conversely, a lower ratio may indicate slower sales, excessive inventory levels, or inadequate inventory management. Monitoring this ratio enables businesses to identify potential issues and implement corrective measures to optimize inventory levels.

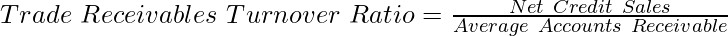

A financial indicator called the trade receivables turnover ratio is used to assess how successfully a business collects payment from its clients for credit sales. The effectiveness of a company’s credit and collection practices is calculated by the trade receivables turnover ratio. It is figured up by dividing net credit sales by the average accounts receivable during a given time frame.

The Trade Receivables Turnover Ratio or Accounts Turnover Ratio measures how frequently a company converts its accounts receivable into cash over a given time period. A lower ratio shows that a company is taking longer to collect its receivables, which could be the cause of concern, while a higher ratio shows that a company is collecting its receivables more rapidly, which is typically considered a positive indicator.

Formula:

Significance:

This ratio indicates how quickly a company collects payments from its customers during a specific period. A higher ratio suggests prompt payment collection, efficient credit management, and lower credit risk. Conversely, a lower ratio may indicate challenges in collecting receivables, which can lead to cash flow problems and increased credit risk. Analyzing this ratio helps companies evaluate their credit policies, identify areas for improvement, and take appropriate actions to optimize cash flow.

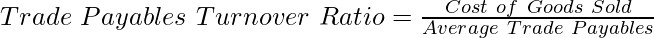

Trade Payable Turnover Ratio is a financial ratio that measures how efficiently a company pays its suppliers for the goods and services it has purchased on credit. It is calculated by comparing the cost of goods sold to the average accounts payable during a particular period. This ratio helps in evaluating a company’s credit management practices and its relationship with suppliers. A higher trade payable turnover ratio is considered better as it indicates that a company is efficiently managing its payable. Trade payable turnover ratio cannot be negative. However, a low ratio may indicate that a company is not effectively managing its payable. A company can improve its trade payable turnover ratio by negotiating better payment terms with its suppliers, improving its inventory management, and reducing its accounts payable days.

Formula:

Significance:

This ratio indicates how quickly a company settles its trade payables during a specific period. A higher ratio suggests timely payments, strong cash flow, and positive supplier relationships. Conversely, a lower ratio may indicate delays in payments, potential liquidity issues, or strained supplier relationships. Monitoring this ratio allows companies to ensure timely payments, maintain healthy supplier relationships, and optimize cash flow.

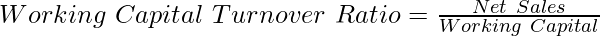

Working capital turnover ratio establishes a relationship between the working capital and the turnover(sales) of a firm. In other words, this ratio measures the efficiency of a firm in utilising its working capital in order to support its annual turnover. A high working capital turnover ratio implies that the company is very efficient in using its current assets and liabilities to support its sales. In other words, for every rupee employed or used in the business, it is able to generate a higher amount of sales. However, a lower working capital ratio means that the amount employed in working capital is higher and that the turnover is not up to the mark. In other words, the turnover is lower than the minimum levels as per the given amount of working capital employed.

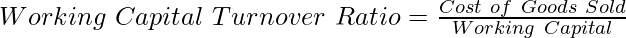

Formula:

or

Significance:

This ratio indicates how effectively a company utilizes its working capital to generate sales during a specific period. A higher ratio suggests efficient utilization of working capital, maximizing operational output. Conversely, a lower ratio may indicate underutilization or potential inefficiencies. Evaluating this ratio helps companies gauge their overall operational efficiency and identify areas for improvement.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...